VRX Shares Quick Win by the Algorithm: A Valiant Effort to Recover

Quick Win by the Algorithm

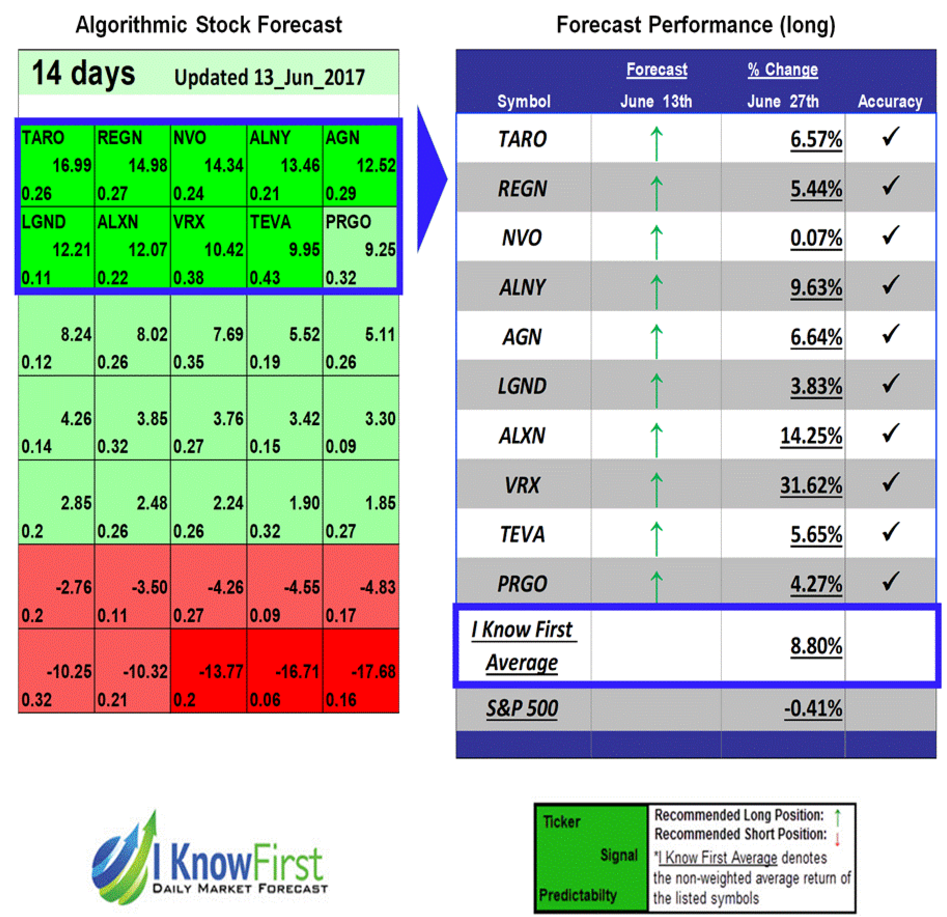

On June 13th, 2017, the I Know First algorithm issued a bullish forecast for Valeant Pharmaceuticals (NYSE:VRX). VRX had a signal of 10.42 and a predictability of 0.38. As a result, in accordance with the forecast, the company’s stock had a return of 31.62% within 14 days, showing a quick win by the algorithm.

In 1960, Milan Panic founded what would eventually become Valeant Pharmaceuticals. Management built the company from ICN Pharmaceuticals, SPI Pharmaceuticals, Viratek, and ICN Pharmaceuticals. This merger occurred in 1994 and in 2003, ICN Pharmaceuticals Inc. changed its name to Valeant. Since then, the company grew quickly with a series of mergers and acquisitions under the leadership of J. Michael Pearson. In 2015, it was the most valuable company in Canada. The company is a multinational pharmaceutical company that develops, manufactures and markets a broad range of pharmaceutical products. These are in the areas of dermatology, gastrointestinal disorders, eye health, neurology, and branded generics.

Approximately two years ago, Valeant investors were gleefully rubbing their hands together in anticipation of all the money they were poised to make. CEO Mike Pearson’s aggressive acquisition-focused strategy forged a meteoric ascent. Much to investors’ delight, the stock rocketed from around $20 to $257. However, the joy was short-lived. Only a few weeks later, the stock came crashing back down, causing catastrophic losses. The company was involved in a controversy about drug price hikes and the use of a specialty pharmacy for the distribution of its specialty drugs.

Since then, Valeant has been slowly clawing its way back from the massive loss. The board replaced Pearson and recent prospects are looking much more positive. The industry knows current CEO Joseph C. Papa to have a stellar track record, and he is fighting to bring this company back. He has committed to reaching the company’s difficult $5 billion repayment in debt goal by 2018. Valeant’s long-term debt climbed to more than $30 billion after Pearson’s high volume and rapid deal-making.

Last month, Valeant showed signs of smart financial moves which put it on track to improve. For example, the company announced the sale of its iNova Pharmaceuticals business for $930 million. Papa is making an effort to refocus the company. He has stated that the company will focus on its core businesses while trimming the excess divisions and unnecessary components. This will be good for the company in terms of its debt and financial performance.

Evidently, investors seem to agree. Valeant’s stock price jumped last month 31.62% over two weeks. Although there is still much to be cautious about this company, one can see why it deserves a place on the watchlist for companies that show future promise.

This bullish forecast on VRX was sent to current I Know First subscribers on June 13, 2017.

Before making any trading decisions, consult the latest forecast as the algorithm constantly updates predictions daily. You can use the algorithm for intra-day trading. The predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.