PDD Stock Forecast: The Development of E-commerce Platforms

This PDD Stock Forecast article was written by Huaiyi Jiang – Financial Analyst at I Know First.

Highlight:

- PDD got 4.7 billion in revenue in 2022 Q2 and had a great performance of EPS

- Business strategies of “Tech for Agri” and expansion e-commerce market

- DCF supports the one-year target price of $78, a 25% upside for PDD stock

Overview

Pinduoduo Inc (NASDAQ: PDD) is a China-based e-commerce platform operator, which creates a platform that connects farmers with consumers directly through its interactive social commerce shopping experience. PDD is the largest agricultural and sideline products trading platform in China. PDD pioneered and popularized a dynamic shopping experience through “Pin”, a team purchase format that seamlessly integrates social experiences with online shopping experiences. The company has consciously built its platform to resemble a “virtual bazaar” where buyers browse and explore a full spectrum of products on their platform while interacting with one another. In July 2018, Pinduoduo was listed on the Nasdaq.

Great Performance of PDD

PDD reports great results for Q2 2022 was 4.75 billion dollars, which is an amazing growth of 27% quarter-over-quarter and 33% year-over-year. Online marketplace Services account for the main part almost 99% of total revenue, which includes two segments online marketing services & others and transaction services. Operating income also has a dramatic increase from Q1 399 million to Q2 3.55 billion because of the increase of Speciality Online Retailers.

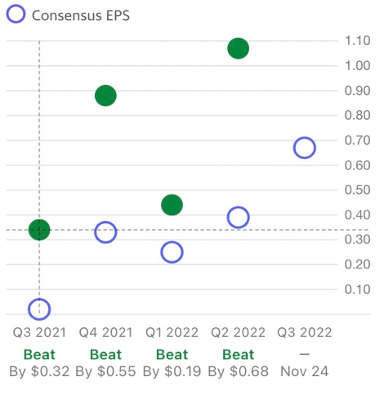

PDD also has a great performance of EPS. The Figure below illustrates the estimated vs. actual EPS for the past few quarters. The actual earnings are all higher than estimated earnings from analysts in the recent few quarters. And, we can also see that forecast of the company’s growth for the next quarters is favorable, which means PDD is a potential opportunity to invest.

(Figure1: PDD Actual & Estimated EPS)

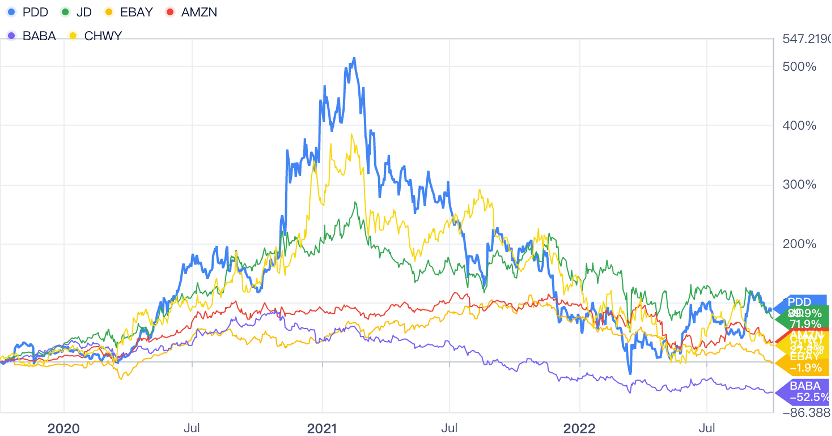

Compared to other companies in e-commerce industry, PDD stock had dramatic growth in recent three years as shown in Figure 2 PDD competitors’ performance, which is a 109.9% growth. PDD has two challenging competitors in Chinese e-commerce, which are Alibaba (BABA) and JD.com (JD). Nevertheless, JD had 71.99% growth and BABA got down by 52.5%, so PDD stock has a better performance than theirs.

Although the Chinese e-commerce company’s growth is cooling off, PDD has potential space to grow because of Tech for Agriculture and its expansion strategies.

(Figure2: PDD Competitors Performance)

Business Strategy of PDD “Tech for Agri”

As a platform connecting millions of farmers and consumers, PDD grasps the opportunity to use technology in agriculture. The digital platform improves the matching of buyers and sellers in agriculture, allowing millions of farmers to boost their incomes through direct access to a wider consumer market, from which they had largely been excluded. In 2021, 16 million farmers supplied their fruits and vegetables to PDD users.

On August 21, 2022, PDD launched an event selling agricultural goods. This event trades 200,000 types of agricultural products and includes more than 100,000 agricultural-related shops. During the event, PDD provides digital resources to the farmer, including teaching them how to use a live-broadcasting platform. This event encourages farmers to display and promote their products, so that consumers can know the quality of agricultural products. With a comprehensive set of online courses, the company has trained more than 100,000 farmers to be familiar with e-commerce. Based on the “Tech for Agriculture” business model, PDD achieved CNY 270 billion in agricultural products in 2020, accounting for 16.2% of the gross merchandise volume.

In addition, PDD pioneered the concept of “consumer to manufacturer”, which Intended to solve the problem of the supply chain of agricultural products. This business model aims to provide real-time information to producers so that they can produce according to fast-changing consumer demand. Also, C2M helps sellers decrease unnecessary production, use fewer resources, and save costs. In the past, the agricultural products supply chain restricted Chinese agricultural development. The circulation losses of fruits and vegetables reach 20%-30%, which is higher than the United States at 11%. At present, PDD keeps re-investing in the construction of cold storage, fresh cold chain logistics systems, and other infrastructure to reduce losses and improve circulation efficiency.

Furthermore, PDD act as a bridge between academic research and commercial application in the area of agricultural technology. They have corporate with top universities to study how to increase agricultural productivity while reducing its impact on the environment. Since 2020, the company has organized an annual Smart Agriculture competition that challenges data scientists and agricultural researchers to develop practical precision farming technologies. The competition aims to use technology to improve land and labor productivity, and to find a new approach for farmers to increase their incomes. PDD is expected to generate more revenue in the future because of its innovation.

Expansion E-Commerce Market

The rapid growth of e-commerce has been driven by changes in consumer habits forced because of the three-year coronavirus pandemic. PDD Inc has created a close-knit community of more than 11 million global merchants over the years and handled 61 billion orders in 2021 alone. This year, PDD planned to expand the overseas e-commerce market.

PDD launched PDD Inc’s sister company Temu in the US in September 2022. Temu was created to give consumers access to buy a broad range of curated products at lower prices. Although the US e-commerce market was led by Amazon.con Inc, Temu has an unusual advantage over other e-commerce platforms because it has access to the network of suppliers and logistics partners built up by PDD over the years. PDD’s strong network of suppliers and fulfillment partners has allowed Temu to offer industry-leading value merchandise to consumers.

In addition, Temu tries to improve its supply chain and inventory management, and select products that will appeal to consumers from all walks of life. At the same time, Temu uses its strong logistics fulfillment capabilities to ship products efficiently to consumers. The company is expected to boost its revenue by attracting more active buyers from all over the world.

PDD Stock Forecast – DCF Aims at $78.06 Target

Based on the 5-years DCF model shown in Figure 3 DCF Valuation Model, the one-year target price is $78.06, inferring a 25% upside from the current price of $62.65 as of Oct.3. 2022.

The main assumptions made are revenue growth rates for the three segments to achieve a 5-year CAGR of 18% from 2022 to 2026. The Revenues Breakdown Forecasting is shown in Figure 4. Online marketing services are the primary source of revenue for PDD, two segments online marketplace service & others and transaction services will have stable growth and the growth rate starts from 30% and 35% respectively. The total growth rate of the online marketplace service segment is 31% for FY2022 and a decline to 15% in FY2026. It is expected to generate more revenue than merchandise because of the popularization of Temu. The revenue growth rate of the merchandise segment is relatively conservative. Nevertheless, the two-year target price is $85.18, indicating a 36% upside, suggesting that PDD is worth investing in for the long run as well.

PDD is China’s largest agriculture products e-commerce platform, it is also a unique one in consumer discretionary securities. The most comparable company is JD.com Inc, the market capitalization of JD is $86.81 billion and the PDD market capitalization is $83.03 billion. However, JD was founded in 1998, and PDD only used sever years and got a similar market capitalization to JD. In addition, PDD has higher multiple ratios than the industry average ratio in Exhibit 3, making its stock overvalued. But PDD is growing more rapidly than its peers.

(Figure 5: PDD Stock Forecast Relative Valuation)

From Yahoo Finance analysis as shown in figure 6 PDD Recommendation Trends and Rating, 16 analysts give Strong Buy position and 18 analysts give Buy position recommendation, and only 8 out of 42 analysts take the Hold position. Also, the analysts give a Recommendation Rating score of 1.7, which is a score between buy and strong buy performance.

(Figure 6: PDD Recommendation Trends & PDD Recommendation Rating)

Conclusion

Based on all the analysis above and a 1-year target price of $78.06, around a 25% upside from the current price, I give a buy recommendation. PDD is expanding the overseas e-commerce market and using technology to improve China’s agriculture. The company is expected to boost its revenue in all segments in the future.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the PDD stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

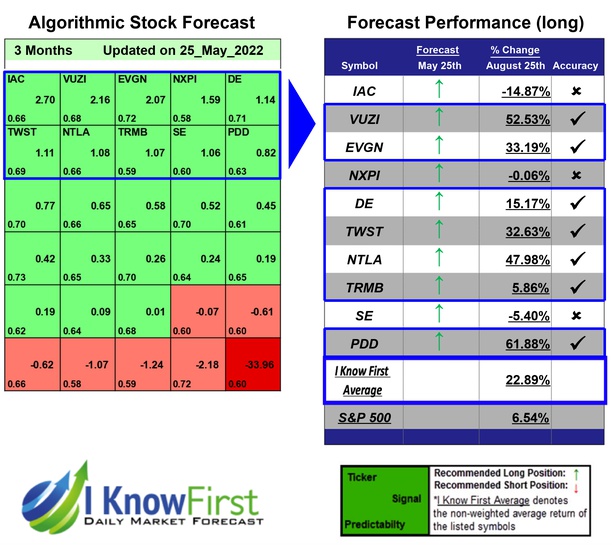

Past Success with PDD Stock Forecast

I Know First has been bullish on the PDD stock forecast in the past. On May 25th, 2022 the I Know First algorithm issued a forecast for PDD stock price and recommended PDD as one of the best stocks to buy. The AI-driven PDD stock prediction was successful on a 3-month time horizon resulting in more than 61.88%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.