PYPL Stock Forecast: Electronic Alternative Makes Transactions Seamless Driving Target Price to $377

This PYPL stock forecast article was written by Nicole Shammay – Analyst at I Know First.

This PYPL stock forecast article was written by Nicole Shammay – Analyst at I Know First.

Highlights:

- High EPS Rating Proves Future Growth Trend

- 2021 Brings 5 New Products

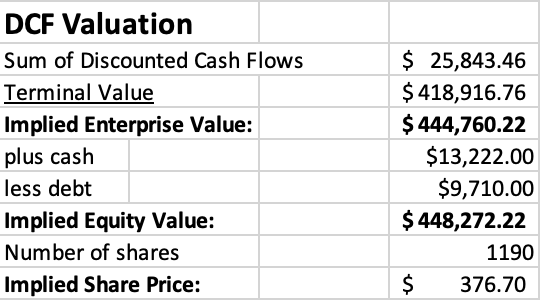

- DCF support around $377, a 30% upside for the PYPL stock on a one-year horizon

Overview

PayPal Inc. is an American-based company that employs an online payment system for online money strangers. It is the most prominent digital platform for transfer services and serves as a computerized alternative instead of more traditional trading methods such as checks and simple cash. Consumers use PayPal as a digital platform on several platforms such as the web, mobile apps, or person. PayPal allows you to pay bills, send and receive money, and more. It is available in more than 200 markets worldwide and owns other operating systems such as Xoom and Venmo.

What’s Better Than Unbeatable Financial Health?

With PayPal (Nasdaq: PYPL) being a prominent element in the rise of digital payments, its evolution and fundamental strength projected it to have the highest possible EPS rating of 99. IBD’s Earnings Per Share Rating allows individuals to spot stocks with the most substantial profit growth speedily. IBD asserts it considers the firm’s historical earnings up to three years, with more weight than recent years. The rating is on a scale from 1 to 99, with 99 being the best. A score of 99 suggests that the company’s profit growth has transcended 99% of all other publicly traded companies within the IBD database.

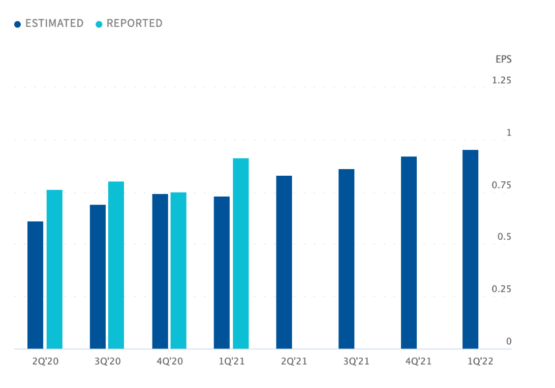

PYPL surprised many as they constantly outperformed estimates. The chart below illustrates the estimated vs. reported EPS for the past few quarters. And, we can also see that forecasts of the company’s growth for the next few quarters are favorable. For the fiscal quarter ending in March 2021, estimates were 24.66% lower than reported earnings. PYPL is a safe bet, given its unbeatable profitability.

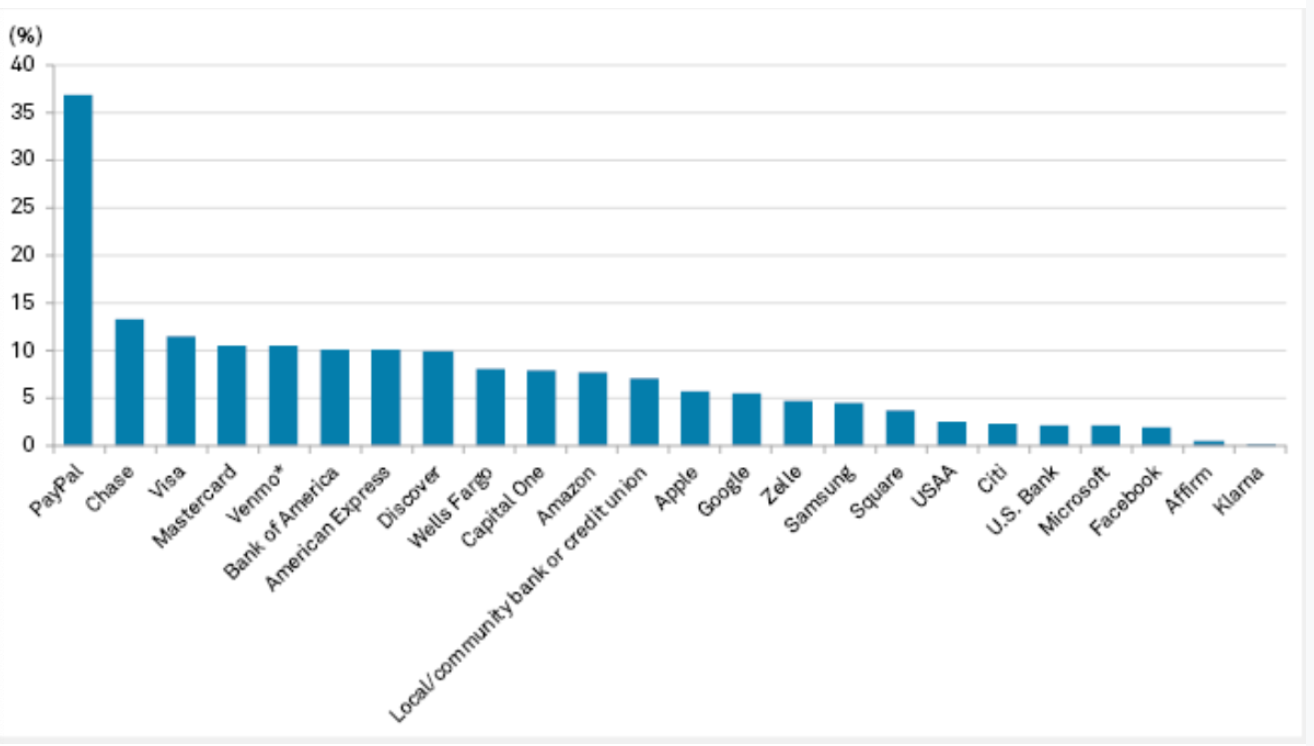

It is no surprise that PYPL soared during the Coronavirus pandemic. PYPL saw a record amount of payment volumes and new accounts due to the dramatic shifts in consumer behavior caused by the pandemic. Furthermore, the pandemic likely served as a catalyst, forever shifted society to online digital payment platforms. With these changes, PYPL has successfully expanded its brand and increased its customer trust within the company. During April of the pandemic alone, PYPL added 7.4 million new accounts. As one can see from the chart below, PYPL has secured high levels of customer trust as a digital wallet provider. They lead by a significant margin and have been successful in pinning themselves as a trusted brand.

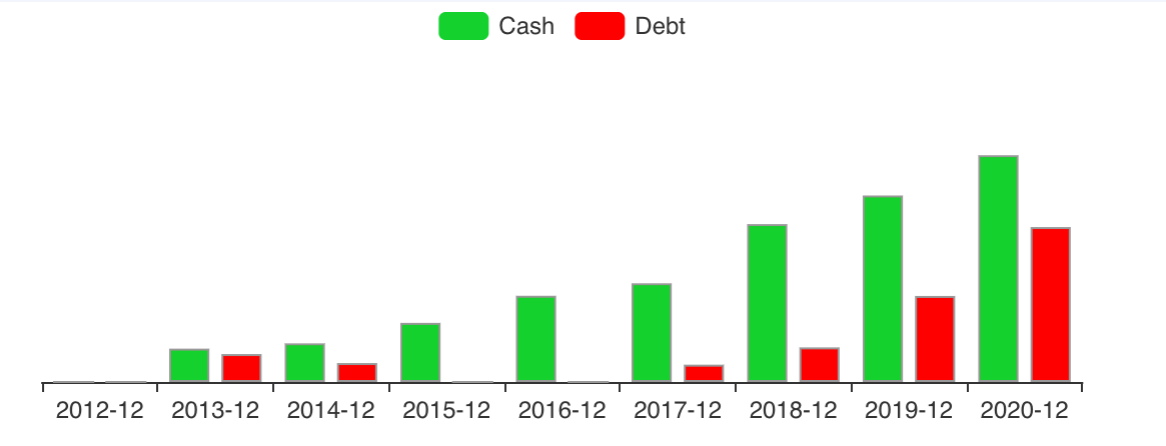

PayPal’s place in the industry is also firm and pretty much impenetrable, as shown by a few of its profitability rankings by Guru Focus. PYPL’s ROE % is 28.48, and ranked better than 94% of other companies in the credit services industry – proving their credibility amongst investors and their stability with their balance sheet. Their 3-year revenue growth rate (per share) also ranked better than 77.73% of companies in similar services, validating their future developments and authenticating their growth potential. Lastly, their debt-to-EBITDA ratio ranked better than almost 80% of companies in similar services, certifying their ability to pay off debts successfully. This ratio is crucial as it demonstrates PYPL’s ability to jump into risky ideas as they can withstand them financially.

PayPal Transforms Online Commerce

Due to the surge in online commerce, PayPal was destined to have a transformative year. On top of their record number of users and a considerable increase in total payment volume, PYPL introduced several new products, which will surely add flair to their platform.

The first is the launch of Paypal’s cryptocurrency investing service. The service is meant to develop further the experience of buying, selling, and holding cryptocurrencies in international markets. This enhancement that PayPal made also had strong potential for growth in the future because if successful, PYPL can propel itself into stock trading as well.

A critical aspect of PayPal’s cryptocurrency promise was that they promised customers that they would use crypto as some payment source somewhere in the near future. Making this promise is unlikely, but if they successfully created the transaction from crypto to currency simply, they would be wildly fortunate.

PayPal’s bill pay further enhances any customer’s experience by allowing one single platform for all transaction needs. PayPal is progressing not simply for regular customers but retailers and companies alike. For instance, Adweek reports that retailers that offer PayPal have 28% higher checkout rates than retailers with different payment methods. PayPal is also securing for retailers because of its international status as it is trusted by over 210 million active customers.

Another potential service addition will be budgeting and saving tools. Adding these enhancements to customer accounts would encourage them to store additional funds into their PayPal wallets. These funds would then essentially be used to make payments later on. These features will entice customers and be transformative enough to make people switch away from their traditional banks.

Lastly, the acquisition of Honey back in 2019 will bring lots of new tools while shopping online and in stores. Honey is an extension used to find discounts at thousands of retailers online. Suggested integrations will include wish lists, price monitoring, deals, coupons, and rewards. Being allowed to use a Honey extension is just another reason why customers will be more attracted to the idea of using PayPal in stores. And, with the pandemic simmering down, having these features ready to go will be very attractive for customers – both old and new. Honey also brings PayPal their loyal user base of 17 million customers ready to use the platform.

DCF Estimates $377 PYPL Stock Forecast

The DCF analysis shows that PYPL’s target stock price should be around $376.70 on a one-year horizon. This expected share price makes a 30% upside from the price on July 5th. The below forecast is based on average data from previous years.

I have made the next assumptions and estimations for this DCF:

- Revenue will expect to grow 20% for 2021

- The effective tax rate to be 16.7%

- The risk-free rate and the risk premium to be equal to 1.730% and 3.77% respectively

Conclusion

PayPal has gone through an intense transformation throughout the past few years. They are quickly advancing into more than just a virtual payment platform, but rather a financial super app. Thus, I suggest the PYPL stock as a buy considering the positive DCF forecast resulting in a $376.70 target price on a one-year horizon. This DCF forecast portrays a 30% upside – almost double the current share price of $290 on July 5th. Considering the company’s impeccable growth in the past, as well as their assuring financial reports, I am extremely confident in their future escalation.

Finally, my bullish prediction for the PYPL stock is unequivocally supported by I Know First’s algorithmic forecast as shown above. With a strong one-year trend signal of 212.66, the forecast represents a fastened indicator to buy as well as an optimistic increase in the stock price in one year’s time.

Past Success With PYPL Stock Forecast

I Know First has been forward-looking with its PYPL forecast in the past. On July 1, 2021, I Know First released an article, “Best Stocks to Buy,” which recommended the best S&P 100 stocks for investors and analysts who need predictions for the best large-cap performing stocks. PYPL was recognized as the sixth-best based on their percentage change and accuracy. The AI-driven PYPL stock forecast proved successful on a one-year horizon, resulting in a 73.14% increase in returns since the original forecast date.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.