Google Stock Price Forecast: Google Wants To Discipline Global Digital Advertising

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Stock Price Google (GOOG)

Summary:

- Google is the largest beneficiary of the booming internet advertising industry.

- Google now wants to police the internet advertising industry by adding an integrated ad-blocking software for its Chrome browser next year.

- Chrome is the most popular browser in the world today. Google can effectively use it to enforce its rule that online ads should not be annoying to users.

- Google’s act is a disciplinary action to force advertisers and site owners to minimize use of intrusive/annoying online and mobile ads.

- I Know First Research still has positive near and long-term forecasts for GOOGL.

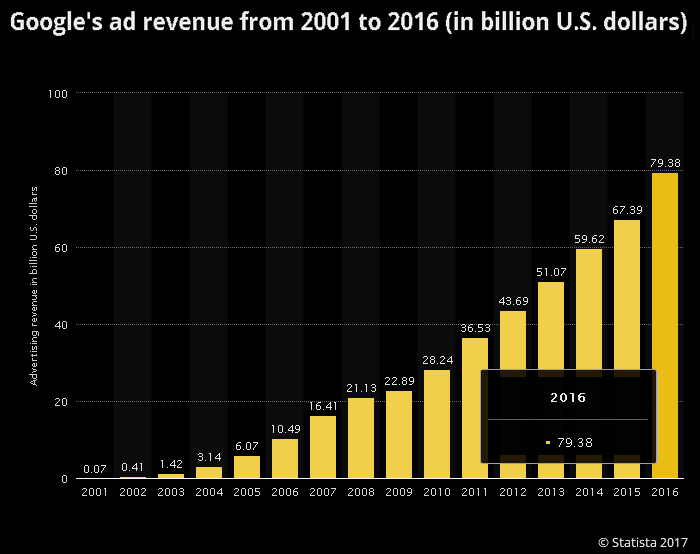

Alphabet (GOOG) is planning to add an integrated ad filter or ad-blocking extension to its Chrome browser next year. At first glance, it is rather ironic since Google is the biggest beneficiary of the booming internet/digital advertising industry. As per Statista’s chart below, Google’s web and mobile advertising business was worth more than $79 billion last year. Google creating its own ad-blocking software is not to harm it business. It’s a disciplinary measure to force advertisers and website administrators to reduce their use of intrusive advertisements.

(Source: Statista)

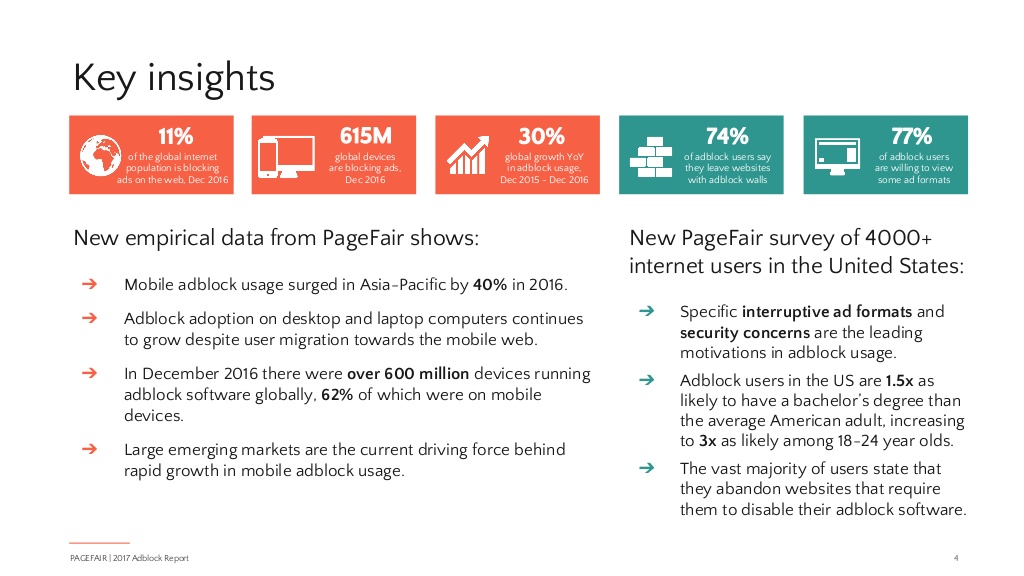

Taking the role as the global police that will help enforce better digital advertising practices is necessary. The rise of third-party ad-block software in recent years has resulted in more than 600 million people now blocking ads on PCs and mobile devices.

(Source: PageFair)

Google has no choice but to flex its muscle and persuade advertisers and website owners to only issue acceptable ads. Any digital ad format that doesn’t comply with Google’s acceptable ads policy will be blocked by Chrome next year. Advertising pays for the free content on the web today. Majority of people are willing to view or even click on ads if they are not intrusive or annoying.

Without this severe action from Google, more people will keep using third-party software to block ads, including those that aren’t intrusive. By forcing advertisers and website owners to follow the new rule of serving only acceptable ads, there’s less incentive for people to use third-party ad-blocking software.

Doing so ultimately protects Google’s advertising-centric business model. The more people there are that do not block acceptable ads, the better it is for Google’s topline and bottomline.

Chrome Is The Most Popular Browser

The global popularity of the Chrome browser on desktop PCs and mobile devices makes Google an effective ad-filtering police man. As per the latest data from NetMarketShare, Chrome has 54.15% share in mobile devices, and 59.36% share in desktop PCs. Adding a built-in advertising filter to Chrome is a strong deterrent to advertisers/marketers who like spewing out unpleasant pop-up ads and auto-play Flash animation/video advertisements on websites.

(Source: netmarketshare.com)

Website owners also know Chrome is too popular to ignore its upcoming ad-filter feature. If they want to retain some decent advertising income, they will stop accepting ad placements that are intrusive/invasive to their site visitors. Advertising-dependent websites will try to hosts only acceptable ads so that Google’s Chrome browser won’t block them.

The truth is some website owners and content publishers are hardheaded. They are using anti-ad blocking software to force users to disable their ad-blocking tool before they can access their websites. That is not the right way to retain favor from yout site visitors and potential advertising click customers.

The only way for content publishers and website owners to prosper is to host acceptable ads. Google knows this and its Chrome browser will inculcate this adage to all content publishers and website owners. If recalcitrant website owners still won’t comply, Google can delist their websites from its search engine. A delisted website from Google search engine’s index is as good as dead.

My Takeaway

Google can be a very effective global police that will discipline digital advertising practitioners. Investors should not worry that Google creating its own ad-blocking browser extension will affect its advertising business. It should be seen as an enhancement toward better advertising practice. Keeping people happy by forcing advertisers to only deliver acceptable ads is a win-win situation for everyone.

Alphabet’s stock has already delivered YTD return of more than 24%, but I am still endorsing GOOGL as a Buy.

(Source: Google Finance)

The fact remains that aside from Facebook (FB), Alphabet has no other rival in the global digital advertising industry. Facebook also competes in digital display ads and app-install ads on mobile. Facebook has so far failed to challenge Google’s monopoly on desktop/web search advertising. Facebook still has no search engine.

A check on FundamentalSpeculation also told me that the Relative Fair Value (as compared to its peers with similar business fundamentals) $1064.38. GOOGL deserves a higher valuation that $976. 62.

(Source: fundamentalspecualtion.io)

I Know First also still gives GOOGL positive near and long-term algorithmic forecasts. I am therefore very confident with my bullish outlook for Alphabet. Machine learning computers always fortify my stock picking judgment.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.

Past I Know First Success With GOOG

I Know First has been bullish on GOOGL shares in past forecasts. On October 13, 2016, an I know First Analyst wrote about GOOGL. In the article, it mentions that Facebook decided to integrate Workplace with Google’s G Suite enterprise productivity software suite. Since then, GOOGL shares have risen 23.2% in line with the I Know First algorithm’s forecast. See chart below.

This bullish forecast for GOOGL was sent to I Know First subscribers on October 13, 2016. To subscribe today click here.