Qualcomm Stock Forecast (NASDAQ: QCOM): Xiaomi Is Boosting Adoption of Qualcomm’s Flagship Smartphone Processors

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- Budget phone leader Xiaomi is very important to Qualcomm’s future. Xiaomi is always the early-bird proponent of Qualcomm’s flagship mobile processors.

- Xiaomi’s willingness to sell affordable iPhone-like Android phones with flagship Qualcomm Snapdragon processors is why it is now the world’s number 4 vendor.

- Xiaomi shipped out 31.9 million smartphones in Q2 2018 – 48.8% higher year-over-year. The recent launch of the $300 Snapdragon 845-powered Pocophone F1 should help Xiaomi maintain this momentum.

- Other leading phone vendors like Oppo, Vivo, and Meizu will likely use Snapdragon 845 for their own $300 – $350 Android phones.

- The NXP deal is dead. Qualcomm needs to sell more processors and modems. The more companies using Snapdragon 845, the better it is for Qualcomm’s bottomline.

Qualcomm (QCOM) is the runaway leader in the $20.2 billion/year smartphone application processors. The end of 2018 is still way ahead of us. My $70 price target for QCOM is therefore highly feasible. The Christmas shopping bonanza is coming soon. Qualcomm’s mobile processors and modems are likely getting tons of orders right now from phone manufacturers.

Tier-1 vendors like Samsung (SSNLF), Oppo, Vivo, Sony (SNE) HTC, and Xiaomi are coming up with new phones to take advantage of the coming Christmas shopping frenzy. Common sense says bulk orders of Snapdragon 835 and Snapdragon 845 are picking up. Phone vendors need to manufacture enough phones in time to meet the expected surge in market demand starting November.

(Source: Ubergizmo)

Xiaomi’s brave decision to release the $300 Snapdragon 845-equipped Pocophone F1 (or Poco F1) should accelerate adoption of Qualcomm’s current flagship smartphone processor. The higher margin possible from selling more flagship processor like the Snapdragon 845 can improve Qualcomm’s bottomline. After failing to acquire NXP Semiconductors (NXP), Qualcomm’s growth is again heavily reliant on selling more modems and smartphone application processors.

(Source: Xiaomi)

Qualcomm has long-term benefits from more people buying Snapdragon 845-equipped phones. The low $300 price tag, the octa-core Snapdragon 845, 6GB of RAM, dual-AI cameras and 4000mAh battery should make POCO F1 one of the best-selling phones this last quarter of 2018. The Poco F1 is a non-overheating gaming machine, thanks to its LiquidCool Technology.

Further, as AnandTech’s hands-on tests, Qualcomm made the Snapdragon 845’s Adreno 630 GPU 30%++ more energy efficient. The chart below illustrates the persistent innovation of Qualcomm over its processor rivals.

(Source: AnandTech)

Why Xiaomi Is Important To Qualcomm’s Future

With Apple (AAPL), Samsung (SSNLF), and Huawei using more of their in-house processors, Xiaomi remains the top cheerleader for Qualcomm’s flagship mobile processors. Xiaomi’s smart strategy of selling affordable iPhone-like Android phones with mid-range and high-end Snapdragon processors is why it is now the fourth-largest vendor of phones.

From a small setback in 2016/2017, Xiaomi has returned to being the fourth-largest supplier of smartphones. It shipped out 31.9 million units in Q2 2018, up 48.8% year-over-year.

Xiaomi’s bargain-pricing strategy is actually profitable. It recently boasted a quarterly net income of $2.1 billion (on sales of $6.6 billion). Xiaomi can afford to sell very affordable phones because it makes money from operating its own Android app store and cloud services.

Xiaomi can help Qualcomm retain its leadership in the $20 billion/year smartphone application processor industry. As of 2017, Qualcomm’s market share in smartphone processor sales was 42%. The $300 premium-level Pocophone F1 will compel other leading Chinese phone vendors like Oppo, Vivo, Meizu, and OnePlus to also use the Snapdragon 845 in their $300 to $350 Android phones. Asustek of Taiwan might also follow suit.

(Source: Strategy Analytics)

Conclusion

QCOM remains a buy in my book. It still touts amazing processors for Android devices. Xiaomi’s continuing rejection of flagship processors from MediaTek and Samsung is a big boost to Qualcomm’s leadership in smartphone chips. Xiaomi’s rivals Oppo and Vivo will have to imitate Xiaomi’s act. Otherwise, they will lose more market share in the important $250 to $350 market segment.

The failed takeover of NXP compels Qualcomm to improve its own semiconductor products. Consistent releases of improved Snapdragon processors keep its OEM partners remain loyal. Lastly, losing much of the modem supply business for the iPhone induces Qualcomm to sell more of its Snapdragon processors. Chip supply business from Xiaomi and Chinese phone vendors can make up for this loss.

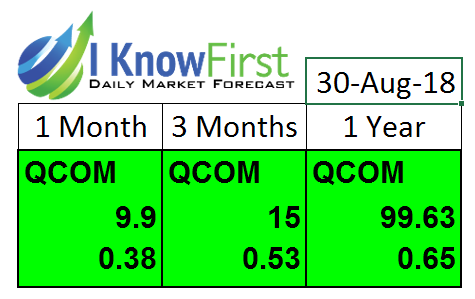

The stock trend prediction from I Know First is very favorable to QCOM. Qualcomm’s stock has a one-year algorithmic market trend score of 99.63. I Know First has a one-year predictability score of 0.65 for QCOM. It means I Know First has a good history of correctly predicting QCOM’s long-term performance.

Analysis of monthly technical indicators and moving averages trends also endorses QCOM as a buy.

(Source: Investing.com)

Past I Know First Success with QCOM

I Know First has been bullish on Qualcomm shares in past forecasts. On August 9th, 2017, I wrote about QCOM another article where I analyzed the influence of an out of court settlement from Apple that could boost QCOM’s price by 10% or more. I also discussed the potential relevant consequences of Apple not having a strong library of patents at that time. As a result, I expected Qualcomm to continue to enjoy healthy patent licensing and royalty fees from smartphone vendors like Apple. I Know First AI Algorithm assigned signal strength of 33.07 and a predictability factor of 0.74 for the 1-year period.Since then, Intel shares have risen 29.33% in line with the I Know First algorithm’s 1 year forecast. See chart below.

This bullish Qualcomm Stock Forecast was sent to I Know First subscribers on August 9th, 2017.

Please note-for trading decisions use the most recent forecast.

To subscribe today click here.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplification explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.