Quick Win Stock Analysis by the Algorithm: VALE Rises 79.87% From the Ashes of Disaster

Quick Win by the Algorithm

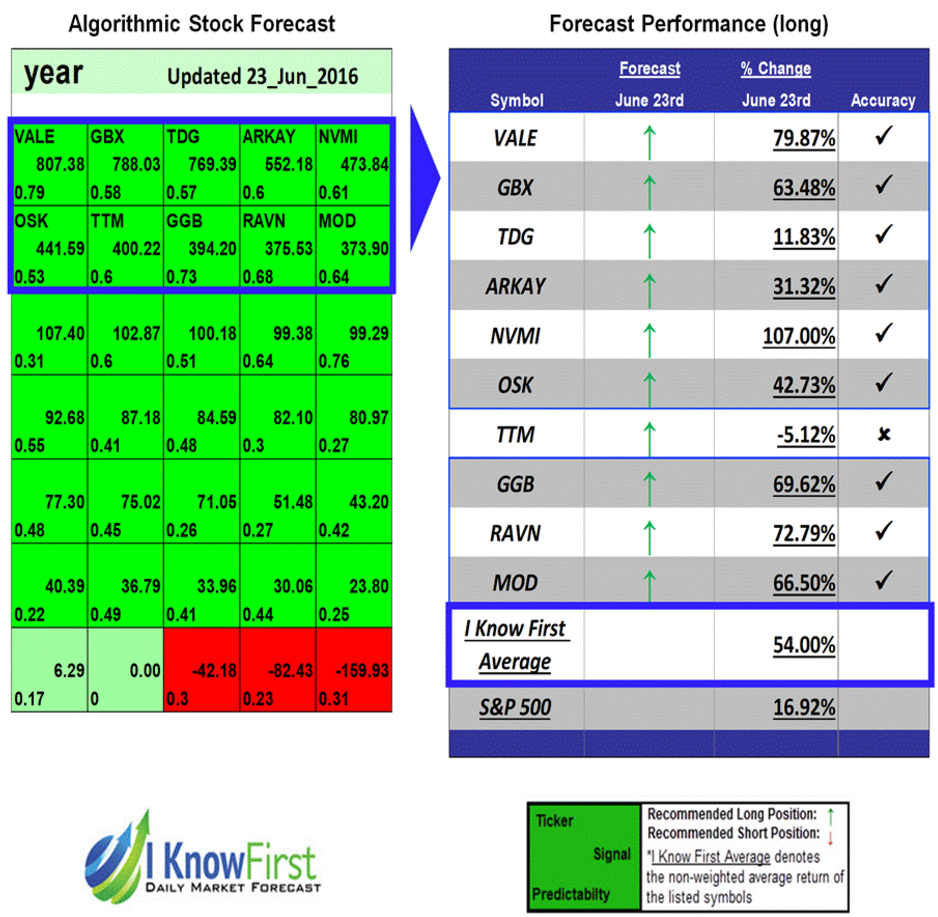

On June 23rd, 2016, the I Know First algorithm issued a bullish forecast for Vale SA (NYSE:VALE). VALE had a signal of 807.38 and a predictability of 0.79. As a result, in accordance with the forecast, the company’s stock had a return of 79.87% within 1 year, showing a quick win by the algorithm.

The Brazilian Federal Government originally founded Vale as the Companhia Vale do Rio Doce (CVRD) in 1942. The company eventually was privatized in 1997. The Brazilian government auctioned off 41.73% interest in the company, which was valued at R$3.34 billion. Today, the company is a multinational corporation which is involved in metal and mining. It is the largest producer of iron ore and nickel in the world. Furthermore, the company currently also operates nine hydroelectricity plants and many transportation facilities.

Vale SA has been a difficult prospect for years. A year and a half ago, the Brazilian government announced that it was suing Vale for $5.2 billion. This was after the collapse of a dam at an ore mine. The collapse spilled 60 million cubic meters of mud and mine waste in to the Atlantic Ocean and killed more than a dozen people. Furthermore, for the fourth quarter of 2015, the company reported a net loss of $8.57 billion. This was the worst loss in the history of Vale as a private company. At the time, commodity prices were at a dismal low. Problematically, iron ore accounted for two thirds of revenues of the company’s business accounts. Perhaps worse, it accounted for nearly 90% of the company’s EBITDA in the third quarter.

Hence, the question. How did Vale recover from such a slump and recently reach the highest stock price it has had for five years? The first thing to understand about Vale is that, as a primarily iron ore driven company, it is highly dependent on other iron exporters and the general market position of commodities. Thus, it is no surprise that the rising prices of commodities over 2016 helped pull Vale’s stock back up. In addition, the company replaced its CEO. Reports of internal governance change spoke positively to investors.

Despite the hits taken in 2015, Vale kept up a strong 2016. It produced a record amount of iron ore last year and has been steadily working on its fundamentals in order to turnaround its situation. This is evident by the string of company announcements regarding taking care of company debt. This was important to investors because Vale’s debt is one of the most worrying and threatening aspects of the company.

This year, Vale SA is looking to grow even further. Although the stock has recently been plateauing slightly overall, Vale SA still has a lot of potential to keep going. The company’s S11D mine is the biggest iron ore production mine today, with a capacity of 90 million tons per year. This is about to go in to full operation and it looks to be a key component to Vale SA’s further growth. All this is backed up by the fact that two years later, Vale SA is now reporting first-quarter profit jumps of 40.20% year-on-year. This is impressive for a company that was struggling so greatly over the last half a decade.

Given these factors, one can see why VALE is a bullish stock with impressive growth to go.

This bullish forecast on VALE was sent to current I Know First subscribers on June 23, 2016.

Before making any trading decisions, consult the latest forecast as the algorithm constantly updates predictions daily. You can use the algorithm for intra-day trading. The predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.