Facebook Stock Predictions: Why You Should Go Long Facebook Right Now

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

FB Stock Prediction

Summary:

- Mark Zuckerberg’s decision to pour advertising on Messenger is a compelling reason to go long FB right now

- Zuckerberg is taking a different approach than Tencent’s WeChat. Facebook’s core strength is always been in advertising.

- Facebook has tried to imitate some of WeChat’s best features like payments and gaming features but Zuckerberg decided that ad placements is still the best way to monetize Messenger.

- Messenger’s peer to peer money transfer and Instant Games will remain free to retain loyalty of users. Games are also a great way to increase time spent on Messenger.

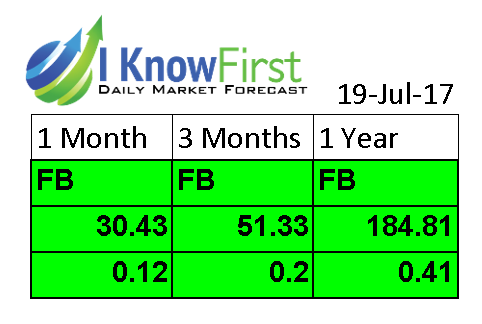

- FB has positive near and long-term algorithmic forecasts from I Know First.

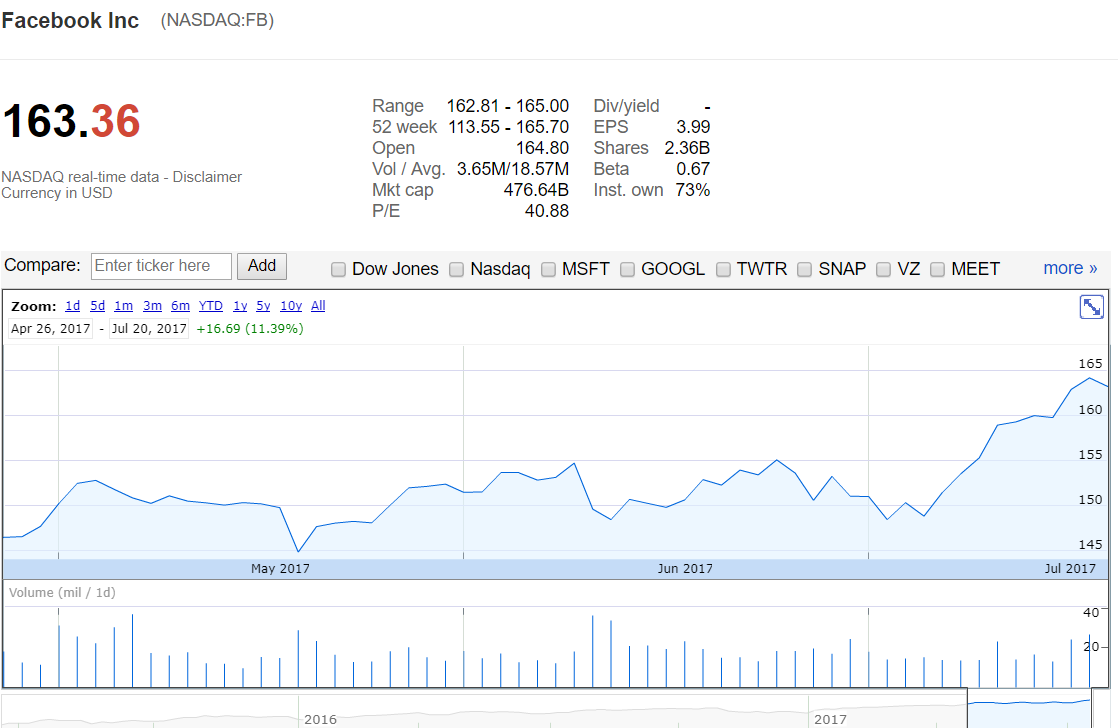

My last buy rating for Facebook (FB) was last May 21. The stock has since returned +10.85%. I’m now endorsing FB again as a buy. Zuckerberg’s change of mind decision to allow advertisements on Messenger is a massive long-term tailwind for Facebook. Delivering home tab-based targeted ads on 1.2 billion Messenger is better than Facebook copying Tencent’s (TCEHY) WeChat platform.

(Source: Google Finance)

Yes, WeChat touts amazing features that Messenger should try to also implement. However, Zuckerberg will only likely copy the mobile peer to peer payments and games features of WeChat to keep Messenger users happy and sticky. Sticky in the sense that Instant Games like the addictive Everwing HTML5 game can keep people spending hours glued to Messenger.

Why Games Are Important For Messenger Advertising

Zuckerberg’s advertising strategy on Messenger requires that people spend more time on the app. In my book games are a good way to keep people captured on your mobile app. The social aspect of competitive online mobile games has an infectious effect that spreads fast among Messenger users. This is how WeChat was able to build a lucrative games/app store.

Facebook’s Everwing is why I am going to re-install Facebook’s Messenger mobile app on one of my Android phones. Everwing is crazy popular here in the Philippines. It’s an updated version of the classic Galaga space shooter game. You only need to use one hand to slide right to left to play Everwing. A great time waster could host several advertisements from Facebook.

(Source: Motek Moyen)

Everwing is also in a sense a collectible card game. You have to play long and hard to eventually get all the best guardians and dragons. The frenzy over getting the highest scores and best guardians has created a very strong competitive buzz around Everwing. Smart, the largest wireless telco here in the Philippines is sponsoring a national tournament for it.

(Source: Motek Moyen)

The global success of Everwing is great validation of Facebook’s Instant Games platform. HTML 5 games are no-download games that only needs a decent phone and 4G or Wi-Fi signal to play. Instant Games is Facebook’s secret weapon to keep Messenger users happy in spite of them now being targeted for personalized advertising.

(Source: Facebook)

The obvious risk of Facebook’s decision to deliver advertisements is that it could turn off some of the 1.2 billion users of Messenger. By giving them free addictive, social hyper-competitive games like Everwing, most users will stick to the Messenger platform. They will also be too busy playing Everwing against their friends and relatives to get annoyed by 3-6 ad placements from Facebook.

The old Roman rulers invented the public spectacle of gladiator arena combat to keep its citizens happy. Happy citizens will not have time to complain about Rome’s excessive tax collections. Likewise, happy gaming citizens of the Messenger platform will have no time to whine that Facebook will likely ad spam them soon.

Messenger Doesn’t Need To Copy WhatsApp

I am content with Zuckerberg’s advertising-centric approach to monetize the Messenger app. I do not want Messenger to become a WeChat-clone. The problem of using Messenger as a digital wallet like WeChat now is that not many traditional retail stores support mobile commerce. If it was so, credit card & debit card would have been extinct a long time ago.

My point is that Messenger’s peer to peer payments feature should only be used between friends, relatives and acquaintances. I dislike the suggestion that a messaging app should be turned into digital wallet to shop online and on traditional stores. Facebook has little to gain competing with PayPal (PYPL), Apple (AAPL) Pay, Google (GOOG) Pay, and Venmo. Facebook should just let those three companies fight over the less than cent fee on every digital wallet shopping on traditional stores.

Better to focus on what is Facebook’s core advantage, and that’s delivering local-aware and accurate targeted advertising. Facebook’s ARPU (Average Revenue Per User) is already very high at $4.23. This is all thanks to advertising.

Conclusion

Taking a long position on FB right now is still highly recommended. The economic potential of serving ads to 1.2 billion Messenger users is quite substantial. In my guesstimate, ads on Facebook’s messaging apps, WhatsApp and Messenger could add up to 30% to its quarterly revenue of $8 billion.

The thought of Facebook getting $2.3 billion more in quarterly revenue can definitely boost the stock by as much as 30%. You think FB is overvalued right now, wait until Zuckerberg starts reporting 9-figure ad revenue from Messenger/WhatsApp advertising. WhatsApp also has 1.2 billion users.

My bullish call for FB is in line with its positive near and long-term algorithmic forecasts.

The positive outlook of I Know First’s computers for Facebook is also congruent with technical indicators.

The positive outlook of I Know First’s computers for Facebook is also congruent with technical indicators.

Past I Know First Forecast Success with FB

I Know First has made accurate predictions on FB in the past, such as its bullish article published on April 26, 2017. In the article, rising net income, significant decrease in cost of goods sold, and impressive growth rates in mobile advertising influenced FB’s stock to increase. During the 3 month period starting on Aril 26th, 2016 until now (July 20th, 2017), FB shares have increased by 11.39% in line with the I Know First algorithm’s forecast. See chart below.

(Source: Google Finance: FB)

This bullish forecast for FB was sent to I Know First subscribers on April 26, 2017. To subscribe today click here.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.