PTC Stock: Why You Should Consider Adding PTC Inc. To Your Growth Stock Portfolio

The PTC stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The PTC stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary

- PTC Inc. is a low-profit, low-growth company but the predictive AI of I Know First has a very bullish one-year forecast for it.

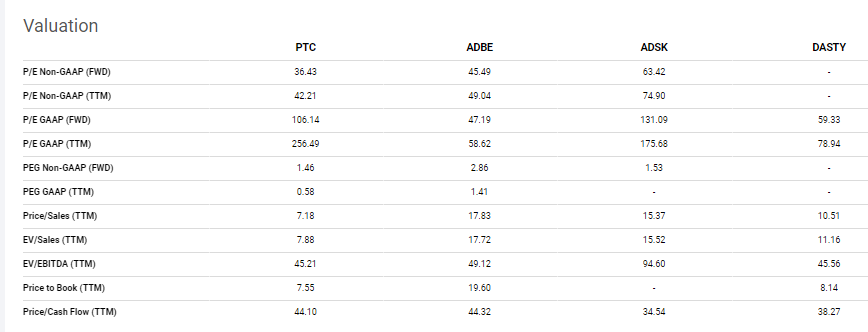

- The enthusiasm of I Know First is in spite of PTC’s current high valuation. It is trading at 256.49x TTM P/E GAAP, and 106.14 Forward P/E GAAP.

- My takeaway is that PTC could improve its profitability and growth potential as it expands beyond its software products to AR, IoT, and industrial automation.

- I agree, PTC could become a future multi-bagger because of its diversified set of customers.

- Last year’s acquisition of Onshape will enable PTC to better compete against Autodesk in CAD sales.

PTC Inc. (PTC) has never been in my radar when it comes to long-term investing. I felt Autodesk (ADSK) was the superior stock to own that is involved in the growing $9 billion CAD software industry. However, PTC’s 2018 shift to subscription-only software marketing is very promising. ADSK and Adobe’s (ADBE) stock are now very highly valued because their transition from perpetual software license to subscription-only substantially improved their revenue growth.

PTC has a YTD return of +11.83%. I’m still endorsing it as a buy. My 1-year price target for PTC is $98.

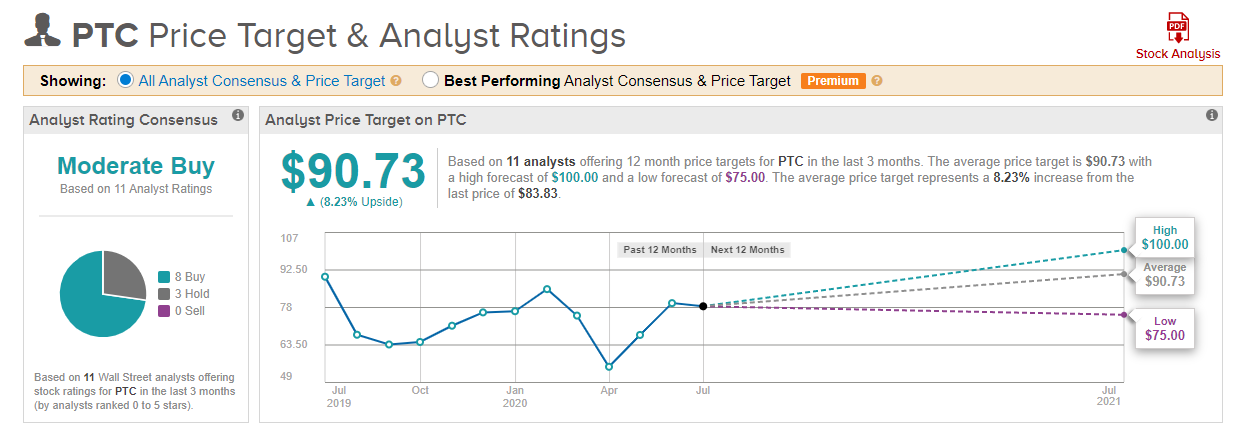

My $98 price target is higher than the average price target of $90.73 at TipRanks. PTC is indeed an under-covered stock. Only 11 Wall Street analysts bothered to rate it. This must be because PTC Inc. is under the big shadow of Autodesk and Dassault (DASTY).

Why PTC Should Be In Your Long-Term Growth Portfolio

The nascent stage of PTC as a SaaS vendor is why it now has a higher TTM GAAP P/E valuation than ADBE and ADSK. PTC’s TTM GAAP P/E of 256.49 is evidence that most investors believe in the company’s future potential.

The high valuation of PTC is in spite of it being a low-profit, low-growth company. Compared to its peers, PTC has been a turtle over the last five years. Investors are rallying behind PTC because this company’s big push in Augmented Reality, Internet of Things, and industrial automation will quickly lead to a 10% or higher forward revenue CAGR.

The worst attribute of PTC Inc is that its 5-year revenue CAGR is only 0.05%. This the obvious risk… the stock market is super bullish on a company that is burdened by its poor past performance. If you can look forward to the huge potential of PTC (and ignore its past), go ahead and invest on this company.

PTC has matured beyond its CAD software expertise. PTC is no longer in danger of becoming irrelevant against the CAD dominance of Autodesk. PTC’s Windchill Product Lifecycle Management or PLM software product has 1.5 million seats. PLM is obviously a bigger growth driver for PTC than CAD software. The global PLM software industry was valued at $21.71 billion last year. It will be worth $32.42 billion by 2025.

Aside from its PLM or industrial/manufacturing automation solutions, PTC has a strong tailwind from Industrial Internet of Things or IIoT. PTC’s ThingWorx is recognized as a Visionary or frontrunner in industrial IoT by Gartner’s Magic Quadrant report. PTC is a good long-term bet because of ThingWorx. The global IIoT (software and hardware) market size is worth $77 billion this year. It will be worth more than $110.6 billion by 2025.

PTC also has a strong long-term growth driver from its Vuforia Augmented Reality platform. Vuforia is the market-leading enterprise AR solution. PTC is selling Vuforia to manufacturers and businesses who needs AR to accelerate production and other corporate workloads. Vofuria Engine is the most used SDK among AR app developers in the world today. PTC is consistent in releasing updated versions of Vofuria engine.

PTC enjoys a forward GAAP P/E valuation of 106x because it is a pioneer leader in the super mega fast-growing Augmented Reality Software industry. AR software sales was worth $8.59 billion last year. It is expected to $137.14 billion by 2027. PTC is a buy because it is a key player in the AR software market that is expected to enjoy a CAGR of 57.21% for the next 7 years.

Further, PTC Inc. is also marketing its Creo 3D parametric CAD/CAM software product as a full suite CAD, IoT and Augmented Reality tools for product design and manufacturing. This clever marketing ploy should help Creo remain relevant against AutoDesk’s AutoCAD Suite and Dassault’s SolidWorks products.

PTC’s $470 million acquisition of subscription-only CAD software vendor Onshape last year should disrupt Autodesk’s brisk Fusion 360 business. Onshape’s annual subscription rates are more expensive than Fusion 360’s Personal annual charge of $495 per year. However, Onshape is geared toward high-income CAD/CAM collaborative-minded designers who need cloud-based solutions.

Going forward, the pricey annual subscription fees of Onshape should help boost PTC’s annual subscription sales to over $700 million. My fearless forecast is that Onshape could accelerate PTC’s path toward $1 billion in annual subscription sales by 2022.

My takeaway is that Onshape is now the more important asset than Creo. Cloud-based Onshape cannot be pirated like the on-site/install versions of Creo, SolidWorks, and AutoCAD. Subscription-only cloud-based software is now the best growth driver for the CAD software industry. PTC is a buy because Onshape made it a legit cloud CAD powerhouse.

Conclusion

PTC is a strong buy because it is indeed growing its subscription revenue. As per its 2Q F20 ER, the company’s annual recurring revenue or AAR is $1.18 billion. This is 10% year-over-year higher than 2Q F19. In spite of the global pandemic, the latest FY20 guidance is that ARR will be $1.27 to $1.295 billion. Full year EPS would be $0.70 to $1.23.

The cautious outlook from the management is due to the serious impact of COVID-19 in North America and Europe. Those two regions are PTC’s biggest revenue generators.

PTC is a buy because its subscription software sales is now $602.15 million. This is far higher than its annual perpetual license software revenue of $70.7 million. PTC is now a legit SaaS company.

My high optimism over PTC is also thanks to its very bullish one-year forecast from I Know First. The predictive AI of I Know First is highly confident that PTC’s current high valuation ratios will only get higher within the next 12 months.

Past I Know First PTC Stock Forecast Success

I Know First was successful with PTC stock forecast. On May 3, 2020, the I Know First algorithm issued a 1-month bullish PTC stock forecast and the algorithm successfully forecasted the movement of the PTC stock. After 1 month, PTC shares rose by 21.93% in line with the I Know First algorithm’s forecast. See chart below.

Here at I Know First, our algorithmic trading AI have modeled and predicted more than 10500 asset price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. We provide stock picking strategies for institutional clients, as well as private investors to identify the best investment opportunities in the market. We have various packages of stock predictions, such as aggressive stocks, top tech stocks as well as Forex forecast, and Apple price target. Today, we also provide gold price prediction and commodity price prediction.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast