Quant Trading Based On Data Analysis: Up to 22.10% Return in 3 Months

Quant Trading

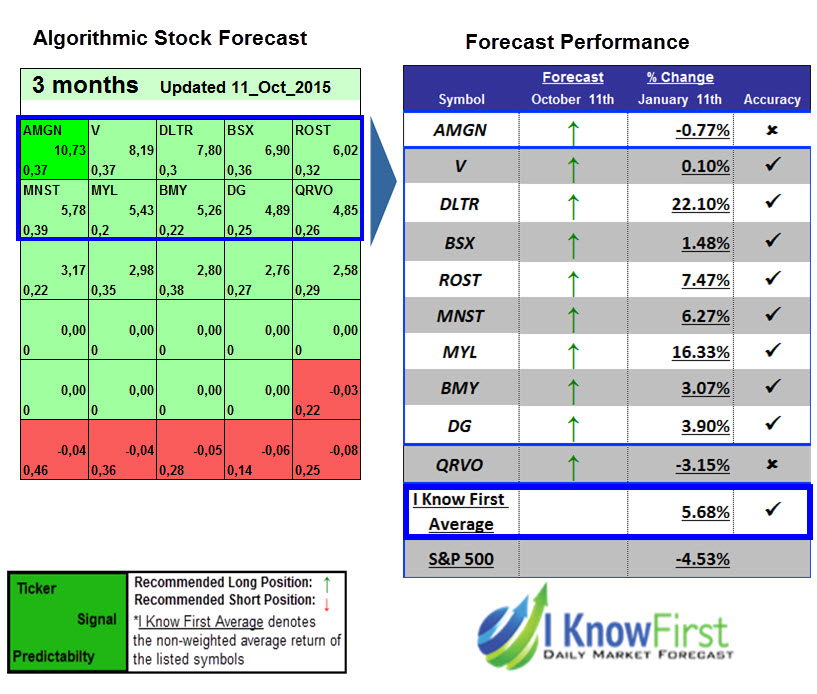

This S&P500 Companies Stock forecast is designed for investors and analysts who need predictions of the best performing stocks for the whole S&P500 Company Package (See S&P500 Company Package). It includes 20 stocks with bullish and bearish signals and indicates the best S&P500 Companies stocks to buy:

- Top 10 S&P500 stocks for the long position

- Top 10 S&P500 stocks for the short position

Package Name: S&P500 Companies

Forecast Length: 3 Months (10/11/15 – 01/11/16)

I Know First Average: 5.68%

The algorithm correctly predicted 8 out of 10 stocks forecasted to increase during the predicted time horizon of 3 months in the S&P500 package forecast from 10/11/2015. The most impressive prediction was for DLTR, which offered a return of 22.10% during the predicted time horizon to investors who bought the stock. Other impressive returns were MYL and ROST which increased by 16.33% and 7.47%, respectively. The average return from this forecast for investors was 5.68%, offering a premium to investors over the S&P 500 loss of 4.53% during the predicted time horizon.

Dollar Tree Inc. (DLTR) operates discount variety stores in the United States and Canada. Its stores offer merchandise at the fixed price of $1.00. The companys stores provide consumable merchandise, which includes candy and food, and health and beauty care products; and everyday consumables, such as paper and chemicals, and frozen and refrigerated food. DLTR soared during november because the company reported higher sales than the consensus estimate.

Mylan N.V. (MYL), through its subsidiaries, develops, licenses, manufactures, markets, and distributes generic, branded generic, and specialty pharmaceuticals worldwide. The company provides generic or branded generic pharmaceutical products in tablet, capsule, injectable, or transdermal patch forms, as well as active pharmaceutical ingredients (APIs). During November, MYL rejected a takeover offer from Perrigo Company and carried a value of $174.36 per share, significatly above the market price at that moment.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First algorithmic traders.

How to interpret this diagram

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.