AI Hedge Fund: Artificial Intelligence Taking over Hedge Fund Markets

The article was written by Blair Goldenberg, a Financial Analyst at I Know First, and enrolled in a Masters of Finance at Colorado State University.

The article was written by Blair Goldenberg, a Financial Analyst at I Know First, and enrolled in a Masters of Finance at Colorado State University.

AI Hedge Fund

Summary

- Artificial Intelligence and Hedge Funds

- Issues With Quantitative Hedge Funds

- Renaissance Technologies Medallion Fund

- I Know First and Hedge Funds

Artificial Intelligence and Hedge Funds

A hedge fund‘s main purpose is to maximize profits for its investors, while managing the risks. A hedge fund is a partnership between fund managers and can be seen as more of a pooling of funds by only certain investors. These investors have to meet certain qualifications, one of which is having a net worth of over $1 million and are referred to as “sophisticated” investors. The idea of pooling funds is that investors can invest in a specific company, accompanied by other companies, that will essentially safeguard the investment as a whole. When the market goes down, hedge funds aren’t affected as much because of this “insulation.” Hedge funds also “exploit quite small market mispricings, a strategy that can nonetheless pay off handsomely if bets are leveraged” (retrieved from Investopedia).

A hedge fund‘s main purpose is to maximize profits for its investors, while managing the risks. A hedge fund is a partnership between fund managers and can be seen as more of a pooling of funds by only certain investors. These investors have to meet certain qualifications, one of which is having a net worth of over $1 million and are referred to as “sophisticated” investors. The idea of pooling funds is that investors can invest in a specific company, accompanied by other companies, that will essentially safeguard the investment as a whole. When the market goes down, hedge funds aren’t affected as much because of this “insulation.” Hedge funds also “exploit quite small market mispricings, a strategy that can nonetheless pay off handsomely if bets are leveraged” (retrieved from Investopedia).

Just like in many other areas of finance, hedge funds are becoming computerized. Famous hedge fund managers are being replaced by super computers with complex algorithms to watch and predict the market in order to make better bids. Rather than these managers working with hedge funds, PhD holders in mathematics are developing new ways to look at data through mathematical equations, essentially replacing the hedge fund manager. Large hedge fund companies such as Tudor Investment Corporation began seeing a decline in their client-base and even saw some investors pull out of the company, prompting Paul Tudor Jones to invest in research and development, aided by scientists and mathematicians. Clients are now investing with companies that use algorithmic trading rather than investing with companies that use traditional hedge fund trading methods.

More recently t he hedge fund industry “has suffered the biggest quarterly outflow since the financial crisis,” because more investors trust the supercomputers than the seasoned and skilled hedge fund managers (retrieved from The New York Times). Statistics show that this year, Investors have invested about $7.9 billion into quantitative hedge funds. Companies’ AUM now using the technology have more than doubled from $408 billion to $900 billion in seven years, according to Hedge Fund Research.

he hedge fund industry “has suffered the biggest quarterly outflow since the financial crisis,” because more investors trust the supercomputers than the seasoned and skilled hedge fund managers (retrieved from The New York Times). Statistics show that this year, Investors have invested about $7.9 billion into quantitative hedge funds. Companies’ AUM now using the technology have more than doubled from $408 billion to $900 billion in seven years, according to Hedge Fund Research.

Issues With Quantitative Hedge Funds

The sudden and increasing push to computerize the finance industry is drawing some criticism. Some critics say that the more companies begin to use computerized models and algorithms, the more alike companies will be which ultimately means that their programs will become insignificantly dissimilar. This would likely create overcrowding in the industry.

Another issue is that because these machines will become so similar, they will forecast similarly. This may create financial ripples in the market that could cause a crisis. For example, if most of the companies begin to have the same “sell” ratings on certain companies, then all investors would be prompted to sell as the exact same time. This happened in 2007 during the “quant crunch.” Right before the housing market collapse, companies such as AQR Capital Management, D.E. Shaw and Renaissance Technologies used models that all showed the possibility of the collapse. Each firm lost significant amounts of money and because they all used similar models, their losses were intensified.

No matter how you look at it, the Finance industry as a whole in undergoing renovations. The world of Artificial Intelligence is quickly expanding and replacing financial advisers and portfolio managers. This could be a good change or a bad change, as skilled workers are being phased out and replaced by machines. As with Tudor Investment Corporation, companies are cutting labor costs and spending that saved money in advanced machines to predict the market and economy. Because the labor costs are down, clients and companies alike will eventually receive higher returns because, essentially, the middle man is being cut out. While this may seem scary for the professionals in finance, this isn’t a death sentence for the career. Analysts believe that the industry will continually need human financial professionals to continue the investment process.

Renaissance Technologies Medallion Fund

The leader in quantitative hedge fund investing is Renaissance Technologies. Founded by a mathematician named Jim Simons in 1982, he brought together many scientists to develop the Medallion Fund.

The Medallion Fund is shrouded in intense secrecy. Since it  foundation, the profits from the fund are approximately $55 billion. The fund can produce profits in less time than the traditional funds run by billionaires such as Ray Dalio and George Soros, and it can produce these profits with less managing assets. The fund almost never loses and the max drawdown in the last 5 years equates to only half a percent. This is unheard of in the financial industry, not just pertaining to hedge funds. Competition-wise, there is none.

foundation, the profits from the fund are approximately $55 billion. The fund can produce profits in less time than the traditional funds run by billionaires such as Ray Dalio and George Soros, and it can produce these profits with less managing assets. The fund almost never loses and the max drawdown in the last 5 years equates to only half a percent. This is unheard of in the financial industry, not just pertaining to hedge funds. Competition-wise, there is none.

The scientists who developed and continually work with the Medallion Fund have such immense wealth, it is “greater than the gross domestic product of many countries and increasingly influences U.S. politics” (retrieved from Bloomberg).

Simons is mathematical genius who was a professor at MIT and Harvard and he has received the Oswald Veblen Prize in Geometry. He is also the co-creator of the Chern-Simons theory. Institute for Defense Analyses employed Simons as a code breaker where he parsed through noise in order to find messages.

Simons is mathematical genius who was a professor at MIT and Harvard and he has received the Oswald Veblen Prize in Geometry. He is also the co-creator of the Chern-Simons theory. Institute for Defense Analyses employed Simons as a code breaker where he parsed through noise in order to find messages.

Though no company can compete with Renaissance Technologies at this point in time, computers and researchers are catching up quickly. With billions of dollars flooding into the research and development of Artificial Intelligence and Self-Learning computers, financial firms will eventually catch up and possibly surpass the Medallion Fund. We’re already seeing the shift and the flow of money with Paul Tudor Jones as stated above.

Employees at Renaissance receive an allocation of shares that they can buy if they decide. Also, part of each employees paycheck is reinvested into Medallion, which equates to about 1/4th of their salary. Employees also have to pay fees to the company, as much as “5 and 44” (5 percent of assets and 44 percent of profits.)

Simons began buying and selling commodities. Based on fundamentals, he made his bets, relying on variables such as supply and demand. He began to work with a team of cryptographers and mathematicians, in order to look for patterns which included Elwyn Berlekamp, Leonard Baum, Stony Brook, Henry Laufer and James Ax. With this team of scientists, they came up with models gradually.

The scientists began to develop their own in-house programming language for the models. The code that is used for the fund includes several million lines, says sources close to the company. Astrophysicists have played a huge role at Renaissance and are part of the reason the Medallion Fund is so successful. The astrophysicists screen “noisy” data regularly and have become adept at it, which is exactly the type of scientific data analysis that the Medallion Fund needs. String theorists are also major figures in the company.

In 2007, when the recession began to infiltrate the United States housing market and mortgages began to rise, causing the collapse in 2008, many large hedge funds companies, which includes Goldman Sachs began to fail. The Medallion Fund lost almost $1 billion which was about one-fifth of the total fund in only a few days. Renaissance executives begin selling positions, thinking that their wealth would collapse with the market. When the market began to revive, Medallion not only made up what they had lost but saw a gain of 85.9 percent. So although the fund was affected negatively by the collapse, they were well equipped to fare the storm and come back even stronger.

I Know First and Hedge Funds

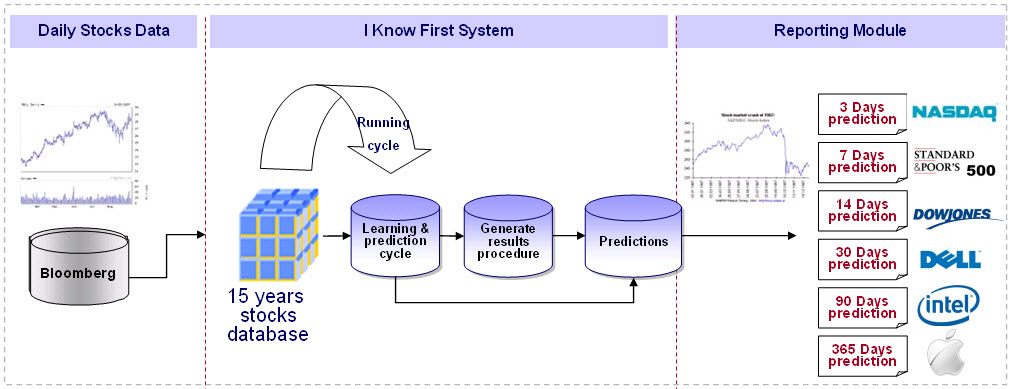

I Know First predicts a growing universe of over 7,000 securities for the short, medium and long term horizons daily by applying Artificial Intelligence and Machine Learning techniques to search for patterns and relationships in large sets of historical stock market data.

Through it’s self-learning ability and flexible multi-layered neural networks structure, the algorithm is able to learn from, adapt to and evolve together with continuously changing markets. It offers an independent, objective and unique perspective on the financial markets and doesn’t rely on any human derived assumptions or traditional theories and models that often do not hold (any more).

The results of intense learning and prediction cycles are aggregated into two indicators per time frame: signal and predictability. While predictability indicator helps to identify and focus on the most predictable assets, the signal is used to define and rank the trades and is related to the magnitude of expected return.

The applications of the algorithmic AI-based forecasts are multi-fold.

The scalability of the algorithmic predictive system allows I Know First to offer custom forecasting solutions to hedge funds and other financial institutions, so they can identify the best opportunities as discovered by the self-learning algorithm within the investment universe of their interest. Further, the solution can be used as a decision support system in form of an algorithmic screen integrated into client’s investment process in order to confirm or reject investment ideas before the execution.

Moreover, I Know First develops and back-tests systematic trading strategies which are used in partnerships with hedge funds and other asset managing entities. These strategies are rules-based and utilize algorithmic forecasting indicators mentioned above in order to rank and select the trades as well as time the execution. The type of strategies varies, including mean-reversion logic and more trend focused approaches, all generating high positive alpha while keeping beta in the 0.3-0.8 range, yielding overall high risk-adjusted returns. The strategies can be used in partnership with I Know First to launch hedge funds, mutual funds or other investment vehicles.

For further information, please review related articles:

Stock Predictions: Daily Stock Selection Based On a Self-Learning Algorithm January-November 2016

Stock Filtering by the I Know First Signal and Predictability Indicators

Day Trading Strategy: An In-depth Analysis of Realistic Back-Tests

Short-term Trading: Summary of Realistic Backtests based on Daily Stock Selection

Or contact I Know First at: