PLUG Stock Forecast: 24.62% Gain In One Month

PLUG Stock Forecast

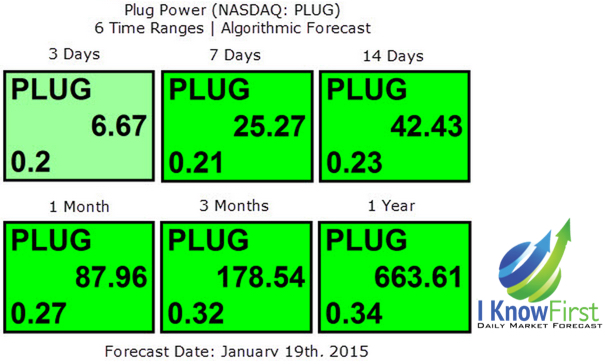

I Know First published an article about Plug Power Inc. (PLUG) on January 21st, 2015 for Seeking Alpha. Plug Power had a strong signal of 87.96 and a predictability of 0.27. In accordance with the algorithm, the company has reported short-term capital gains of 24.62% since that time.

Plug Power was part of the stock forecast that can be found in the “Small Cap Stocks” Package.

The full Top 10 Small Cap Stocks forecast includes a daily prediction for a total of 20 stocks with bullish and bearish signals:

- Top ten stocks picks to long

- Top ten stocks picks to short

Plug Power is a powerhouse in hydrogen fuel cell technology, revolutionizing the industry with cost-effective solutions that increase productivity. The company manufactures fuel cells used to power forklifts in warehouses and distribution centers. It is currently trying to create new customer bases by producing fuel cells for refrigerated trucks and vehicles used to haul luggage at airports. Its biggest customers are Walmart and FedEx.

During a conference call, Plug Power executives announced lower revenue projections than expected, reducing them to $100 million for 2015. However, the lower projections are not due to slower acceleration of sales, but how revenue is recognized. Sales cannot be counted until the product is shipped. Further, the company is giving lower guidance because it wants to under promise and over deliver. Plug Power still plans to increase revenue by 40%, and executives believe that it could break even by the fourth quarter of 2015, a first for the public company that has never reported a profit.

The company also announce changes to its corporate management team that provide the structure needed to enable Plug Power to translate success and momentum generated in 2014 into profitable growth opportunities in 2015. Tim Cortes, who joined as Vice President of Hydrogen, will oversee the company’s GenFuel Business. His knowledge of investment planning to drive product development and market penetration will enable the company to expand its GenFuel solution within adjacent segments.