BlackBerry Stock Predictions: BlackBerry Could Lead In Automotive-Security-As-A-Service Subscription Business

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

BBRY Stock Prediction

- BlackBerry is reported to be testing an anti-hack/security service for vehicles.

- Luxury car makers Aston Martin and Range Rover are testing BlackBerry’s service that can scan idle cars for viruses and other security threats.

- Automotive security is definitely an important service that people will gladly pay for to help keep their connected/smart cars safe.

- BlackBerry’s brand power and long history of providing the best enterprise security services could help it gain a foothold in the Automotive- Security-as-a-Service industry.

- BBRY has buy signals from the near and long-term market trend algorithmic forecasts of I Know First.

More and more cars are getting connected to the internet. BlackBerry (BBRY) is supposedly working on a service that will protect cars from hackers and software-related viruses. Luxury car manufacturers Aston Martin and Range Rover is said to be testing the said anti-hack service from BlackBerry.

Building on the dominance of its QNX Operating System in-vehicle infotainment platform, BlackBerry’s upcoming service can do regular scans and release security patches to protect cars from unwanted software intrusions. The modern car is now emerging as a computer unit. A connected car is now built with millions of software code. Securing the software of connected cars is a no-brainer expansion move for BlackBerry.

If firms and home users are spending billions of dollars to protect their home and office computers every year, the market for securing connected vehicles should also eventually become a multi-billion global industry. BlackBerry’s transformation from a hardware manufacturer to a pure software provider leader could be accomplished by becoming the leader in in-vehicle security.

BlackBerry Has A Ready Customer Base for Automotive Security Service

BlackBerry QNX’s current roster of car manufacturer customers is a ready market for a paid, subscription-only Automotive-Security-as-a-Service program. Car makers paid BlackBerry to install QNX RTOS as their in-vehicle infotainment operating system in more than 60 million cars. It is not far-fetched to expect that car makers could also eventually install BlackBerry’s upcoming anti-hack for vehicle service on 60 million cars.

(Source: BlackBerry)

Compared to laptops, the importance of securing the software of vehicles is not only to protect the cars. It also secure the lives and privacy of their owners. Car buyers will likely be more enthusiastic in purchasing connected/smart cars if they know they have anti-hack protection.

Affordable Automotive Software Security

BlackBerry reportedly could charge $10/month per vehicle for its upcoming Automotive-Security-as-a-Service product. This $10/month fee is affordable even for folks who drive ordinary (not luxury) $30k cars. I am very confident that BlackBerry could have a hit product within this upcoming anti-hack service for car owners.

A subscription-based, anti-hack service for vehicles could provide BlackBerry a steady source of new revenue stream. Going forward, BlackBerry has the potential to earn more than $400 million in annual fees from subscribers of its upcoming anti-hack car protection service.

The affordable $10/month subscription fee of BlackBerry’s anti-hack security service for cars could easily attract 3.5 million subscribers within a year of its release. The total addressable market of a BlackBerry-branded anti-hack service is definitely greater than just owners of luxury vehicles from Aston Martin and Range Rover.

The current roster of government and corporate clients that subscribe to BlackBerry Enterprise Services is also a ready market for a $10/month car software security service. The employees and managers of corporations obviously use cars in their daily commute to and from work. Enterprise IT administrators will eventually have to secure not only the office computers, servers and networks. They will also have to set a budget on how to secure corporate vehicles.

Final Thoughts

The key to BlackBerry’s transformation as a full-pledged software-only company lies in taking an early lead in automotive software security. BlackBerry could become the McAfee or Norton antivirus provider of the connected car. BlackBerry’s QNX operating system is already the go-to choice for in-vehicle infotainment. BlackBerry should also focus on becoming the go-to choice for in-vehicle security.

Based on its decades-long track record as the go-to provider for network and mobile security, I am highly confident that BlackBerry could really dominate the nascent industry for automotive software security. I rate BBRY as a Buy for the long-term investing horizon.

The short and long-term algorithmic forecasts from I Know First are also signaling a Buy for BBRY. The 30-day and and 90-day market trend signals are highly positive, both scores over 100. I expect BBRY’s price to breach $11 again within the next three months.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.

My last Buy recommendation for BBRY was in September 22, 2016. To date, BBRY’s price has risen 30%. The latest news that BlackBerry is venturing in subscription-only automotive security could help the stock rise another 10-20% within the next 8-12 months.

Past I Know First Success With BlackBerry Ltd.

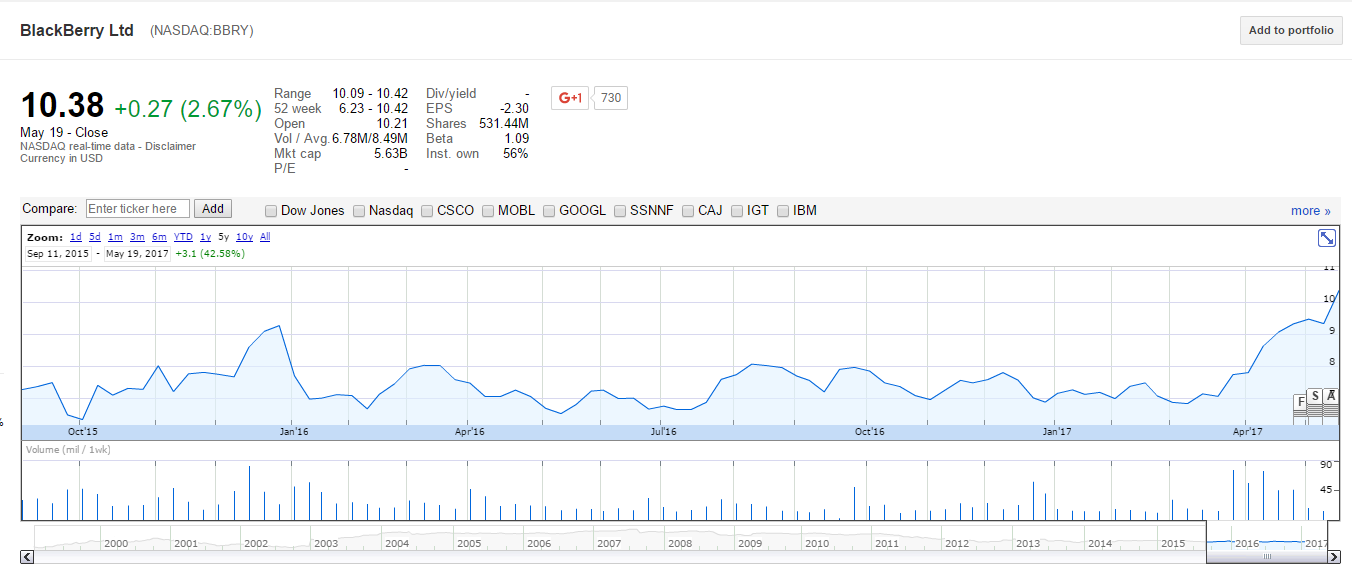

I Know First has been bullish on BBRY shares in past forecasts. On September 10, 2015, an I know First Analyst wrote about BlackBerry and the numerous reasons to be bullish on the stock. In the article, it mentioned the recent acquisition of rival security company Good Technology Corporation. Combined with the purchase of AtHoc, Blackberry has shifted to provide service and software security, securing big clients such as TSA. Since then, BBRY shares have risen 42.58% in accordance with the I Know First algorithm’s forecast. See chart below.

This bullish forecast for BBRY was sent to I Know First subscribers on September 10, 2015. To subscribe today click here.