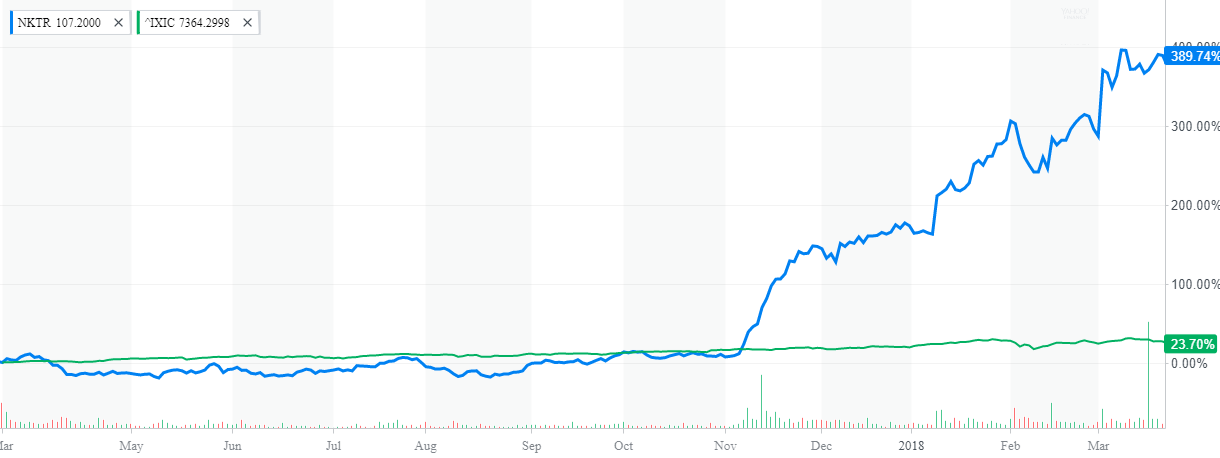

Quick Win by the Algorithm: Nektar Therapeutics (NASDAQ: NKTR) Treats Investors With Stock Up 383.54% In 1 Year

Quick Algorithm

“This past year was truly transformational for Nektar as we achieved a number of successes with Nektar medicines across our three key therapeutic areas of immuno-oncology, immunology and pain”

– Howard W. Robin, President and Chief Executive Officer of Nektar Therapeutics

(Image Source: Nektar)

Over the past year Nektar Therapeutic’s stock price steadily grew from $21.60 to $104.51 per share, outperforming the market by more than 365%. So what is the driver behind that growth and what happened during 2017 financial year? The reason lies in the company’s results for 2017 released with the following highlights:

- Revenue for the year ended December 31, 2017 was $307.7 million as compared to $165.4 million in 2016

- Total operating costs and expenses for the year ended December 31, 2017 were $367.4 million as compared to $278.3 million in 2016

- R&D expense for the year ended December 31, 2017 was $268.5 million as compared to $203.8 million in 2016

- Net loss for the year ended December 31, 2017 was $96.7 million or $0.62 loss per share as compared to a net loss of $153.5 million or $1.10 loss per share in 2016

From the above figures one can see that despite that the company heavily invests into R&D activity and increased it by some 31% comparing to 2016, the total operating costs of the company for 2017 financial year also increased by some 32%. This shows that the company managed to invest those amounts without affecting the overall costs composition and production efficiency. At the same time we see 86% rise in revenues accompanied by 37% decrease in net loss. These numbers tell us that there was an overall performance improvement from operational and investment perspectives, because the company not just receive the revenue from the increased sales but heavily reinvests them into R&D. As mentioned by the company’s CEO in respect of the year results there are three major breakthroughs:

- In the area of pain, the company completed a successful Phase 3 program for NKTR-181 in over 2,100 patients and healthy volunteers that will comprise our NDA submission in the second quarter of 2018.

- In immunology, the company entered into a major partnership with Eli Lilly for NKTR-358, a potential first-in-class T regulatory resolution therapeutic, which will be developed to treat a broad range of auto-immune disorders.

- In immuno-oncology, the company achieved clinical success with NKTR-214 which led to a groundbreaking collaboration with Bristol-Myers Squibb that now enables Nektar Therapeutics to broadly and rapidly advance NKTR-214 into over 20 registrational trials in up to 15,000 patients.

Finally, the latest Yahoo Finance data supports the positive outlook and shows that 10 out of 11 analysts took the buy position with regards to Nektar Therapeutic’s stock.

[Source: Yahoo Finance]On March 21, 2017, I Know First issued a bullish 1 year forecast for Nektar Therapeutics (NASDAQ: NKTR). The forecast illustrated a signal of 926.93 and a predictability of 0.33. In accordance with the forecast, NKTR’s stock returned 383.54% over this period, highlighting the accuracy of the prediction produced by the I Know First algorithm.

Current I Know First subscribers received this bullish NKTR forecast on March 21, 2017.

To subscribe today click here.

How to read the I Know First Forecast

Nektar Therapeutics (NASDAQ: NKTR), a research-based biopharmaceutical company, discovers and develops drug candidates for cancer, auto-immune disease, and chronic pain based on its PEGylation and polymer conjugate technology platforms in the United States. The company offers ONZEALD, a topoisomerase I inhibitor that is in Phase III clinical trial for advanced metastatic breast cancer in patients with brain metastases; NKTR-181, an orally-available mu-opioid analgesic molecule, which is in Phase III clinical trial for moderate to severe chronic pain; NKTR-214, a cytokine immunostimulatory therapy that is in Phase I/II to treat cancer; NKTR-358, which is in Phase I to treat autoimmune diseases; and NKTR-262 for solid tumors, as well as NKTR-255 that is under research/preclinical stage for immuno-oncology. It is also developing MOVANTIK for opioid-induced constipation in adult patients with chronic non-cancer pain, and who have an inadequate response to laxatives; ADYNOVATE for hemophilia A; Somavert to treat acromegaly; and Neulasta for treating neutropenia. In addition, the company develops PEG-INTRON for the treatment of hepatitis-C; Macugen for age-related macular degeneration; CIMZIA to treat rheumatoid arthritis, Crohn’s disease, and psoriasis/ankylosing spondylitis; and MIRCERA for anemia related to chronic kidney disease in patients on and not on dialysis. Further, it is developing SEMPRANA to treat migraine; dapirolizumab pegol for systemic lupus erythematosus; PEGPH20 for ancreatic, non-small cell lung cancer, and other tumor types; and longer-acting blood clotting proteins for hemophilia. The company has collaboration agreements with AstraZeneca AB, Shire plc, Pfizer Inc., Amgen Inc., Merck & Co., Inc., Valeant Pharmaceuticals International, Inc., UCB Pharma S.A., F. Hoffmann-La Roche Ltd, Allergan, Inc., Halozyme Therapeutics, Inc., and Baxalta Incorporated. Nektar Therapeutics was founded in 1990 and is headquartered in San Francisco, California.

Disclaimer

Before making any trading decisions, consult the latest forecast as the algorithm updates predictions daily. You can use the algorithm for intra-day trading. The predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.