AI Hedge Fund: Hedge Funds With Machine Learning Capabilities

The article was written by Blair Goldenberg, a Financial Analyst at I Know First, and enrolled in a Masters of Finance at Colorado State University.

The article was written by Blair Goldenberg, a Financial Analyst at I Know First, and enrolled in a Masters of Finance at Colorado State University.

AI Hedge Fund

Summary

- AI Hedge Fund and Machine Learning

- I Know First and Hedge Funds

AI Hedge Fund and Machine Learning

Hedge funds using artificial intelligence are becoming a staple. Consumers want to know that their investment is safe and secure, so they have turned to hedge funds that utilize AI. Tim Wong, the chairman of AHL and Man Group Asia has been successful using AI in hedge funds. However, he doesn’t plan on getting rid of employees altogether. Instead he plans on continually employing professionals because of possible dangers that would come into play if the AI system is left unchecked. Even so, “famous hedge fund managers are being replaced by super computers with complex algorithms to watch and predict the market in order to make better bids. Rather than these managers working with hedge funds, PhD holders in mathematics are developing new ways to look at data through mathematical equations, essentially replacing the hedge fund manager” Retrieved from AI Hedge Fund.

AI, though, isn’t enough in the financial industry. Machine learning, which is part of AI, is a way for machines to learn from their data and grow, just like humans learn. Specifically, machine learning is “a method of data analysis that automates analytical model building. Using algorithms that iteratively learn from data, machine learning allows computers to find hidden insights without being explicitly programmed where to look” (Retrieved from SAS).

Hedge funds have moved into the AI sector because with such large amounts of data in the market, machines can better process it as well as find patterns within the market at a much quicker rate. And at this day in age, we produce massive amounts of data on a daily basis, much more than we ever used to in the past. This is where AI excels and humans do not. While humans can consume large amounts of data and can adequately detect patterns from the given data, there is a limit. Humans can only work through data for certain periods and at a certain rate. Because humans are living beings, they get distracted, thus further limiting the pace that they can analyze data. AI can incorporate even the smallest amounts of data, digest it, and come up with patterns in a speed that no man can compete with. At this point, it is a given that financial markets should be analyzed for patterns by machines rather than humans. It’s cost-effective, quick, and human error is effectively eliminated. However, as briefly mentioned above, humans aren’t being completely erased from the equation. Wong continues employing financial professionals in order to manage risk. Wong stated that his team meets weekly in order to discuss possible problems with the program and how they would react if that were to happen, effectively creating emergency plans for any problem (Retrieved from SCMP).

Though the system incorporates AI machine learning, humans play an important role because it isn’t completely self-sufficient as of yet. Again, there may be issues that arise that require a human to fix as the machine may not realize that their pattern detection has gone of course. There are two types of machine learning within AI, supervised and unsupervised learning. In this case, AHL and Man Group Asia’s algorithm is supervised, which at this point in time, is the most frequently used. A supervised system is where a human must input certain variables as well as the output on the variables, which then teaches the algorithm to map the input and output functions. In essence, the human is teaching the algorithm how to function with the data set that they are give. Very much like a human learning from a human teacher.

Conversely, the unsupervised machine learning entails an input data set but the human does not give the algorithm an output. The idea is that the algorithm will take the input and evaluate the structure which then leads the algorithm to learn more about the type of data involved. Unsupervised algorithmic data sets have no correct answer and there is no “teacher” involved. It is entirely up to the algorithm to digest the data and draw conclusions based on the data.

While Wong begins to use algorithmic models for the company’s hedge fund, I Know First has already created an algorithm that not only incorporates machine learning, but also incorporates neural networks that evolve in time. Although I Know First doesn’t manage its own hedge fund, the company does follow top stocks that are included in top hedge fund portfolios.

I Know First and Hedge Funds

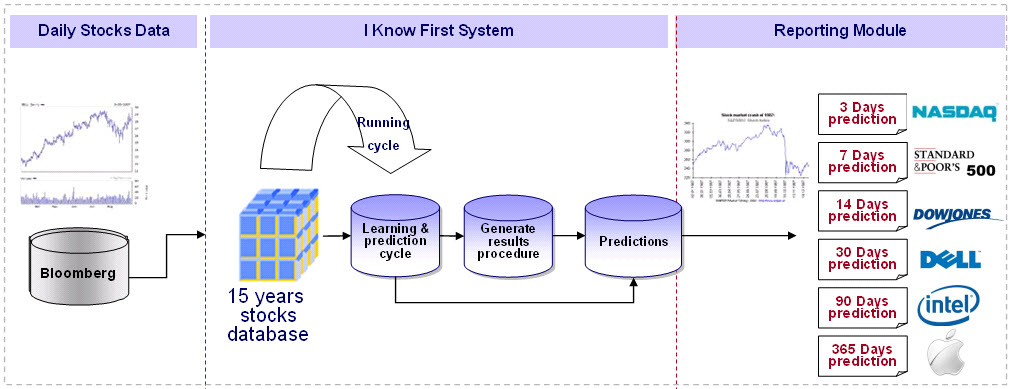

I Know First predicts a growing universe of over 13,000 securities for the short, medium and long term horizons daily by applying Artificial Intelligence and Machine Learning techniques to search for patterns and relationships in large sets of historical stock market data.

Through it’s self-learning ability and flexible multi-layered neural networks structure, the algorithm is able to learn from, adapt to and evolve together with continuously changing markets. It offers an independent, objective and unique perspective on the financial markets and doesn’t rely on any human derived assumptions or traditional theories and models that often do not hold (any more).

The results of intense learning and prediction cycles are aggregated into two indicators per time frame: signal and predictability. While predictability indicator helps to identify and focus on the most predictable assets, the signal is used to define and rank the trades and is related to the magnitude of expected return.

The applications of the algorithmic AI-based forecasts are multi-fold.

The scalability of the algorithmic predictive system allows I Know First to offer custom forecasting solutions to hedge funds and other financial institutions, so they can identify the best opportunities as discovered by the self-learning algorithm within the investment universe of their interest. Further, the solution can be used as a decision support system in form of an algorithmic screen integrated into client’s investment process in order to confirm or reject investment ideas before the execution.

Moreover, I Know First develops and back-tests systematic trading strategies which are used in partnerships with hedge funds and other asset managing entities. These strategies are rules-based and utilize algorithmic forecasting indicators mentioned above in order to rank and select the trades as well as time the execution. The type of strategies varies, including mean-reversion logic and more trend focused approaches, all generating high positive alpha while keeping beta in the 0.3-0.8 range, yielding overall high risk-adjusted returns. The strategies can be used in partnership with I Know First to launch hedge funds, mutual funds or other investment vehicles.

For further information, please review related articles:

Stock Predictions: Daily Stock Selection Based On a Self-Learning Algorithm January-November 2016

Stock Filtering by the I Know First Signal and Predictability Indicators

Day Trading Strategy: An In-depth Analysis of Realistic Back-Tests

Short-term Trading: Summary of Realistic Backtests based on Daily Stock Selection

AI Hedge Fund: Bridgewater Using AI to Increase Profits and Productivity

- AI Hedge Fund: Artificial Intelligence Taking over Hedge Fund Market

Or contact I Know First at: