Quick Win by the Algorithm: XME Benefits From Increasing Commodity Price

Quick Win by the Algorithm

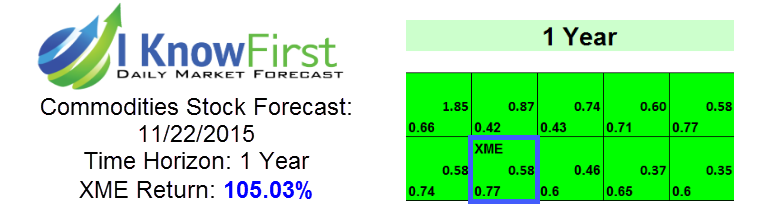

On November 22, 2015, the I Know First algorithm had predicted a bullish forecast for SPDR S&P Metals & Mining ETF (XME). XME had a signal of 0.58 and a predictability of 0.77. In accordance with the algorithm, the company reported long-position capital gains of 105.03% experiencing a quick win by the algorithm.

SPDR S&P Metals & Mining ETF (XME) seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P Metals and Mining Select Industry Index. This fund focuses solely on US stocks and is equally weighted. This results in no stocks having a significant position compared to others in its funds, in order to provide stability.

The index rose by two factors: increase in commodity price and the result of the US election. The largest holding in the ETF is AK Steel Holding Corporation (AKS). I Know First algorithm accurately forecasted AKS stock. In a time span of 3 days, the stock rose by over 27% from November 8, 2016. Another stock among the fund’s top holding is United States Steel Corporation (X). I Know First once again accurately forecasted the stock’s rise from November 15, 2015. Both stocks benefited greatly after U.S. Trade Regulators began adding heavy tariffs on Chinese Steel. This encouraging news gave these companies and others in the industry to improve their competition to Chinese imports. Besides steel, coal is another major factor influencing the stocks price. Since February 2016, the price of coal increased over 80%. After facing 3 years of declining commodity price, China took steps to stabilize the market. In late September, Citi state’s China’s Transport Ministry introduced land transportation restrictions to curb freight overloading. Not only did this restrict the availability of the commodity to be introduced into the market, but it also increased freight cost. China also limited operating days for coal mines to 276 days. Each events helped contribute to coal’s rise by restricting the supply to the market.

Another factor that helped increase the stock’s value was the aftermath of the US election held on November 8, 2016. The sector reacted positively as investors sees Trump’s policy being favorable to the sector. If Trump removes some of the strict guidelines set by the EPA, coal mining companies could improve their competition among other foreign firms.

This bullish forecast on XME was sent to current I Know First subscribers on November 22nd, 2015.

Before making any trading decisions, consult the latest forecast as the algorithm constantly updates predictions daily. While the algorithm can be used for intra-day trading the predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.

Missed the latest trend? Looking for the next best market opportunity? Find out today’s stock forecast based on our advanced self-learning algorithm