AMD Stock Prediction: Why Advanced Micro Devices Can Continue Moving Higher

![]() Naman Shukla is an Analyst at I Know First. He writes and invests in the stock market. Ranked in the top 8 percentile in TipRanks.com. Featured on SeekingAlpha.com, GuruFocus.com, Valuewalk.com among others

Naman Shukla is an Analyst at I Know First. He writes and invests in the stock market. Ranked in the top 8 percentile in TipRanks.com. Featured on SeekingAlpha.com, GuruFocus.com, Valuewalk.com among others

AMD Stock Prediction

Summary

- Gaining traction in the GPU segment will certainly benefit the company.

- Strong sales growth shows that the company is no longer struggling.

- Investors can expect AMD to continue improving its balance sheet going forward.

- Deal with Alibaba is another tailwind.

I changed my stance on Advanced Micro Devices (AMD) a few months ago and the stock has been up 26% since in a good agreement with I Know First Algorithm bullish forecast on AMD published in my article dated July 26th. In fact, AMD has moved higher consistently since touching year-to-date lows in February, and I think it can still continue growing in the near future. Despite the fact that AMD is up almost 600% from its 52-week lows, I think the stock can still offer considerable upside and here’s why.

Inevitable Growth

Over the past few years, Advanced Micro Devices had faced many problems mainly due to the tough competition from its foremost rival NVIDIA. However, the company has performed amazingly well this year thanks to the launch of its new Polaris architecture. Despite the fact that NVIDIA is still a strong competitor in the GPU space, AMD has managed to gain traction this year.

Over the past three quarters, the company has successfully managed to beat analyst estimates on the earnings as well as revenue. In the most recent quarter, the company’s bottom-line came in at $0.03, easily beating the estimates by 4 cents. On the other hand, the company’s revenue came in at $1.30 billion, $90 million greater than the estimates. That figure also represents an increment of 22.6 percent year over year. Clearly, AMD’s days of struggle are over as the company has started reporting stunning sales growth.

The primary reason behind the company’s amazing growth was the robust demand for its graphics products as well as record semi-custom sales. Moreover, the company also reinforced its balance sheet and enhanced its P&L over a series of capital markets transactions that decreased its debt.

When talking particularly about AMD’s Computing and Graphics segment, the company reported robust growth in the quarter, as the revenue generated from this segment escalated 11 percent compared to a year ago period mainly due to the enhanced sales of mobile APUs and discrete GPUs.

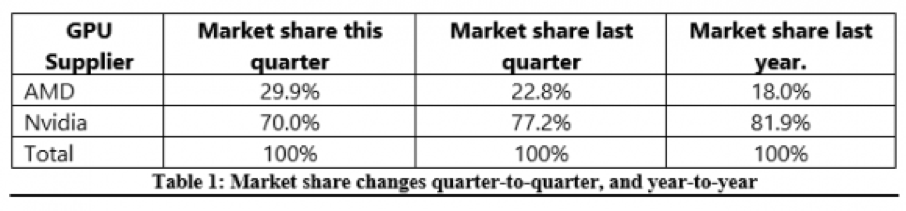

(Source: JonPeddie.com)

It is well known to everyone that AMD and NVIDIA are the only two most significant players in the GPU market. Over the past two years, NVIDIA gained a strong lead over AMD, but this year AMD has successfully reversed its fortune by launching the prolonged family of Polaris desktop GPUs.

AMD’s current stock price clearly verifies that the company played a smart move by placing its primary focus on mainstream consumers. The RX 480 was the first Polaris based GPU priced at $199 and its sales drove the company’s highest quarterly channel GPU revenue and average selling price since early 2014.

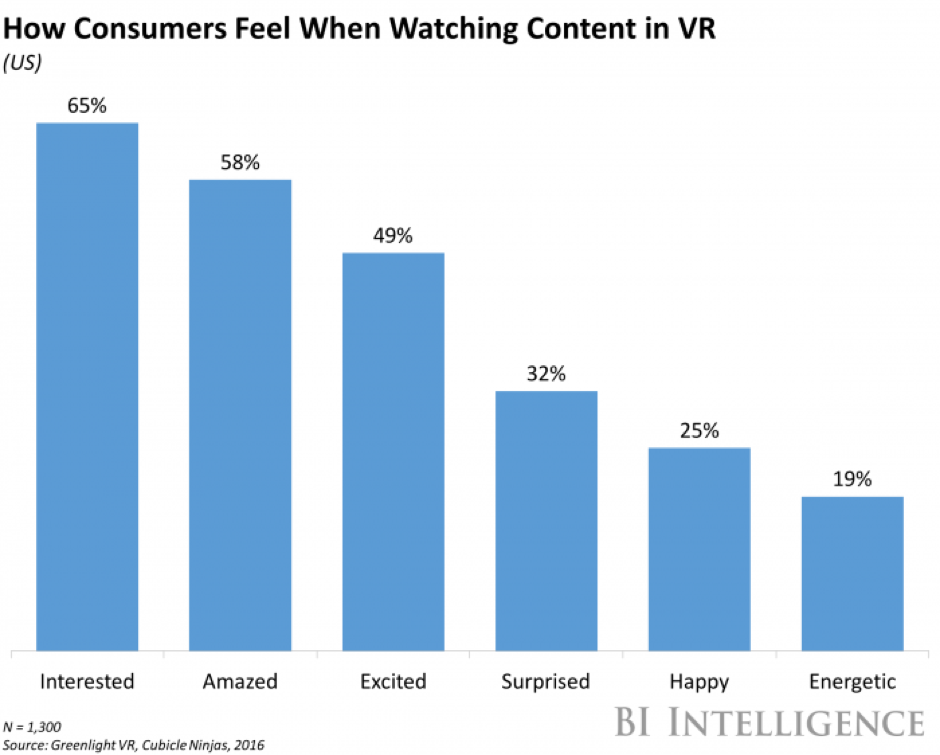

Most significantly, virtual reality market is growing at a rapid rate and the Radeon RX 480 efficiently supports both the high-end VR devices, Oculus Rift and HTC Vive, hence making VR affordable. At present stage, Radeon RX GPUs account for over 50 percent of the company’s channel GPU revenue. Given the expected growth of the virtual reality space, I think AMD’s early initiatives to tackle the market will prove to be beneficial.

(Source: Business Insider)

In comparison, NVIDIA’s strategy was to first launch graphics cards based on Pascal architecture for high-end consumers. However, the main reason which helped AMD to move upward was its pricing power.

Moving onward, AMD is on its way to launch its new ZEN architecture for CPU which will directly face competition from Intel’s upcoming CPU architecture. AMD’s future depends on the upcoming ZEN architecture, as it can take the company to great heights.

However, on the flipside, if the company fails to meet the public expectations, it could certainly lose most of the recent gains and can even create serious problems for the company in the long-run.

A great Opportunity

Few months ago, Alibaba signed a deal with AMD to use its GPUs into its cloud platform. And recently, Google announced that it will use AMD’s server GPUs into its cloud platform. NVIDIA’s server chips are already being used by substantial cloud-computing vendors such as Microsoft’s Azure, Amazon Web Services, and IBM’s cloud platform, but in the case of AMD, Google’s deal will prove to be a blessing for the company.

The Google deal signifies remarkable progress for the company, which has failed to take advantage of the rising trend of GPUs being used in the data centre to the same magnitude as NVIDIA. As a result, the company has secured two most significant deals which will definitely help the company to regain its lost position.

Given the positive trends, I think AMD’s rally is still alive and the stock can still continue heading higher.

Conclusion

Despite the fact that AMD has staged a massive turnaround this year, I think the stock still has upside potential. Making up grounds on NVIDIA in the GPU segment has certainly helped the company and if it can repeat its performance under the leadership of Lisa Su, then the stock can potentially move further higher. My bullish stance on AMD is resonated by I Know First’s algorithm as evident from the image below. The green 203.54 1 year forecast indicates that the algorithm is extremely bullish on AMD in the long term.

*1 Year signal strength of 203.54 and a predictability indicator of 0.51. A detailed explanation of the signal strength and predictability can be found below.

About I Know First’s Algorithmic Forecasts

The underlying technology of the algorithm is based on artificial intelligence, machine learning, and incorporates elements of artificial neural networks and genetic algorithms through which we analyze, model, and predict the stock market. The algorithm is adaptable, scalable, and features a Decision Support System (DSS) to optimize the information produced by the years of data inputted. The algorithm produces a forecast with a signal and a predictability indicator.

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm, allowing the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.

I Know First Past Success With AMD

I Know First’s self-learning algorithm continues to be bullish on AMD shares in past forecasts. In addition to the past forecast described above, on August 31st, 2016, an I Know First financial analyst wrote a bullish outlook on AMD, in accordance with I Know First’s algorithm’s prediction. The article had discussed how AMD’s management has begun to act more strategically with a long-term outlook in mind. Since then, AMD shares have risen by over 24% to date.

This forecast was sent out to I Know First subscribers on August 30th, 2016. To subscribe now click here.