Facebook Stock Forecast: Facebook Watch’s TV-Anywhere Service Increased Its Advertising Reach

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Facebook stock Forecast

Summary:

- The launch of Facebook Watch service last month convinced me that Facebook’s advertising revenue this year will reach $36 billion.

- Mobile-friendly original and crowd-sourced TV shows are new expansion channels where Facebook can push its targeted advertising services.

- Going forward, Facebook could eventually spend $5 billion on original video content like what Netflix is doing. It can recoup this content acquisition expense through ad sales.

- Facebook Watch might also become an alternative crowd-source video sharing platform if Facebook starts implementing its version of Google’s AdSense program.

- I Know First has a very bullish one-year algorithmic market trend forecast for Facebook’s stock.

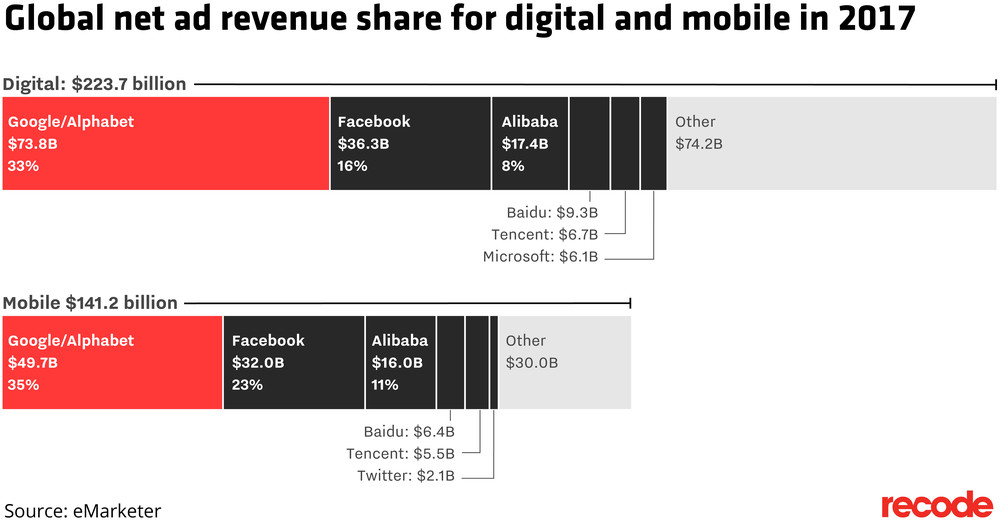

A Recode article predicted that Facebook’s (FB) advertising revenue would hit $36 billion in FY 2017. I strongly agree with this forecast because I can appreciate the future ad revenue stream of Facebook’s Watch TV-anywhere platform. Launched only last month, Facebook Watch is an expansion channel where more targeted advertising could be served to more than 2.2 billion people.

The Watch tab for original TV shows can be accessed through the PC and mobile apps of Facebook. It is initially launched with a some pioneer content partners. In addition to direct production payments, Facebook will pay its content partners 55% of the ad revenue generated from their TV shows.

(Source: Facebook)

I expect top Hollywood TV show producers to eventually join the Facebook Watch platform. Facebook could become the future of television. The more TV producers are expanding their services through Facebook Watch, the better it is for Facebook’s advertising business. Around 73% of American binge-watch TV shows. Feeding ads to people who watch TV shows for 5 or 8 hours straight is the future tailwind for Facebook.

Why Investors Should Care

Facebook providing a cross-platform service where TV shows can be binge-watched is a decisive move. Facebook needs new avenues where it can deliver its targeted ads. The growth momentum of Facebook’s fast-growing quarterly revenue cannot rely solely on mobile app installed ads and Newsfeed Sponsored ads. Watching TV is a global addiction which has a larger captured audience than mobile gaming or social chat.

Facebook has consistently delivered double-digit growth rate on its quarterly revenue. However, nothing lasts forever in this world. Without new conduits where it can deliver ads, this growth momentum could stagnate or even decline. Facebook obviously has no search engine that could help it compete against Google (GOOG).

What Facebook has is 2.2 billion of monthly active users who could become addicted to Watch. Creating a digital TV service is easiest expansion move for Facebook. Pirating TV show producers and advertisers away from traditional TV companies is beastly good for Facebook’s long-term growth.

The future economic benefit of Facebook expanding to TV streaming is easy to comprehend. The massive shift to mobile-based TV/movie watching is why Netflix’s (NFLX) stock enjoys super-high valuation (223x P/E ratio). Netflix’s huge multi-billion spending on original content is why it now touts 104 million paying subscribers.

Facebook’s $1 billion budget for original video content next year is way smaller than the $7 billion that Netflix plans to spend on original programming in 2018. However, Facebook has tons of cash; it can easily afford to spend $5 billion on original programming to quickly build a loyal following for its Watch TV-anywhere platform.

Becoming More Like Google When It Comes To Video Streaming

Google’s (GOOG) YouTube is the leader in crowd-sourced, ad-driven free video sharing. I guesstimate that is generating more than $8 billion in annual ad sales for Google and its AdSense video content creator partners. Facebook’s Watch TV platform could also become as big as YouTube. I prefer Facebook to focus on ad-driven TV and movie streaming because advertising is its forte.

It is also cheaper to crowd-source original content by ordinary people than paying license fees to Hollywood content owners. Crowd-sourcing content is also faster than Facebook itself spending billions of dollars to produce its TV shows or movies. YouTube became such a huge hit because people are earning big money on creating videos for it.

Facebook needs to create a more generous ad revenue-sharing offer to video content producers to attract millions of YouTube creators to expand their service to the Facebook Watch platform. Giving content producers 70% of the generated ad revenue should be enough incentive for many of them.

Conclusion

Advertising and marketing research firm eMarketer believes Facebook can hit $36 billion in ad revenue this year. With the launch of Facebook Watch last month, this is an achievable prediction. The Christmas shopping quarter period is almost upon us. Advertisers will be buying ad placements for Facebook’s huge 2.2 billion users. I’m therefore highly confident that Facebook could surpass eMarketer’s estimate.

My guesstimate is that Facebook’s FY 2017 could deliver $37 billion in ad sales. I rate FB as a buy. This advertising giant also touts a bullish one-year algorithmic trend forecast from I Know First.

My 12-month price target for FB is $200. This is slightly higher than the average PT of $192.52 made by TipRanks-tracked Wall Street analysts.

(Source: TipRanks.com)

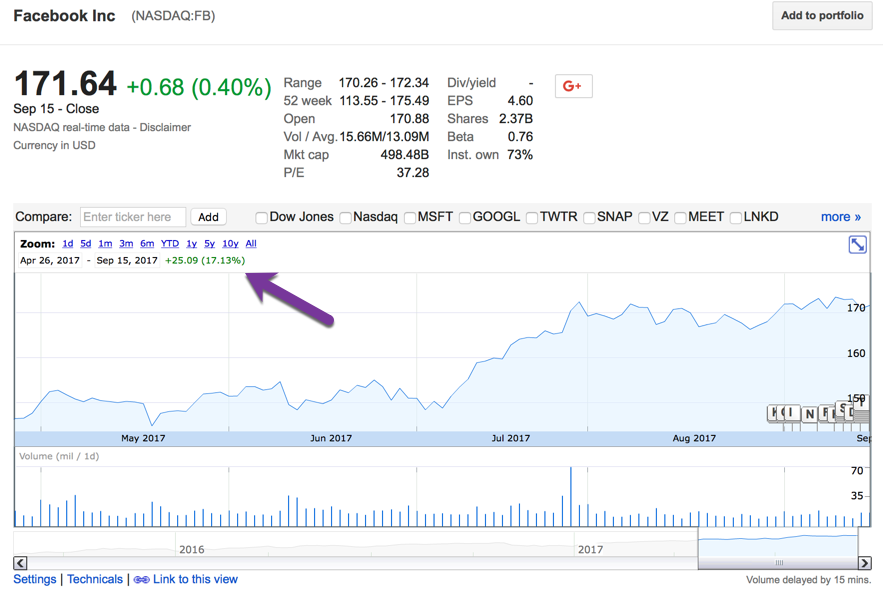

Past I Know First Forecast Success with Facebook

I Know First’s algorithm has made accurate predictions on FB in the past, such as its bullish article published on April 26, 2017. In the article, it explains the growth in mobile advertising. Facebook’s average revenue per user increased by 34% to $15.98 compared to 2016 and advertising revenue increased by 57% from last year to $26,885 million from $17,079 million. Since the April 26,2017 forecast, FB shares increased by 17.13% in line with the I Know First algorithm’s forecast. See chart below.

(Source. Google Finance: Facebook)

This bullish forecast for FB was sent to I Know First subscribers on April 26, 2017. To subscribe today click here.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.