Bradesco Stock Forecast: Optimistic Scenario Ahead

Felipe Spritzer, is a Junior Financial Analyst at I Know First, and enrolled in a B.A. in Industrial Engineering at the Federal University of Rio de Janeiro (UFRJ).

Bradesco Stock Forecast

Summary:

- Company background

- Fundamental and Scenario Analysis

- Explanation of I Know First’s algorithm

- Bullish forecast for Bradesco

- IKF past success with BBD

I Know First Stock Algorithm, generated a forecast on February 5th with strong bullish signals for different time horizons for Bradesco, a famous Brazilian Bank.

We are going to analyze the company and the scenario to check if they match the algorithm prediction. After the analysis, we are going to give a quick explanation on how the forecast works:

The company

Banco Bradesco S.A. attracts deposits and offers commercial banking services. The Bank offers business loans, personal credit, mortgages, lease financing, mutual funds, securities brokerage, and Internet banking services. Bradesco operates in Brazil and Argentina, the United States, the Cayman Islands, and the United Kingdom. It also offers credit cards, insurance, and pension funds.

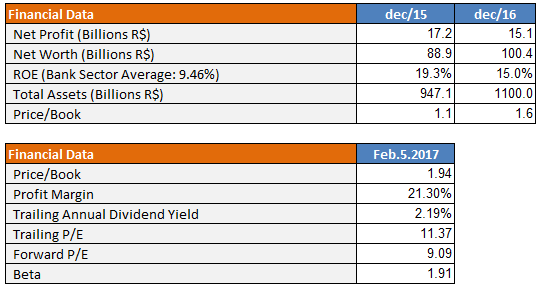

Fundamental Analysis

Recently Bradesco released its results of 2016. Net profit went down in R$ 2.1 Billion, especially because of a growth in default’s rate caused by Brazilian’s economy crisis. Net Worth grew approximately 13% reaching the hundreds of billions. ROE also decreased significantly, however, it still presents a good rate when compared to the sector’s average of 9.46%. Bradesco’s total assets surpassed R$ 1 trillion, explaining why it’s considered the most valuable brand in Latin America.

Price/book has been increasing in the last periods, showing the recovery of the brand’s perception by investors, but it’s still at a reasonable rate to be bought. Profit margin is 21.30%, thus comparing favorably with the current overall market average of approximately 8%. Bradesco’s dividend yield is good, especially when compared to other Brazilian companies that struggled in giving dividends. Trailing and forward P/E are showing high numbers, however, that is expected to happen with companies that have been around longer and have deeper economic moats.

Scenario Analysis

Bradesco reported on Thursday morning, 2, its results for the year of 2016. As results were below the expectation, its stocks fell hardly on the same day:

However, after the panic vanished, the price already started going up again. After all, despite the results being below expectation, the company still presented good numbers and the fundamentals are still solid, especially for an unstable economy. Adding to that, Bradesco is seeing an optimistic scenario ahead:

- Indicators of economic activity and data on consumer and business confidence indicate that the Brazilian economy has already left the worst behind, after almost three years of decline, Bradesco president Luiz Carlos Trabuco said on Friday.

- Bradesco faces its highest levels of default in the last two years. The index of non-payments for more than 90 days rose to 5.5% due to the economic crisis, bankruptcy and corporate recovery and unemployment. However, according to Carlos Firetti, director of market relations at Bradesco, the default is on the peak now, but the bank is already starting to see an improvement. These figures tend to improve in the coming quarters, he said.

- Also, Bradesco is now heavily investing in creating a completely digital bank. It should start operating this semester. The idea is to attract young audiences, aged 25 to 35, who already have a different relationship with the financial sector. The bank also encourages the use of digital agencies among customers who already carry out most of their transactions by electronic means.

Stock Market Prediction

The I Know First algorithm identifies waves in the stock market to forecast its trajectory. Every day the algorithm analyzes raw data to generate an updated forecast for each market. Each forecast includes 2 indicators: signal and predictability.

Signal

The signal represents the predicted movement and direction, be it an increase or decrease, for each particular asset; not a percentage or specific target price. The signal strength indicates how much the current price deviates from what the system considers an equilibrium or “fair” price.

Predictability

The predictability is the historical correlation between the past algorithmic predictions and the actual market movement for each particular asset. The algorithm then averages the results of all the historical predictions, while giving more weight to more recent performances.

Predictability is measured on a scale ranging from negative 1 to positive 1; this metric is an adaptation of the Pearson correlation coefficient.

P=-1 means the actual market moved in the opposite direction than the algorithm predicted.

P=0 means that there is no correlation between the prediction and the actual market movement.

P=1 means that there is perfect correlation between the actual market movement and its predicted movement.

Any value of P above zero indicates a positive predictability, the higher the better. For stocks we monitor and predict, the Predictability (P) generally ranges between P=0.2 and P=0.7.

The Forecast

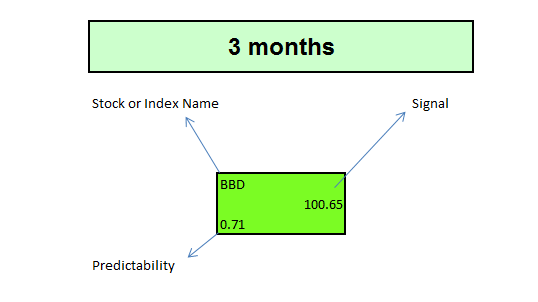

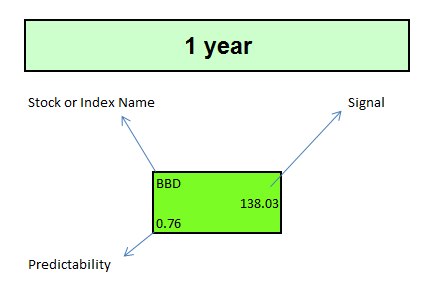

I Know First’s algorithm generated the forecast for three different periods:

1 month –

Signal: 68.59

Predictability 0.57

3 months –

Signal: 100.65

Predictability 0.71

1 year –

Signal: 138.03

Predictability 0.76

Conclusion

After fundamental and current scenario analysis it’s possible to see a lot of variables pointing to a strong bullish prediction to Bradesco’s stock that resonates with bullish I Know First forecast.

I Know First Past Success With Bradesco

I Know First has been bullish on Bradesco shares in past forecasts. On February 5, 2016 and January 14,2016, IKF wrote bullish outlooks on BBD that brought splendid results of 128.37% (1 year) and 163.77% (1 year), respectively.

This bullish forecast for Bradesco was sent to I Know First subscribers on February 5th, 2017. To subscribe today click here.