Quick Win by the Algorithm: QCRH win 92.49% in 1 Year

Quick Win by the Algorithm

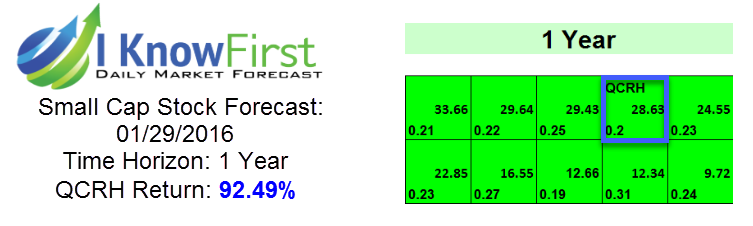

On January 29, 2017, the I Know First algorithm had predicted a bullish forecast for QCR Holdings, Inc. (QCRH). QCRH had a signal of 28.63 and a predictability of 0.2. In accordance with the algorithm, the company reported long-position capital gains of 92.49% experiencing a Quick Win by the Algorithm.

QCR Holdings, Inc. (QCRH), a multi-bank holding company, provides commercial and consumer banking, and trust and asset management services for the Quad Cities, Cedar Rapids, Waterloo/Cedar Falls, and Rockford communities. It operates through Commercial Banking and Wealth Management segments. Since releasing the company’s first quarterly earnings for the year 2016, QCRH’s stock has nearly doubled. The company surpassed analyst’s estimation for Earnings Per Share (EPS) in the first and second quarter. Despite missing expectation on its third quarter on July 20, the company’s revenue increased by approx. 20% since the second quarter. Can QCRH continue its positive trend? Investors are awaiting for the company to release its fourth quarter report on February 7, 2017. Given the stocks rise, EPS is forecasted to be $0.68.

Since releasing the company’s first quarterly earnings for the year 2016, QCRH’s stock has nearly doubled. The company surpassed analyst’s estimation for Earnings Per Share (EPS) in the first and second quarter. Despite missing expectation on its third quarter on July 20, the company’s revenue increased by approx. 20% since the second quarter. Can QCRH continue its positive trend? Investors are awaiting for the company to release its fourth quarter report on February 7, 2017. Given the stocks rise, EPS is forecasted to be $0.68.

As the stock increased, so did volume traded. For example: on January 4, 2017, the company went through a bump of the volume of its stocks with 99,431 shares traded instead of the daily traditional 61,172 shares. Higher volume of stocks traded is a sign for a rise of market awareness regarding the company targeted. This also indicated the bullish signal in which QCRH is currently evolving. As a result, Zack Investment rated the stock as a buy. This may be a long term investment.

This bullish forecast on QCRH was sent to current I Know First subscribers on January 29, 2017.

Before making any trading decisions, consult the latest forecast as the algorithm constantly updates predictions daily. While the algorithm can be used for intra-day trading the predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.

Missed the latest trend? Looking for the next best market opportunity? Find out today’s stock forecast based on our advanced self-learning algorithm