Quick Win By The Alogrithm: Rising SunPower

Quick Win by the Algorithm:

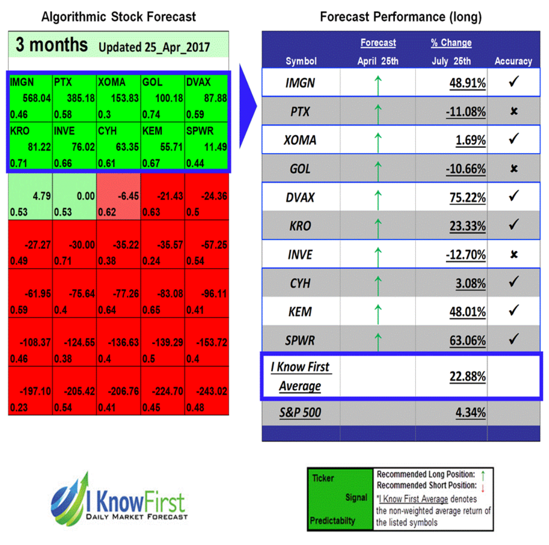

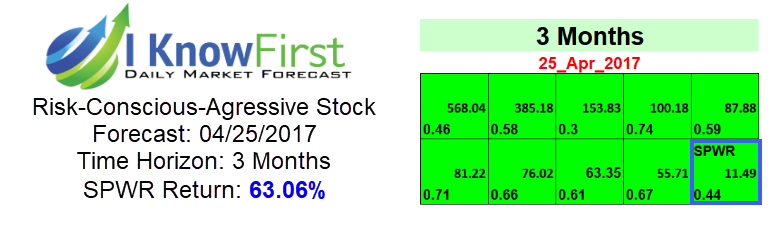

On April 25, 2017, the I Know First algorithm issued a 3-month forecast for Sun Power Corporation (NASDAQ:SPWR), with a signal of 11.49 and a predictability of 0.44. As a result, in accordance with the forecast, company’s stock produced a return of 63.06% over this period, solidifying another quick win by the I Know First algorithm.

SunPower Corporation is an American, San Jose, the California-based solar company founded in 1985. The company is currently researching, developing and installing solar panels. Specifically, SPWR focuses on developing world’s highest efficiency Maxeon cell solar panel technology. SunPower has 750 patents for the solar technology and diversified global portfolio leading residential, commercial and utility solar energy markets worldwide.

Over the past five years, solar has become America’s fastest-growing energy source. In some parts of the U.S., the cost of solar is now equal to buying power from the electrical grid. Many investors didn’t think there could ever be this level of pricing parity, or at least not this soon.

Europe is now entering the traditional peak-selling season and the Suniva “Section 201” trade case, has resulted in installation boom in the U.S., before expected trade barriers resulting from the “Section 201” action, are officially put into practice. A lot of U.S. PV power plants are under construction ahead of time. It leads to strong demand for the manufacturers that are not applicable to the trade barriers set by Europe and the U.S. Therefore, developers in China, Europe, and the U.S. find themselves placing module orders at the same time. The cumulative result is that solar panel prices are rising in the U.S. and Europe.

High tariffs on imports could derail more than two-thirds of all US solar installations over the next five years. But a price floor could be good for SunPower and bad for everyone else. SunPower’s solar panels are the most efficient in the business. As a result, management can charge a premium for them. Major SunPower production is in Asia, but there are power plants in the US and Mexico. Moreover, plants in Mexico could get around trade rules through NAFTA.

The surge in U.S. demand coincides with the bankruptcies of two domestic solar manufacturers: SolarWorld and Suniva. Their loss leaves a gap in supply, compounded by U.S. tariffs that affect some suppliers in Asia. Also in China, some projects have delays and under construction till the end of July. This means the expected decline in demand during the second half of the year will be postponed by at least a month.

Altogether these factors gave SPWR stock 63% growth within a 3-month period.

Current I Know First subscribers received this bullish SPWR forecast on April 25th, 2017.

Before making any trading decisions, consult the latest forecast as the algorithm updates predictions daily. You can use the algorithm for intra-day trading. The predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.