Quick Win by the Algorithm: AAXN Products Driving Strong Growth in 2018

Quick Win by the Algorithm:

Source: Axon Enterprises

“We’ve just completed a pivotal year where we changed our company name from TASER International to Axon Enterprise (Axon) to better reflect our go-forward mission and made significant investments to drive progress within our four strategic growth areas. We don’t intend to slow down in 2018. This year, we plan to introduce several new products and services and improve upon our existing suite of offerings – which we believe will grow recurring cash flows and increase average revenue per user. We’re also scaling up our offices across the world and cross-pollinating our internal groups to ensure we execute against one vision for Axon. In short, we are focused on disciplined execution and preparing for significant growth across the globe.”

— Rick Smith, CEO

Axon Reports Record Revenue of $95 million for Q4 2017 and $344 million for FY 2017

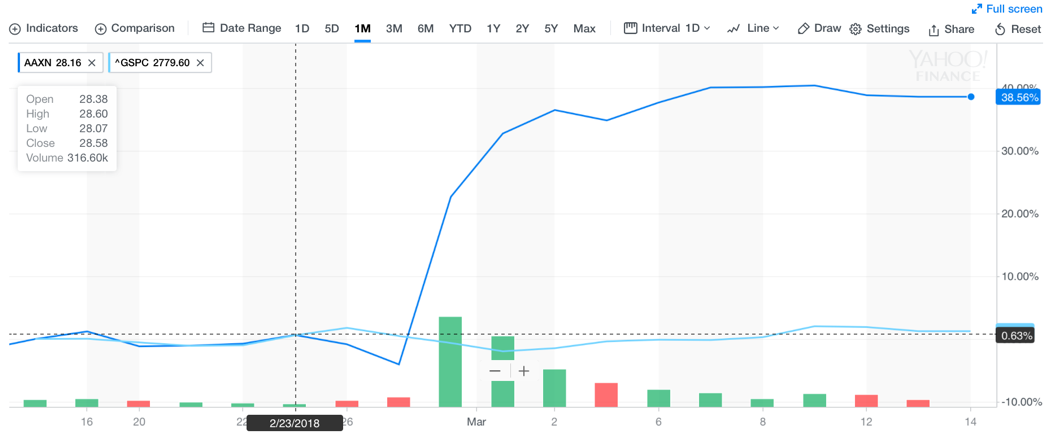

Following Axon Enterprises (AAXNS) Q4 quarterly update to shareholders on February 27th, 2018, Axon’s stock jumped from $27.25 to $39.35 per share, outperforming the market by more than 36%. Upon examining the drivers behind this impressive growth that occurred within the past month, the quarterly update to shareholders provides the following highlights and updates that shed light on the stock event:

- Axon recorded annual revenue of $344 million, up 28% from 2016 and $82 million of cash and short-term investments and zero debt at December 31st, 2017.

- Introduces 2018 financial guidance, including 16%-18% revenue growth and 300-400 basis points of operating margin expansion.

- Net Sales increased 15% to $94.7 million in Q4 compared to $82.1 million in Q4 2016.

- Consolidated gross margin was 66.6% in Q4 2017 compared to 55.1% in Q3 2017 and 60.6% in Q4 2016.

As such, we have seen that the algorithm accurately predicted the signal and direction of Axon Enterprise’s stock over the past month. In accordance with the forecast, it is evident that the company is in growth stages as they aim to achieve the following objectives for the full year ending December 31, 2018. They expect revenue growth of 16% to 18%, and plan for an operating margin expansion of 300 basis points to 400 basis points. They continue to remain confident in their goal of providing the premier end-to-end technology solution for law enforcement. They believe in their ability to “morph from a hardware-only business into a subscription-hardware-plus-SAAS-soliutions-and-enterprises-software company.” Additionally, Axon documents that their software and sensors segment revenue grew 27% YOY to $30.2 million in Q4 2017 compared to $23.7 million in Q4 2016. The annual recurring service revenue grew 74% YOY to $70 million in Q4 2017 compared to $40.2 million in Q4 2016. Annual bookings grew 15% year-over-year from $254 million in 2016 to $291 million in 2017. As a result, Axon has demonstrated a unique performance boost for 2018. The latest Nasdaq data supports that positive outlook and shows that 2 out of 4 analysts took the buy position with regards to Axon’s stock.

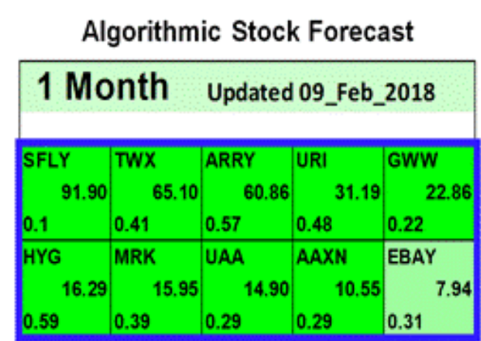

On February 9th, 2018, I Know First issued a bullish 1 Month forecast for AAXN stock. the forecast illustrated a signal of 10.55 and a predictability of 0.29. In accordance with the forecast, AAXN’s stock returned 57.42% over this period, highlighting the accuracy of the prediction produced by the I Know First algorithm.

Axon Enterprise, Inc., formerly TASER International, Inc., incorporated on January 5, 2001, is engaged in development, manufacture and sale of conducted electrical weapons (CEWs) for use by law enforcement, military, corrections and private security personnel, and by private individuals for personal defense. The Company is also engaged in development of connected wearable on-officer cameras, which utilize its cloud-based digital evidence management solution. The Company operates through two segments: the sale of CEWs, accessories, and other related products and services (the TASER Weapons segment), and the Axon business, focused on devices, wearables, applications, cloud and mobile products (the Axon segment). Axon Enterprises Inc. continued to grow both its Taser and body camera businesses in the fourth quarter of 2017, continuing a year of momentum. As we head into 2018, new products like a camera for vehicles, a records management system, and a smart holster for weapons could drive even more growth.