Sarepta Stock Quick Win by the Algorithm: SRPT Remains on a Positive Trajectory

Quick Win by the Algorithm

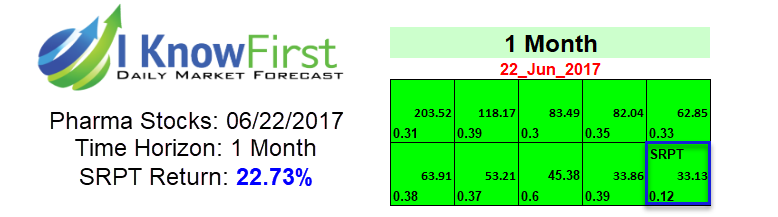

On June 22, 2017, the I Know First algorithm issued a bullish forecast for Sarepta Therapeutics, Inc. (NASDAQ:SRPT). SRPT had a signal of 33.13 and a predictability of 0.12. As a result, in accordance with the forecast, the company’s stock had a return of 22.73% within 1 month, showing a quick win by the algorithm.

Sarepta Therapeutics, Inc., a biopharmaceutical company, was founded in 1980 and is headquartered in Cambridge, Massachusetts. The company focuses on the discovery and development of RNA-based therapeutics for the treatment of rare neuromuscular diseases. The company offers EXONDYS 51, a disease-modifying therapy for the treatment of duchenne muscular dystrophy (DMD). DMD is a rare genetic muscle-wasting disease caused by the absence of dystrophin. It also develops SRP-4045 and SRP-4053, which are exon skipping clinical product candidates for the treatment of DMD. The company has a strategic alliance with Nationwide Children’s Hospital for the advancement of microdystrophin gene therapy program. SRPT distributes its products through a network of specialty distributors and specialty pharmacies in the United States.

Recently, SRPT announced their second quarter financial results. Revenue for the quarter was $35 million. This figure was $12.5 million higher than industry analysts had predicted. Industry analysts had estimated that the company would suffer an earnings loss of 91 cents per share. Instead, SRPT only endured an earnings loss of 46 cents per share. This revenue and earnings quarterly performance should satisfy Sarepta investors. The company determined that the influx in revenue was primarily due to the company’s advancements with their muscular dystrophy drug, Exondys 51. This year SRPT’s stock price has increased by 58.26%, making it one of the more compelling stocks on the market.

“Management admitted to setting a more conservative guidance until the growth trajectory comes more predictable, so investors will likely be drawn to the robust growth story behind Sarepta,” said Leerink analyst Joseph Schwartz.

On July 24, 2017, Sarepta Therapeutics, Inc. announced that it is offering to sell $250 million in shares of its common stock in an underwritten public offering. Sarepta intends to use the net proceeds from the offering for the continuation and initiation of further clinical trials, commercialization, manufacturing, and business development activities.

Current I Know First subscribers received this bullish SRPT forecast on June 22, 2017.

Before making any trading decisions, consult the latest forecast as the algorithm updates predictions daily. You can use the algorithm for intra-day trading. The predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.