Apple Stock Predictions: Apple Is The Second-Biggest E-Commerce Leader, Tim Cook Is The 2nd Highest-Paid CEO

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Apple Stock Predictions

Summary:

- Apple has toppled Wal-mart to become the second largest online retailer in America. It goes to show that e-commerce could be done on decent-margins.

- Bezos’ revenue-growth-first-before-profit mantra is not the only path toward success in e-commerce.

- Steve Jobs’ successor, Tim Cook is also the second-highest compensated CEO in the U.S. The top-compensated CEO of 2016 was Marc Lore, CEO of Wal-Mart’s U.S. E-commerce business.

- Tim Cook should be commended for making Apple an exemplary model for e-commerce. Unlike Amazon which specializes in thin-margin products, Apple sells pricey products online.

- Direct selling online is more beneficial to Apple’s gross margins.

Apple (AAPL) has won many accolades. For some people, Apple has the best smartwatch, headphones, smartphone, tablet, computer, and app store. Tim Cook’s reign also saw Apple’s ascendance as the most valuable company in the world. Apple sells luxury-priced consumer electronic products and is making tons of money doing it.

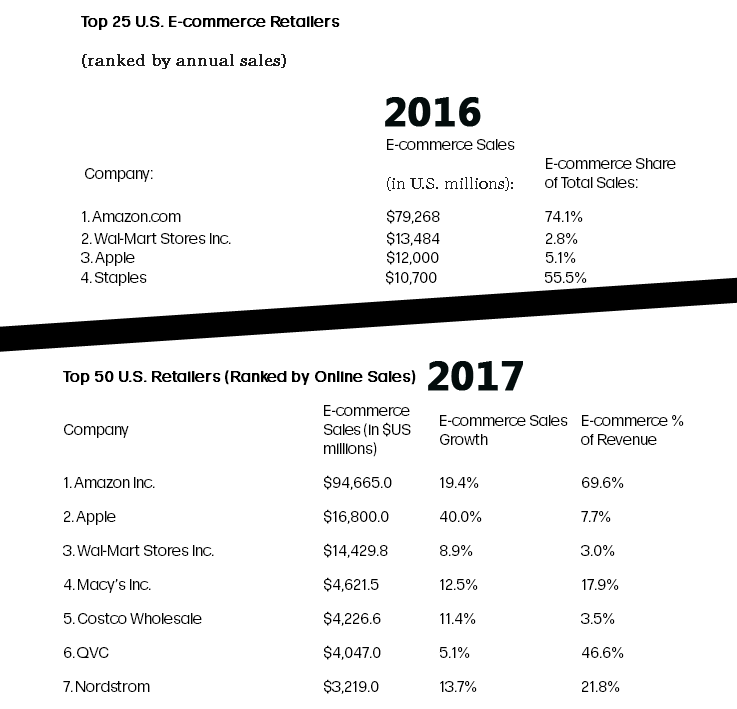

We can now add another laurel to Apple’s crown. Apple recently dethroned Wal-mart (WMT) to become the second-biggest online retailer in America. This is according to eMarketer’s trailing 12 month period ending last March 2017. Apple did e-commerce sales of $16.8 billion in the U.S., beating Wal-mart’s $14.3 billion.

(Source: wdd.com)

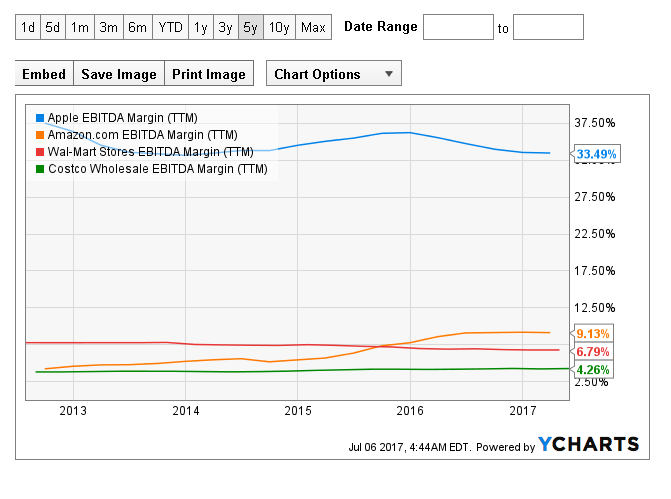

This achievement matters because Apple still practices a high-margin-only strategy without breaking the 6 pillars of design policy imposed by the late Steve Jobs. Unlike the low-margin approach of Amazon (AMZN), Costco (COST), and Wal-mart, Apple showed that e-commerce can be efficiently done on decent EBITDA margins.

The chart below should be a strong reason for Seeking Alpha members to stay long AAPL. The late Steve Jobs would be proud to see that Apple still managed to become America’s second-biggest e-commerce operator in spite of its pricey products. Many people are willing to pay extra money for high-quality products, which also emphasized user-friendliness above all other things.

(Source: YCharts)

Tim Cook Is Not Jeff Bezos

Jeff Bezos is a cult hero to many. He is the anti-thesis of Tim Cook/Apple. Bezos’ revenue-growth-first-before-profit mantra has seduced many institutional and retail investors. This is why AMZN now enjoys ultra-stratospheric valuation. America’s long-running love affair with Amazon is why I believe that Bezos will eventually become the world’s richest man.

(Source: YCharts)

Nevertheless, we cannot deny that Tim Cook is doing a wonderful job at Apple right now. As his just reward, Mr. Cook is now the second-best compensated CEO in America. Giving a man a fair reward for his labor often leads to him working harder. I hope Mr. Cook gets $300 million in 2017, which could make him No.1. I think $150 million/year is not yet enough to inspire Mr. Cook to fully maximize his potential as the anointed successor of Steve Jobs.

(Source: Bloomberg)

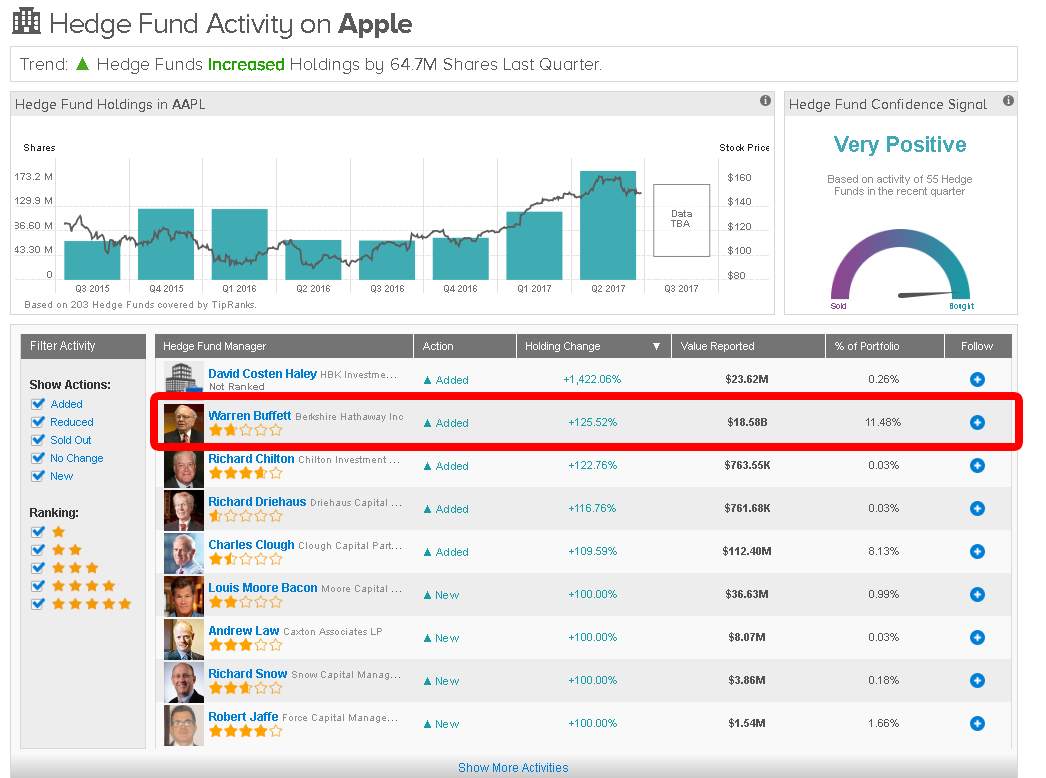

I would loathe to see Tim Cook leaving Apple. He is still the right man to steer Apple for the next ten years. He is never going to be as charismatic as Elon Musk or Jeff Bezos. However, Apple will do just fine under Cook’s leadership. We have to take into account that it was under Cook’s reign that Warren Buffett finally went big on AAPL.

Buffett ignored ModernGraham’s report last January that AAPL did not meet the criteria for Benjamin Graham’s Enterprising Investor or the Defensive Investor. Buffett’s $18.58 billion bet on AAPL earlier this year is partly why AAPL surged.

(Source: TipRanks)

We should also never forget that since 1982, Buffett’s no.4 tenet before Berkshire Hathaway (BRK.A) (BRK.B) invests in a company is “management-in-place.”

Buffett’s $18.58 billion investment in Apple is also his big seal of approval for Tim Cook’s leadership and management style.

Conclusion

I hope I made a clear investment thesis on this one. Apple is doing a great online retail business. Tim Cook is doing great as CEO. Even the great Rocco Pendola will agree with me now that his Tim-Cook-Must-Go campaign four years ago was myopic and unfair. Tim Cook was a far better CEO than the genius but temperamental Steve Jobs. If he was alive now, Jobs would be kissing and hugging Cook. Yes, Apple will always be Jobs’ legacy. However, Tim Cook deserves adulation/respect for being so proficient in taking care of Jobs’ masterpiece showcase of capitalism.

I will continue to hold on to AAPL. Tim Cook is running not just an iPhone company. Apple is also an e-commerce company that is disproving Amazon’s popular business model. I am also long AMZN. These two greatly dissimilar companies can both flourish.

You bet on AAPL because of its massive cash hoard, titanium-strong fundamentals, and its large captured customer base. You bet on AMZN because it’s the most beloved prom queen of the stock market.

I am waiting for the bearish mood to make AAPL cheaper so I can buy some more. I just checked its Exponential Moving Average scores and I like it that a downward trend is becoming clear. Apple’s 5-day EMA of 139.71 has crossed below its 13-day EMA of 142.75. The 20-day EMA has also crossed below Apple’s 50-day EMA of 145.91.

AAPL is likely headed for more dips.

(Source: StockTA)

My wait and see if APPL goes lower then buy strategy is in-line with the algorithmic forecasts of I Know First. AAPL has negative near-term market trend scores but the one-year algorithmic prediction is very positive.

Past I Know First Forecast Success With Apple

I Know First has made accurate predictions on Apple in the past, such as its bullish article published on January 5th, 2016. In the article, it outlines Apple’s financial earnings report and its impressive results from 2015. Since then, AAPL shares have risen 44.72% in line with the I Know First algorithm’s forecast. See chart below.

(Source: Yahoo Finance: AAPL)

This bullish forecast for AAPL was sent to I Know First subscribers on January 5th, 2016. To subscribe today click here.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.