Quick Win by the Algorithm: NVDA Still Climbing, Up Over 9% in 3 Days

Quick Win by the Algorithm

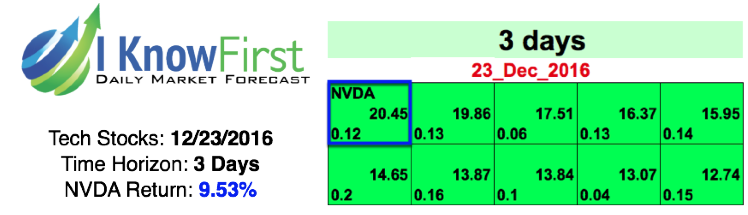

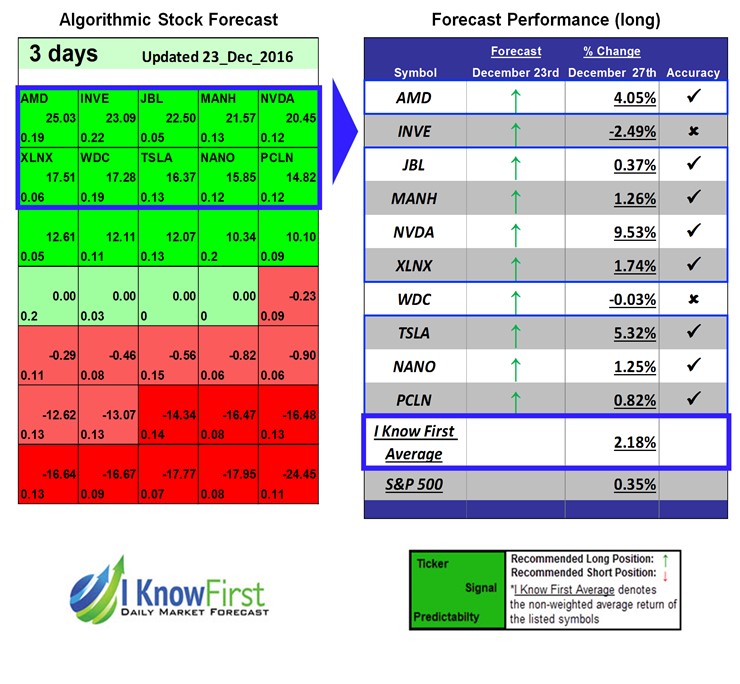

On December 23, 2016, the I Know First algorithm had predicted a bullish forecast for Nvidia Corporation (NVDA). NVDA had a signal of 20.45 and a predictability of 0.12. In accordance with the algorithm, the company reported long-position capital gains of 9.53% experiencing a quick win by the algorithm.

NVIDIA Corporation (NVDA), is a visual computing company worldwide. It operates in two segments, GPU and Tegra Processor. The GPU segment offers processors, which include GeForce for PC gaming; Quadro for design professionals working in computer-aided design, video editing, special effects, and other creative applications

I Know First has been bullish on NVDA for quite some time. Analysts Motek Moyen, Blair Goldenberg, and Yosef Cohen have all written extensive articles highlighting the strong position Nvidia has in the Tech industry. As of today, NVDA stock has gone up 261.55% in the past year, and 9.53% is from the last 3 days. The continued rise in share price is due to the massive research and development into AI-based technology for GPU development as well as partnering with companies such as Microsoft and Nintendo. NVDA’s future is bright, with continued improvements on GPU devices and new projects continuing their growth, NVDA doesn’t seem to be slowing down any time soon. I Know First continues to be bullish on NVDA well into next year.

This bullish forecast on NVDA was sent to current I Know First subscribers on December 23rd, 2016.

Before making any trading decisions, consult the latest forecast as the algorithm constantly updates predictions daily. While the algorithm can be used for intra-day trading the predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.

Missed the latest trend? Looking for the next best market opportunity? Find out today’s stock forecast based on our advanced self-learning algorithm