Predictive Modeling Using I Know First Algorithms: HES, 3.65% In 4 days

Predictive Modeling Using I Know First Algorithms

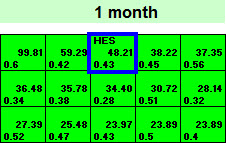

On the 18th of December 2014 I Know First algorithm released a bullish signal on its 1 month forecast for HES. At the same time the price moved above the 5 day simple moving average of the stock’s price, which is a strong position to buy a stock at. Below is the original forecast, and the resulting trade which made 3.65% in just 4 days.

Key Numbers and Dates

Buy Recommendation

You would buy the stock on Dec, 18th 2014 according to the I Know First signal you received that morning of 48.21 and the fact that the stock closed above the 5 day simple moving average on the 17th of December. You would buy the stock at the market opening price of $71.31.

Customized Forecast Sell Recommendation – 3.65% In 4 Days

According to the algorithm you would sell the stock on the 22nd of December at the market opening price of $73.91 based on the weak signal (below 10) you received before the market opened of 8.60. Your return of the trade would be 3.65%.

Market Sell Recommendation – 4.21% In 8 Days.

According to the 5 day simple moving average (SMA) you would sell the stock on Dec 26th post market when the price closed below the 5 day SMA at the price of $74.31. The Total return without an algorithmic exit would be 4.21%.

Where could I have found this forecast?

GEL belongs to our “Top x Stock Picks + S&P500” universe. On Dec 18th, 2014 the stock’s position on the 1 Month table was the 3rd, making it available to “Top 5” and above subscribers.

What is HES?

HES is the stock ticker for the Hess Corporation (formerly Amerada Hess), an American integrated oil company headquartered in New York City, and a Fortune 100 corporation. Hess Corporation is a global exploration and production (E&P) company that develops, produces, purchases, transports and sells crude oil and natural gas. Hess also operates a marketing and refining (M&R) segment. The M&R businesses manufacture refined petroleum products and purchase, market, store and trade refined products, natural gas and electricity, as well as operate retail gasoline stations, most of which have convenience stores. Below is the trade we forecast in relation to the last year.