Artificial Intelligence: The Future of Trading

![]() The article was written by Jacob Saphir, a Financial Analyst at I Know First.

The article was written by Jacob Saphir, a Financial Analyst at I Know First.

Artificial Intelligence

“It’s very hard for someone using traditional methods to juggle all the information of the global economy in their head. Eventually the time will come that no human investment manager will be able to beat the computer.” David Siegel, co-head of Two Sigma

Summary:

- Asset management industry is downsizing

- Popularity in indexation, shift from institutional to retail, and growth in multi-asset solutions are deterring active management

- Artificial intelligence may be the missing link

- I Know First Application

Asset Management Industry Trend:

Since the Great Recession of 2007, the asset management industry has been facing a downsizing trend. What is forcing the most highly valued activity in financial services to adapt to its new environment? Unfortunately, the recession forced people to look differently upon the industry. As a result, people questioned how their investments should be handled and by whom. Moreover, the debate of active and passive investment was revitalized. Given the advancements in technology and the availability to access information through the internet, many are reconsidering their strategy. Consequently, the industry is in need for a solution.

Challenges Facing:

The asset management industry is facing challenges from the popularity of indexation, the shift from institutional to retail money, and the growth in multi-asset solutions.

Indexation

- Most active fund managers fail to surpass index funds such as the S&P 500. If a passive index fund investor earns a higher return and pay less in expense ratio (as low as 0.12%), why entrust an active manager whom charges a higher expense rate (above 1%)?

- Since the introduction of exchange traded funds (ETF) in the early 1990s, it has been gaining in popularity and fees decreasing for the past 5 years.

- Although ETFs constitute 35% of the US equity market, Robeco estimates the index funds will be between 40% to 50% of the global equity flows in the future.

Institutional to Retail

- Pension funds are becoming less popular due to rising cost in contribution. As a result, companies began offering 401(k) plans. Thus, leaving asset managers to seek clients elsewhere.

- Unlike a pension plan, 401(k) allows employees to be more responsible with their retirement planning and contribution. There are no guaranteed minimum or maximum contributions a company must make. In a pension fund, the investment portfolio is guaranteed a certain monthly income and managed by the company.

- The trade-off is more market risk for more control and flexibility.

Multi-Asset Management

- Investors are charged on average a lower fee compared with active equity products.

- Real Estate is one of the biggest alternative asset class.

- Robo-advisors such as: Charles Schwab’s Intelligent Portfolio, Betterment, and Wealthfront, all charge between 0-0.35% in expense fee.

- Robo-advisors trade using algorithms to pick and trade stocks on behalf of their clients based on their tolerance to risk or their ultimate goal in investing.

What can asset management do to adapt to its environment?

Artificial Intelligence:

The future of asset management is utilizing what was once considered science fiction, Artificial intelligence. Artificial intelligence is now being used to forecast the stock market and pick stocks based on one’s risk tolerance. Like a magician pulling a rabbit out of the hat, how does machine interface and artificial intelligence know what stocks to pick or judge its probability to increase or decrease in the future? Taking human factor and market noise out of the equation, machine learning uses an accumulation of data to learn from past experience. The more data it processes, the more it will learn, recognize patterns, and sort through relevant information. This results in forecasting stocks and calculating its predictability in market performance given the data received. Like Salesforce.com has revolutionized Customer Relations Management, the asset management industry must also look digital. Michael Dobson, the main board director of Deutsche Bank, indicates “a more data-driven environment will bring opportunities for distribution in terms of accessing customers, measuring sales effectiveness and tailoring products to target specific customer segments.”

The future of asset management is utilizing what was once considered science fiction, Artificial intelligence. Artificial intelligence is now being used to forecast the stock market and pick stocks based on one’s risk tolerance. Like a magician pulling a rabbit out of the hat, how does machine interface and artificial intelligence know what stocks to pick or judge its probability to increase or decrease in the future? Taking human factor and market noise out of the equation, machine learning uses an accumulation of data to learn from past experience. The more data it processes, the more it will learn, recognize patterns, and sort through relevant information. This results in forecasting stocks and calculating its predictability in market performance given the data received. Like Salesforce.com has revolutionized Customer Relations Management, the asset management industry must also look digital. Michael Dobson, the main board director of Deutsche Bank, indicates “a more data-driven environment will bring opportunities for distribution in terms of accessing customers, measuring sales effectiveness and tailoring products to target specific customer segments.”

With artificial intelligence and machine learning, asset managers can utilize this technology to analyze large amounts of data. According to market research firm Preqin, 9% of all hedge funds or about $197 billion in total, use computer models to make trades. Wired.com discloses “as the volume of data expands, new methods will be required to harness these data insights in investment, and demand for employment skills will shift towards data sciences and maths.” Although the industry is downsizing, its future will focus on the hiring of data scientists—or “quants,” to sort data.

Artificial intelligence is not always applied for high-frequency trading. The end game for some is not to make a series of trades within the days by holding stocks for hours or even minutes. One company, I Know First, has been applying this application using 15 years of market data and machine learning to suggest algo traders.

I Know First

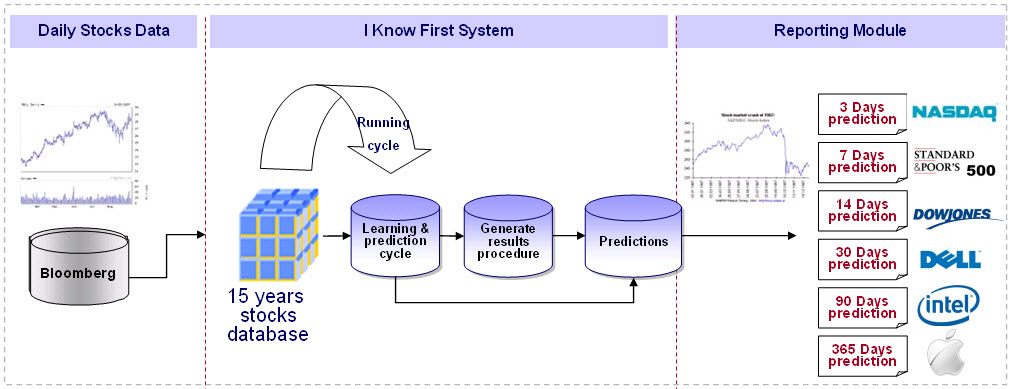

I Know First, Ltd. is a financial technology company that provides daily investment forecasts based on an advanced, self-learning algorithm. The underlying technology of the algorithm is based on artificial intelligence, machine learning, and incorporates elements of artificial neural networks and genetic algorithms through which we analyze, model, and predict the stock market. The algorithm is adaptable, scalable, and features a Decision Support System (DSS) to optimize the information produced by the years of data inputted.

Investors use a mix of fundamental and technical analysis, but there is so much data to review. Artificial intelligence can process the information quicker and use algorithms to analyze stock trends and fundamentals with market noise and human emotion to output highly accurate market predictions. As Tali Soreker explained in her article, “the system outputs the predicted trend as a number, positive or negative, along with a wave chart that predicts how the waves will overlap the trend. This helps the trader to decide which direction to trade, at what point to enter the trade, and when to exit.”

Since the model is 100% empirical, the results are based only on factual data, thereby avoiding any biases or emotions that may accompany human derived assumptions. The human factor is only involved in building the mathematical framework and providing the initial set of inputs and outputs to the system.

An Example of Past I Know First Forecast Successes:

In such as the one dated on April 17, 2015, the algorithm accurately forecast a signal for Netflix. In a one year time span, the stock rose impressively by 71.71%, beating the S&P 500 negative return of 1.08%. The market premium calculates to an astounding 72.79%.

Below is the latest forecast I Know First algorithm released as of today on September 15, 2016. If we were to compare the forecast back in April 17, 2015, we can see both forecasts rate Netflix as a buy. The confidence level is even higher in our most recent forecast. If the previous forecast last April accurately predicted the stock would increase and it did by over 70%, the higher confidence level registered in the latest forecast below could indicate another high rate of return.

The forecast is color-coded, where green indicates a bullish signal while red indicates a bearish signal. Brighter greens signify that the algorithm is very bullish as it does at the top of this forecast. The signal is the number flush right in the middle of the box and the predicted direction (not a specific number or target price) for that asset, while the predictability is the historical correlation between the prediction and the actual market movements. Thus, the signal represents the forecasted strength of the prediction, while the predictability represents the level of confidence.

Conclusion:

As asset management industry faces challenges from passive against active management, artificial intelligence could be the industries answer to win back clients and reduce expense ratio costs. I Know First demonstrates its incorporation of the potential of its benefit and accuracy.