ATW Stock Analysis: Oil is Up, Why Has ATW Been Downgraded?

This article was written by Blair Goldenberg, a Financial Analyst at I Know First, and enrolled in a Masters of Finance at Colorado State University.

This article was written by Blair Goldenberg, a Financial Analyst at I Know First, and enrolled in a Masters of Finance at Colorado State University.

ATW Stock Analysis

Summary

- Background on Atwood Oceanics (ATW)

- ATW Stock Analysis

- Payment of New Atwood Drillships

- Bullish I Know First Forecast on ATW

Background

Atwood Oceanics, Inc., incorporated on October 9, 1968, is an offshore drilling company. The Firm is engaged in the drilling and completion of exploration and development wells for the global gas and oil industry. The Firm owns various types of drilling rigs, such as Ultra-Deepwater Rigs, Deepwater Semisubmersibles and Jackups. The Company’s Ultra-deepwater Rigs and Deepwater Semisubmersibles include Atwood Achiever, Atwood Archer, Atwood Admiral, Atwood Advantage, Atwood Condor, Atwood Eagle and Atwood Osprey.

ATW Stock Analysis

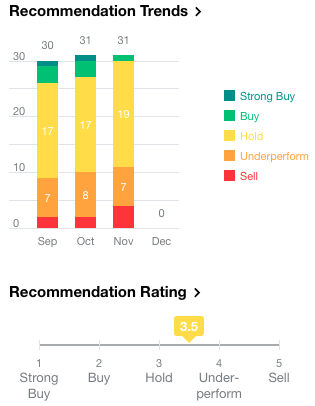

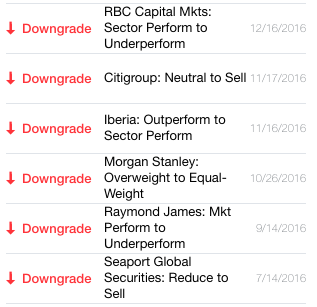

On December 17, ATW was downgraded by RBC Capital Markets from a “perform” rating to an “underperform” rating. The consensus rating on ATW stands at hold currently. As you can see from the charts below, ATW has been downgraded by many companies in the last few months, and the above-mentioned consensus rating is corroborated by Yahoo Finance.

Retrieved from Yahoo Finance

Price targets for ATW vary from $4.5 to $18, which means the company price per share could drop 37.56%. On December 9, ATW broke the resistance level and stood at $13.60 per share. But by December 12, there was a high-volume sell-off on the stock. But ATW has been up since the beginning of November 2016 where the share price dropped to $7.14 on November 4. Currently, ATW stands at $13.46.

The OPEC deal may help ATW’s share price. Crude oil is set to increase up to $59 per barrel in the near future. Because ATW is an offshore drilling company, this may end up being very beneficial for them. This benefit can already be seen from the graph above. Since the deal in early December, the stock jumped and continued its upwards climb until very recently where it seems to have leveled out. However, the deal hasn’t been set in place and come January, a rise in oil prices will benefit drilling companies all over the world, including ATW.

Payment of New Atwood Drillships

On December 6, 2016, ATW announced that they would delay the release and use of Atwood’s new ultra-deepwater drillships called the Atwood Admiral and the Atwood Archer. They’ve decided to delay by two years. ATW has also decided that they would make payments on the ships, for the Archer, the company will pay $125 million up front and then pay $15 million on June 30, 2018 or when the ship is delivered. As for Atwood Admiral, ATW will make a payment of $10 million on September 30, 2017 or on the date of delivery. Other fees for the ships will be extended to December 30, 2022, where Atwood would need to pay $83.9 million plus fees and interest for Admiral and $165.0 million plus fees and interest for Archer which will be under an issued promissory note that will be executed by the subsidiaries of Atwood Oceanics, Alpha Admiral Company and Alpha Archer Company. The promissory note has an interest payment of 5% on a yearly basis.

There are a few reasons the company may be putting off use and deliverance of the drillships. The OPEC deal aims to reduce crude oil output, ATW already has drillships currently being used and may not need the new ones as of yet. Other possibilities are that the company simply doesn’t have enough money to purchase the drillships outright and need the extra time to collect the amount of money needed to receive the shipments. Either way, the drillships will be in use in the next few years and could replace older, less productive drillships already in use. Whatever the case may be, the ships will improve the companies stance in the long run.

Bullish I Know First Forecast on ATW

I Know First currently maintains a bullish stance on ATW with signal strength 144.48 and predictability 0.77 for 1 year forecast.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm, allowing the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.

Conclusion

In my opinion, it is much to early to start selling ATW, as it may still rise well into next year. If we look at the historical data, there is a large gap in share price that the company may grow into now that the OPEC deal will be executed.