HPQ Stock Price Prediction: Looking to Continue Its Momentum

The article was written by Jordan Klotnick, a Financial Analyst at I Know First. He graduated from the University of Monash with a Bachelor’s in Business- Majored in Marketing.

HPQ Stock Price Prediction

Summary:

- The stock price has risen drastically in 2016, and expected to grow further

- The company outgrew all of their major competitors

- HPQ set to acquire Samsung’s printer business in a deal valued at $1.1 billion

- I Know First Algorithm Bullish Forecast for HPQ

Background

HP Inc, formerly known as Hewlett-Packard Company, is a corporation who provides services, technological products, computers, printers and solutions to individual consumers, businesses, large enterprises and government bodies worldwide. The company offers a wide variety of personal computers (PCs), as well as printing hardware.

The company operates through 3 business segments: Personal Systems, Printing and Corporate Investments. The Personal Systems segment provides commercial personal computers, consumer PCs, workstations, calculators and other related accessories, software and services for the commercial and consumer markets. The Printing segment provides consumer and commercial printer hardware, supplies, media and scanning devices. In addition, the Printing segment focuses on imaging solutions in the commercial markets. The Corporate Investments segment includes HP Labs, the webOS business and certain business incubation projects. The company was founded by William R. Hewlett and David Packard in January 1939, and is headquartered in Palo Alto, CA.

Rising Revenue

Hewlett-Packard (HPQ) stock skyrocketed in 2016, rising by nearly 30% owing to an upsurge in shipments, as well as PC revenue rising by 4%. The first fiscal quarter of 2017 resulted in a 10% increase in net revenue, commercial revenue increasing by 7%. The graph below shows at the start of February 2016, the stock started at $10.90, and one year later it closed at $17.65.

Source: Yahoo Finance

There are a few contributing factors to HPQ’s stocks increasing. The company’s sales of new PC products contributed to a 2% growth in revenue for the fourth-quarter of 2016. According to CEO, Mr. Weisler, the company generated $2.8 billion in free cash flow for the fiscal year ended in October 2016. They also returned 72% to the shareholders in dividends and stock buybacks. In fiscal fourth-quarter 2016 the growth in revenues for their personal systems PC group was up by 4%, or $8 billion. It rose 5% on year-over-year constant basis. According to the CEO, the firm “outgrew all major competitors”. HPQ is set to tap into the new 3D printing market and it is expected to grow at rapid rates through to 2021. The company believes they are able to communicate to 77% of the 3D plastic market. Therefore, HPQ may have potential for future stock increase.

Increasing Market Share in Printing

Additionally, the growth is due to the rising popularity of the PC gaming sector, helping the firm outperform consumer notebook growth by over 10 points. In September of 2016, the company announced an intention to acquire Samsung’s printer business in a deal valued at $1.1 billion. HPQ is looking to disrupt the print space using multifunction printer technology, which will replace traditional copiers. This is expected to close in the first quarter of 2017. HPQ will provide in 2017 its own specialized security technicians to support and implement commercial print security plans. The advances in technology have made cyber attacks more common. Thus, HPQ will be tapping into this market, to further enhance their security for their consumers.

Source: Bidnessetc

Conclusion

We are maintaining a bullish forecast of the stock. I Know First’s algorithm forecast the stock as a long term investment.

HPQ is a company that will only grow in the future, especially now with the soon to be acquisition of the 3D printing market. They have been an industry leader in the traditional printing business for the past 30 years. With an eye on the new 3D printing market. The potential for this market is expected to grow at 30% through 2021. The company believes they will be able to address 77% of the 3D plastic market, which will drive revenue significantly over the next few years. HPQ’s first quarter revenue for 2017 is already up 4% from last years.

Past I Know First Forecast Successes With HPQ:

Earlier this year, I Know First predicted a bullish forecast on HPQ. The forecast was sent to I Know First subscribers on September 23, 2016. HPQ showed a 16.01% return, shown below on our forecast performance chart. This gain goes along with the I Know First bullish predictions.

In another example such as the one dated on August 23, 2015, the algorithm accurately forecast a short position for HPQ. Given its time span of 3 months, the stock decreased by 54.1%.

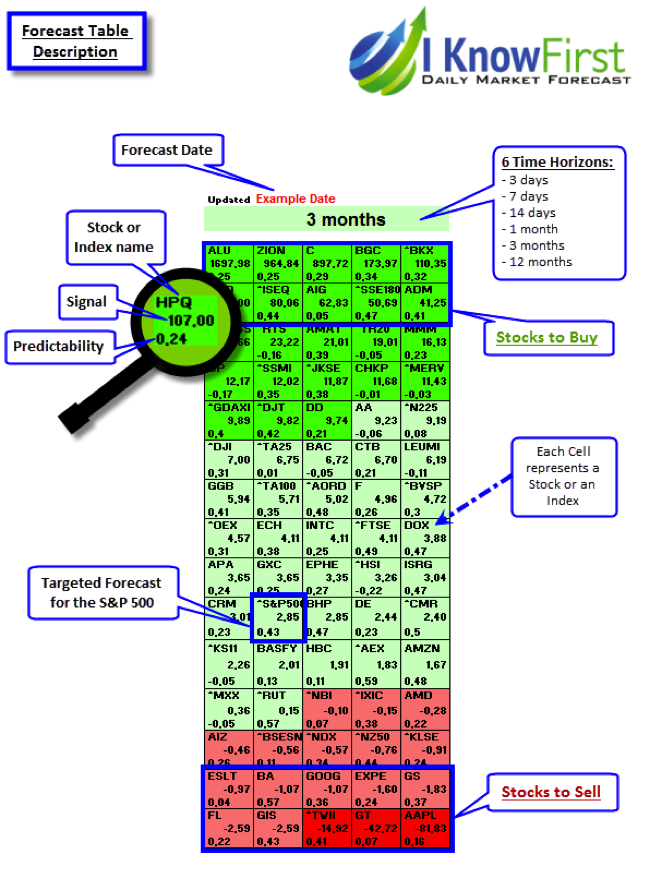

Below is the latest forecast I Know First algorithm released on February 26, 2017. If we were to compare the forecast back in September 23, 2016, we can see both forecasts rate HPQ as a buy. If the previous forecast on September 23, 2016 accurately predicted the stock would increase and it did by 16.01%, the latest forecast below could indicate a higher rate of return.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm, allowing the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.