Quick Win by the Algorithm: TEVA Share Price Plummets, as Expected

Quick Win by the Algorithm:

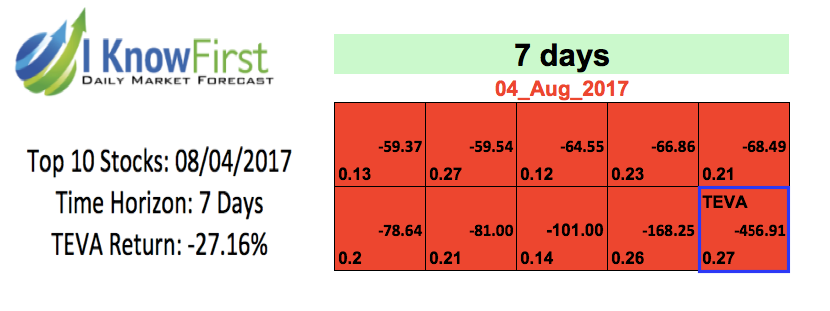

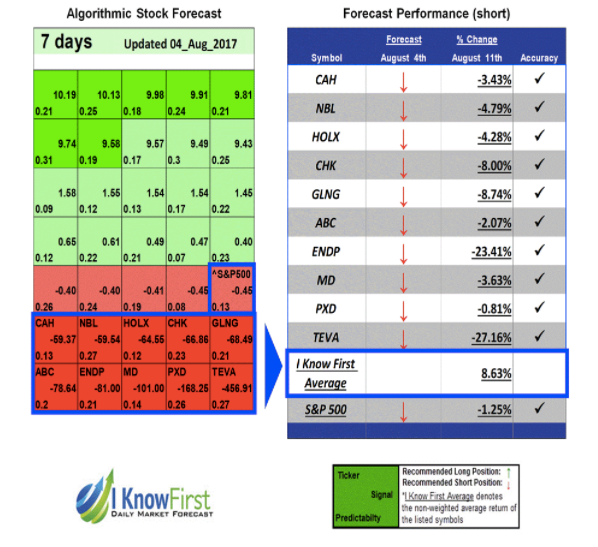

On August 4th, 2017, the I Know First algorithm issued a bearish 7-day forecast for Teva Pharmaceutical Industries (TLV:TEVA). The forecast showed a signal of -425.91 and a predictability of 0.27. As a result, in accordance with the forecast, the company’s stock produced a return of -27.16% over this period, solidifying another quick win by the I Know First algorithm.

Teva Pharmaceutical Industries develops, manufactures, markets, and distributes generic medicines and a portfolio of specialty medicines worldwide. It operates through two segments, Generic Medicines and Specialty Medicines. The Generic Medicines segment offers sterile products, hormones, narcotics and high-potency drugs. This segment also develops, manufactures, and sells active pharmaceutical ingredients. The Specialty Medicines segment provides branded specialty medicines for use in central nervous system and respiratory indications, as well as the womens health, oncology, and other specialty businesses. Teva Pharmaceutical Industries was founded in 1901 and is headquartered in Petach Tikva, Israel.

The decrease for share price is attributable to many reasons. Everything started on August 3rd when Teva published a weak earnings report. Then Teva took a $6.1 billion write-down on its generics business, slashed its dividend 75% and announced thousands of layoffs. It’s also facing the risk of breaching its debt covenants, thanks to a $40 million hole it dug with a disastrous purchase of Allergan’s generics unit.

Analysts believe that Teva had it coming for while, as there is widespread belief that they overpaid in the Allergan’s purchase and got into too much debt. Since the purchase, Teva’s stock had been steadily decreasing, but it never truly plummeted like it did last week.

Investors are running away from the Israeli giants, citing lack of confidence in the company’s ability to forecast the business. Also, investment houses have downgraded their ratings and target prices

Current I Know First subscribers received this bullish Teva forecast on April 28th, 2017.

Before making any trading decisions, consult the latest forecast as the algorithm updates predictions daily. You can use the algorithm for intra-day trading. The predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.