Robinhood Trading Using AI: Top Stock Picking Strategies to Boost Portfolio Now

This Robinhood trading article is written by Hao Liu, Financial Analyst at I Know First.

This Robinhood trading article is written by Hao Liu, Financial Analyst at I Know First.

“Retail participation is at levels we haven’t seen in 20 years. In terms of the most dramatic rises in speculative behavior that is generating many of the strangest outcomes in markets right now, it’s Robinhood-centric.”

——Benn Eifert, managing partner of QVR Advisors

Summary

- Robinhood Trading users are taking high risks for lack of investment knowledge.

- I Know First can help Robinhood users alleviate risks by utilizing AI-powered stock forecasts.

- I Know First offers highly customizable forecasting solutions tailored to investor’s needs and riskiness.

Robinhood Investors Are Taking High Risks Without Them Knowing Of

Robinhood, the millennial-popular trading app, recently has been questioned again for their persistent ignorance of the potentially high risk of their creations. While Robinhood trading has lured more retail investors to the market since the pandemic, the recent suicide of the 20-year-old Robinhood user Alex Kearns has also triggered reflections on these online brokerages. Investors from these brokerages are taking higher risks while lacking the required financial competence to make optimal investment decisions, some of the assets they traded are too complex for them to handle.

How I Know First AI Forecasts Can Improve Robinhood User Experience

On the one hand, I Know First forecast helps Robinhood trading users make more informed investments. It’s reported that many millennial newbies have outperformed the Wall Street traders in the past few months during the pandemic, but it seems that these inexperienced retail investors are winning by gambling instead of making reasonable investments. As Soc Gen pointed out, “In terms of overall economic value, Robinhood investors appear to be buying both high quality and lower quality stocks.” The relevant graphs are shown below, it seems that Robinhood investors don’t really understand what they’re investing in. Buying bankrupt stocks is also a good example. More dramatically, there were even cases Robinhood investors mistaken the stocks to buy just according to some declaration on social media. With I Know First forecasts, these retail investors may have had a second opinion before they went in with impulse.

On the other hand, I Know First packaged forecasts allow Robinhood users to build investment strategy according to their own circumstances (expected return, capital size, risk preference, etc.). Among different investment strategies, the most popular ones are shown in the image below.

With different investment strategy, the investor will compose their portfolio accordingly. Below is an example of hypothetical asset allocations for five different investing strategies depending on financial goals and risk tolerance. When younger, the investor may want to be more aggressive and invest in high-growth stocks; when retiring, the investor may want to be more conservative and allocate assets into bonds.

Many investors also combine multiple strategies to find the best personalized strategy. But either a single strategy or a combination of multiple strategies, the ideal strategy is the one that increases return and decreases risk. I Know First have forecasts on a wide range of different packages that help investors personalize their portfolios while achieving high returns based on their risk appetite.

One example is to combine Warren Buffett Portfolio with Tech Giants Stocks/top stocks from Tech Stocks. For those who wish a lower risk and steady return, but also a chance to outperform the broader market, this could be an option. Even though Berkshire Hathaway has been under-performing the market for a decade, many investors still look up to the Oracle of Omaha and follow his portfolio. As I previously mentioned in the analysis of Warren Buffet’s portfolio, one big reason Warren Buffett under-performed lies with the composition of his portfolio – light on tech and heavy on financials. But since Warren Buffett adopts value investing, many stocks he picked are mature companies with lower risk and moderate return. There is a chance to outperform Warren Buffett’s portfolio by including more big tech firms or high growth firms.

Another possible package combination could be Aggressive and Conservative Stocks. Aggressive package features high return and high risk, while conservative package is the opposite, featuring low return and low risk. Investor can choose several top stocks from both packages to establish a portfolio. The rationale is pretty easy to understand – top stocks ensures returns while combination of aggressive and conservative strategies balance out the risk.

Finally, I Know First recently introduced their own tailor-made custom forecast in which the users are provided with the most promising stocks among the the top 100 most traded stocks on the Robinhood trading platform.

In addition to this, I Know First gold and commodities, currencies forecast and cryptocurrencies packages allows investors add more elements to their portfolio, especially those active investors. As for those “lazy” investors, I Know First also provides packages requiring less monitoring. At this time, the Coronavirus package could be a good choice.

Why Robinhood Users Should Consider I Know First AI Predictions

Firstly, Robinhood investors are exposed to highly risky products such as complex commodity-linked ETFs, which are considered especially unsuitable for new retail investors. I Know First forecasts on a variety of assets, including those traded on Robinhood, to help investors alleviate investment risks by making more informed decisions. As shown above, the I Know First Stock Forecast Algorithm gathers all market data free from human derived assumptions, which guarantees the objectiveness and timeliness of the forecast. Thus, I Know First AI predictions can serve as a more reliable alternative opinion for investors especially those who base their decisions on a declaration on social media.

Secondly, Robinhood has limited market research and educational components. This could be a turnoff for new investors, who also happens to be their major users. Though this has started to change after the recent events, Robinhood still has a long way to offer learning portals like Investopedia. I Know First premium articles keep you informed about the fundamentals of the companies you invested in and help you understand why it’s a good investment as well as embedded risks. As these articles are prepared for all levels of investors to read (from novice to veteran), a lot of financial knowledge is explained in the analyses, which are instructive for new investors.

Thirdly, I Know First gives Robinhood users more choices to customize portfolio based on their own capital size (I Know First offers small cap and mega cap stocks package) and risk preference (I Know First has both aggressive and conservative stock forecast package). I Know First also provides forecast on world indices and ETFs, which are traded on Robinhood as well. Apart from this, I Know First can offer custom forecasts to more experienced investors, and even totally customized forecasts based on clients’ selection of stocks/assets for his or her portfolio to enable daily portfolio monitoring.

Recent Success of I Know First Algorithm Forecasts

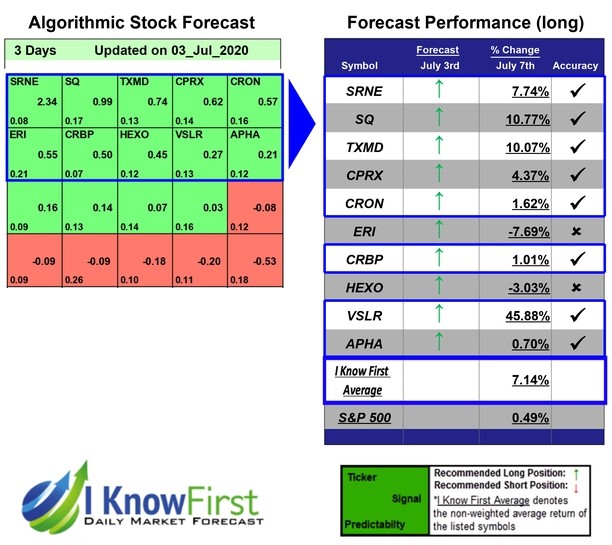

For some of the most highly traded stocks on Robinhood, I Know First has provided algorithmic forecasts on them with incredible feats. This algorithm developed by I Know First can consistently predict stock movements throughout various time periods. Even on small horizons such as in the 3-days top Robinhood stocks forecast below, the algorithm managed to successfully predict 8 of 10 stocks that surged up during the week:

Thetop performing prediction from this top 10 Robinhood stock picks package was VSLR with a suberb return of 45.88%. SQ and TXMD followed with returns of 10.77% and 10.07% for the 3 Days period. Overall, if someone just followed the top 10 selection in a passive way with long position, the result would be 7.14% versus 0.49% S&P 500’s performance – a market premium of 6.65%.

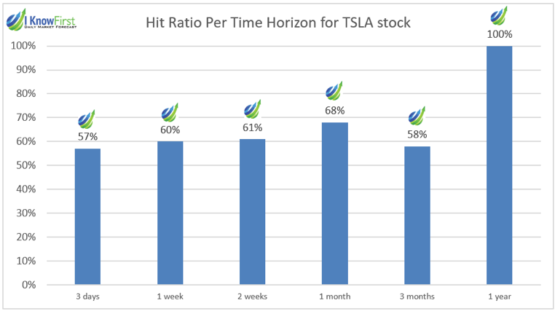

Another example, as shown in the bar chart below, despite AAPL stock performance has been volatile over the past year, I Know First has achieved over 65% hit ratio in all forecast time horizon varying from 3-day to 1-year. The 1–year time horizon even hit 100% accuracy.

In fact, AAPL is not the only success I Know First has achieved. Other nowadays popular stocks such as TSLA and NVDA are also accurately predicted by hitting exact movement 100% of the time for the 1-year prediction time horizon (see bar charts below).

These successful results allow our clients to make safer investments especially at this unpredictable time. As can be seen in the heatmap below, when all airlines surge in the late May, not only did I Know First identified the bullish signal of UAL and LUV among the top 10 stock market opportunities, but also indicate how bullish each stock will be. For those beginner investors without solid financial knowledge on Robinhood, this forecast will help them gain better returns by being informed of the trend and knowing which stock is a better investment.

Conclusion

Generally speaking, Robinhood investors are exposed to highly risky products and need to make more informed decisions when investing. I Know Firs can provide support for such decisions by providing a universal ranking by signal and predictability indicators for stocks that could indicate riskiness and potential gain on stocks.

Specifically, I Know First premium articles feed more financial analysis to help investors understand the investment, and AI forecasts offer opportunities to build up investor’s own investment strategy. I Know First can also provide various solutions to different Robinhood users that could be tailored to each one of them. Such AI-powered stock market forecasts are becoming a basic service that offers second opinion to investors of different levels which ultimately democratizes the stock market. Especially considering the high hit ratio of past success, I Know First allows investors make the safest investments at this unpredictable time.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.