Costco Stock Analysis: Bright Light at the End of the Tunnel

The article was written by Moises Meir, a Financial Analyst at I Know First.

The article was written by Moises Meir, a Financial Analyst at I Know First.

Costco Stock Analysis

Summary

- Amazon Disrupts Grocery Chain Industry, Costco Unfazed

- Costco Earnings Report Shows Strong Sales

- Stock Performance and Analysts Target Prices

- I Know First’s Bullish Forecast For Costco Stock

The Costco Wholesale Corporation (COST), better known as ‘Costco’, experienced a very interesting month of June. The early and mid-parts of the month had Costco and every other public retailing chain facing uncertainty and stock drops, as Amazon acquired healthy-choice grocery chain Whole Foods Market. For the last trading days of the month, Costco’s stock made a massive comeback, surpassing the stock price it had before the Whole foods acquisition. Many reasons are attributable for the rise, including: Costco’s core competencies that are unfazed by Amazon’s entry, and great expectations of their sales/revenue in the quarter. Here at I Know First we are riding with the stock’s recent trend as our algorithm reveals a bullish forecast.

Costco Wholesale Corporation, operates membership warehouses. It offers branded and private-label products in a range of merchandise categories. The company provides dry and packaged foods, and groceries; snack foods, candies, alcoholic and nonalcoholic beverages, and cleaning supplies; appliances, electronics, health and beauty aids, hardware and more. They are the second largest retailer in the world, and also the largest retailer in the meat, wine and organic segments. As of 2016, it operated 715 warehouses, including 501 warehouses in the United States. Further, the company sells its products online. Costco Wholesale Corporation was founded in 1976 and is based in Issaquah, Washington.

Amazon Shakes Up the Grocery Chain Industry But Costco’s Competencies Prove To Be Unique.

In June 16th, Amazon agreed to buy the upscale grocery chain Whole Foods for $13.4 billion, in a deal that will instantly transform the company that pioneered online shopping into a merchant with physical outposts in hundreds of neighborhoods across the country. This bold move by Amazon shacked up the whole industry, with every stock tumbling down. Costco’s stock specifically, started to fall since the beginning of the month when rumors of the acquisition started spreading. COST began the month at $158.81 and stumbled to a low point of 150.40 by July 21, 2017.

Investors feared that Amazon’s new physical presence would take away significant percentages of market share from Costco, Walmart and other retailers. While in theory it sounds like an accurate assertion, it really isn’t the case for a company like Costco. There are two reasons for this. First one is that Costco makes a huge amount of revenue on membership fees and has an extremely loyal clientele (they pay the fee for a reason) that won’t switch so easily. The second reason is that the products that Costco sell are very different to Whole Foods’; Costco is a cost-leader that sells products in bulk, attracting customers because it saves substantial amounts of money in the long-run. Whole foods on the other side is a differentiator; customers go there to buy high-quality, premium-priced products that Costco doesn’t offer.

The stock started rising on July 22, 2017, as realization about the different core competencies became more and more widespread. Today the stock is trading at $162.49, an 8.04 percent increase since it low point eleven days ago.

Costco’s High Sales Projections & Higher Target Prices Help

Of course that there was more to it than a different clientele. Costco was scheduled to report earnings for the month on July on August 2nd. As the month came to an end, Wall Street’s expectation for the numbers increased, increasing demand for COST shares, thus raising the price. The net sales for the month amounted to $9.41 billion, while the consensus projection a few weeks ago was $9.22 billion.

Costco has consistently overachieved, as in three of the last four quarters this exact same scenario has occurred. With the dividend payment date approaching, many investors are looking to get a piece of the cake.

In addition, several equities research analysts have recently weighed in on the company. Robert W. Baird set a $200.00 target price on Costco Wholesale Corporation and gave the stock a “buy” rating. Cowen and Company restated an “outperform” rating on shares. Vetr upgraded Costco Wholesale Corporation from a “buy” rating to a “strong-buy” rating and set a $168.75 target price for the company. In total, two research analysts have rated the stock with a sell rating, nine have given a hold rating, twenty-one have given a buy rating and one has given a strong buy rating to the stock. The stock currently has a consensus rating of “Buy” and a consensus target price of $179.11 (a 10.22% upside).

I Know First’s Bullish Forecast

There are plenty of reasons to be optimistic about the future for Costco, whether it be the extremely strong core competencies, the high sales, or the bright future of the company. I Know First’s forecast is in harmony with my personal opinion, as they released a bullish forecast for Costco in both the short and long term. The forecast appears to be more bullish towards the long term, as the signal strength and the predictability ratio are increasing. Past I Know First Success With COST

Past I Know First Success With COST

I Know First correctly predicted a bullish forecast for Costco in August 18, 2015. Costco has been maintaining a high customer satisfaction rate along with entering a new agreement to accept Visa card holders. These factors help explain how Costco managed to increase by 14.83% in a year.

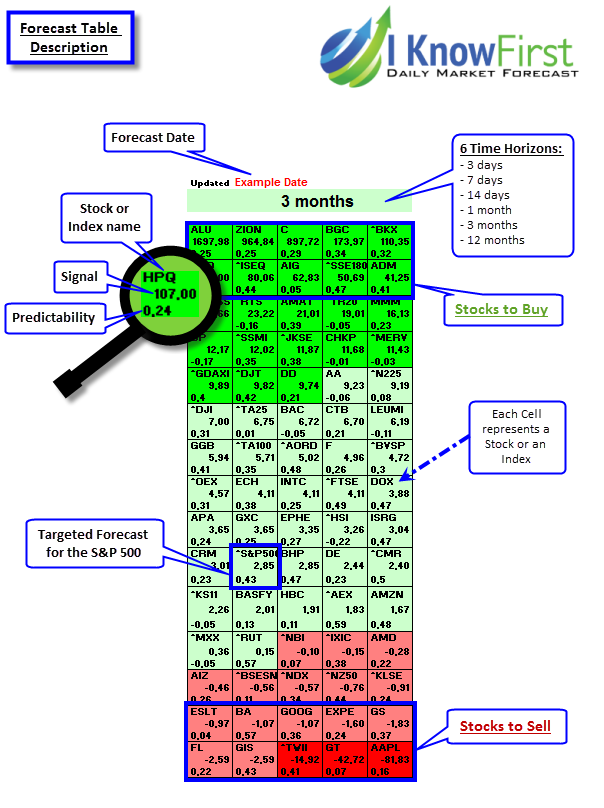

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm, allowing the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above in order to fill confident about/trust the signal.