Adobe Stock Forecast: Key Strengths Review Prior to Q1 2017 Announcements

The article was written by Jordan Klotnick, a Financial Analyst at I Know First. He graduated from Monash University with a Bachelor’s in Business – Majoring in Marketing.

The article was written by Jordan Klotnick, a Financial Analyst at I Know First. He graduated from Monash University with a Bachelor’s in Business – Majoring in Marketing.

Adobe Stock Forecast

Summary

- Adobe financial highlights for the past 4 quarters

- Adobe’s Future Targets

- I Know First Bullish Forecast for Q1 results 2017

Background

Adobe Systems Incorporated is one of the largest software companies in the world. They offer products and services that are used by creative professionals, markets, and consumers. They use the product for managing, delivering and measuring compelling content and experiences across personal computers, devices and social media. Adobe is expecting to announce its Q1 2017 results on March 16th 2017, and many research analysts maintain a bullish view on the firm’s prospective results. I Know First’s self-learning algorithm maintains a bullish mid-term outlook on the firm moving forward.

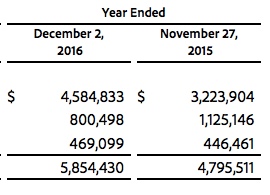

Adobe has two major competitors, the first being Microsoft and second Red Hat. The year 2015 was very good for Adobe, who is the leader in software tools for content creators. The company shifted to a Web-based business model. Almost 70% of total sales come from recurring revenue from Creative Cloud and other subscriptions. Although subscriptions decreased from 2015 to 2016 (1,125,146 to 800,498), revenue increased from $3,223,904 to $4,584,833.

Financial highlights for the past 4 quarters:

Source: Yahoo Finance

Source: Yahoo Finance

According to the CEO of Adobe, Shantanu Narayen, “FY ‘16 was another great year for Adobe. Our record growth and net income were driven by strong performance in Creative Cloud annualized recurring revenue, continued growth of Adobe Document Cloud subscriptions and strong revenue and bookings for Adobe Marketing Cloud. In Q4, we delivered record revenue of $1.61 billion, which represents 23% year-over-year growth. For the year, we grew total revenue to $5.85 billion, which represents 22% annual growth.”

Adobe’s Future Targets

The company is expecting 2017 to be a promising year, particularly after their acquisition of TubeMogul on December 19, 2016. Adobe is expecting total revenue to be approximately $7.090 billion with their digital media segment revenue to grow by around 20% year-over-year.

Source: Adobe

Source: Adobe

I Know First Bullish Forecast

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm, allowing the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.

Conclusion

Adobe is announcing their first quarter financial results on March 16th, 2017, post-market. Investing in a firm prior to earnings can result in a massive opportunity set (those the risks are high). ADBE has shown a high growth trend over the past four quarters, indicating the firm is on track for a positive performance. Additionally, I Know First’s AI-based algorithm maintains a bullish prediction on ADBE shares as well.

To learn how you can become a subscriber today, click here.