Quick Win by the Algorithm: Micron Technology Continues to Rise in Memory Markets

Quick Win by the Algorithm

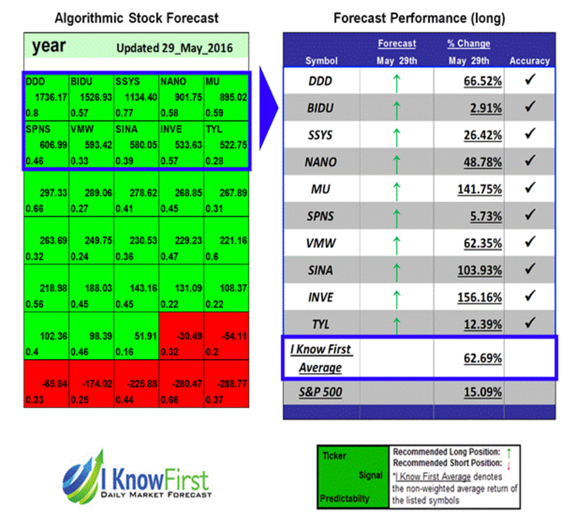

On May 29, 2016, the I Know First algorithm issued a bullish forecast for Micron Technology, Inc. (MU). MU had a signal of 895.02 and a predictability of 0.59. As a result, in accordance with the forecast, the company’s stock increased by 141.75% in just 1 year, showing a quick win by the algorithm.

Micron Technology, Inc. is engaged in semiconductor systems. The Company’s portfolio of memory technologies, including dynamic random-access memory (DRAM), negative-AND (NAND) Flash and NOR Flash are the basis for solid-state drives, modules, multi-chip packages and other system solutions.

Micron Technology (MU) had a one year low of $11.73 in early July of 2016 and a high of $30.70 one year later at the end of the forecast period. In July 2015, Micron and Intel announced their joint venture on the 3D XPoint non-volatile memory. This will undoubtedly find a stable position in the memory end-market due to the technology’s compactness, cheapness, and non-volatility. Intel guided in January for 3D XPoint to account for 10% of its flash memory division’s annual revenue and a much larger percentage the coming year.

Around the same period in October, Micron acquired Tidal Systems, an SSD controller design firm. Moreover, this vertical integration will allow Micron to develop high-end client SSDs independently, which has seen paralleled success in Samsung and Intel.

As detailed in the latest quarterly report, MU had a quarterly revenue of $4,648 million.

This bullish forecast on MU was sent to current I Know First subscribers on June 4, 2017.

Before making any trading decisions, consult the latest forecast as the algorithm updates predictions daily. You can use the algorithm for intra-day trading. The predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.