Options Trading Strategies Forecasts and Risk Modeling

Dr. Lipa Roitman, Co-Founder & CTO at I Know First..

Dr. Lipa Roitman, Co-Founder & CTO at I Know First..

Michael Shpits, Financial Analyst at I Know First.

Michael Shpits, Financial Analyst at I Know First.

Summary:

- Introduction to risk modeling and forecasting options with machine learning.

- New Implied Volatility package from I Know First Predictive Algorithm.

- Options trading strategies for optimal returns and risk mitigation.

- Algorithmic performance analysis of Implied Volatility package.

Risk Modeling and Forecasting

When contemplating an action, whether to cross the street, or to invest in a company stock, one must be aware of a spectrum of consequences to that decision. Due diligence is to look left and right, to check the financials of the company as often as you can. No company lives in isolation, all are part of a larger environment. Ask yourself, what could happen if ‘x’ happens. To think of the possibilities! Regardless, a decision must be made within the constraints of time. Then how do you decide? This is what risk modeling is all about.

The outcome of your decision depends on how good your model is. The faulty risk model relies too heavily on historical data and neglects the possibilities that are not present there. Fat tail distribution, black swan event, butterfly effect, all too often prove to be elusive to the human senses. Periods of quiet, punctuated by periods of news triggered volatility, human failings, the combination of over-confidence, short-sightedness, and complacency, these are the traits which spell disaster. As proof, a pandemic of size known only once in a hundred years is a risk that few people considered.

Some governments have think-tanks charged with the job of considering such possibilities and evaluating emerging risks. An artificial intelligence system employing machine learning could help in modeling this risk by creating and testing a number of scenarios ranging from a bank failure to a natural disaster.

Our I Know First market forecasting model is modeling the market forces and can be queried to simulate the outcome of various contingencies, such as a change in the interest and currency rates.

To help with market risk assessment and mitigation we have recently introduced a bank liquidity index forecast and selected individual stocks trading volume and volatility forecasts, in addition to VIX and similar indices. These can be useful for options trading in employing strategies with pre-set risk. We are also forecasting the trading volume of many of the S&P 500 stocks. For now, we offer an AAPL volatility forecast, as well as one for SPY volatility.

Implied Volatility vs the I Know First Volatility Forecast

The Implied Volatility and Greeks can be calculated by using simple formulas at any time with six inputs: Spot Price, Strike Price, Risk-Free Rate, Volatility, Dividend Yield, and Expiration Time.

The Implied Volatility is the projected value of future volatility based on today’s values that affect the price of the option. It is commonly described as forward looking, but in reality, it is not. It only reflects current markets’ participant expectation. The volatility itself is volatile, changing with time.

We now have an alternative way to forecast volatility using the I Know First algorithm. It learns the historical data of the same stock, its historical volatility, and how they interact with other equities. The options trader can now use the six different time frames of our volatility forecast to better judge the price of the option and utilize any discrepancy between the price based on Implied Volatility and our forecasted volatility.

Options Trading Forecasts

We have created ten options trading strategies forecasts that traders can use to evaluate the price of options. The stocks are selected to be suitable for each of the ten options strategies. Our forecasts are for the underlying stock prices, not for the options.

A Covered Call or buy-write strategy is used to increase returns on long positions, by selling call options on an underlying security you own. Profit is limited to the strike price of the short call option minus the purchase price of the underlying security, plus the premium received. Loss is limited to the purchase price of the underlying security minus the premium received. The covered call strategy is useful to generate additional income if you do not expect significant movement in the price of the underlying security.

A Naked Put or short put strategy is used to capture option premiums by selling put options, where you expect the underlying security to increase in value. Profit is limited to the premium received. Risk occurs if the security decreases in value, and the loss is the difference between the price at entry and current price less the premium received. The naked put strategy succeeds if the underlying security price is above the sold strike at expiration.

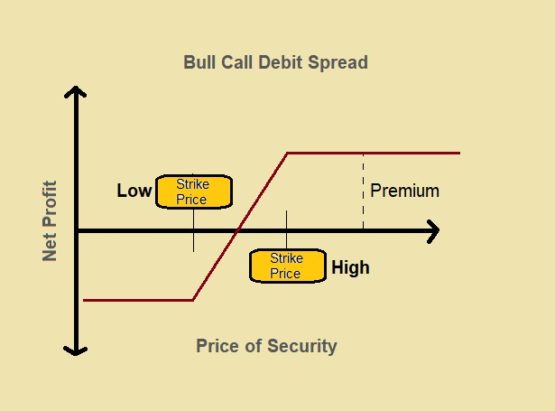

A Bull Call debit spread is a long call options spread strategy where you expect the underlying security to increase in value. Within the same expiration, you buy a call and sell a higher strike call. Risk is limited to the premium paid which is the difference between what you paid for the long call and short call. Profit is limited to the difference in strike values minus the credit. The bull call strategy succeeds if the underlying security price is above the higher or sold strike at expiration.

A Bear Put debit spread is a long put options spread strategy where you expect the underlying security to decrease in value. Within the same expiration, buy a put and sell a lower strike put. Risk is limited to the premium paid which is the difference between what you paid for the long put and short put. Profit is limited to the difference in strike values minus the credit. The bear put strategy succeeds if the underlying security price is below the lower or sold strike at expiration.

A Bull Put credit spread is a short put options spread strategy where you expect the underlying security to increase in value. Within the same expiration, you sell a put and buy a lower strike put. Profit is limited to the credit or premium received, which is the difference between the short put and long put prices. Risk is limited to the difference in strikes values minus the credit. The bull put strategy succeeds if the underlying security price is above the higher or sold strike at expiration.

A Bear Call Credit Spread is a short call options spread strategy where you expect the underlying security to decrease in value. Within the same expiration, you sell a call and buy a higher strike call. Profit is limited to the credit or premium received, which is the difference between the short call and long call prices. Risk is limited to the difference in strike values minus the credit. The bear call strategy succeeds if the underlying security price is below the lower or sold strike at expiration.

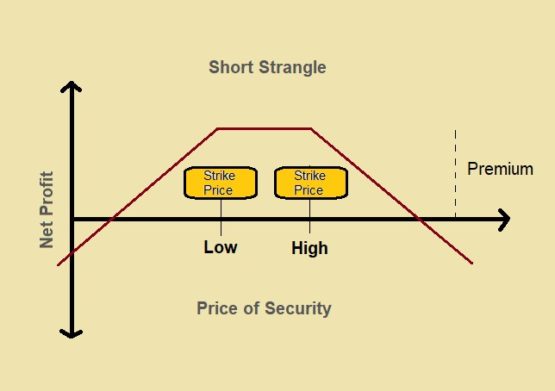

A Short strangle position consists of a short call and short put where both options have identical expirations and different strike prices. When selling a strangle short, risk is unlimited. Profit potential is limited to the net credit received (premium received for selling both strikes). The short strangle strategy succeeds if the underlying price is trading between the lower price strike (minus net credit) and the higher price strike (plus net credit).

A Long strangle position consists of a long call and long put where both options have identical expirations and different strike prices. When purchasing a long strangle, risk is limited to the net debit paid (premium paid for both strikes). Profit potential is unlimited for this strategy. The long strangle strategy succeeds if the underlying price is trading below the lower price strike (minus net debit) or above the high price strike (plus net debit).

A Short straddle position consists of a short call and short put where both options have the same expiration and identical strike prices. When selling a straddle, risk is unlimited. Max Profit is limited to the net credit received (premium received for selling both strikes). The short straddle strategy succeeds if the underlying price is trading between the downside break even (strike minus net credit) and upside break even (strike plus the net credit).

A Long straddle position consists of a long call and long put where both options have the same expiration and identical strike prices. When buying a straddle, risk is limited to the net debit paid (net premium paid for both strikes). Max Profit is unlimited. The long straddle strategy succeeds if the underlying price is trading below the lower break even (strike minus net debit) or above the upside break even (strike plus net debit).

Although these strategies only reflect ten of the many options trading methods available for traders, they constitute the core of options trading and serve as the foundation on which more complex trading strategies are built upon. In order to effectively utilize either these fundamental strategies or use them to construct more in-depth approaches, it is imperative that the investor employs due diligence in finding a strategy that works for them. This can be done more efficiently with the proven consistency of the I Know First Predictive Algorithm, whose machine learning and empirically based insights can augment traders’ own individual research. But, do not take our word for it! Instead, let us look at some of the most recent performances from the newly released Implied Volatility Options package.

In the three-month forecast, the algorithm was able to correctly predict eight out of ten long position stock movements. The top three returns of the forecast came from NVAX, TSLA, and PENN, yielding 165.55%, 147.75%, and 138.43%, respectively. If an options trader would have constructed a portfolio with all the predicted assets on May 20, 2020 and sold their position on August 20, 2020, they would have earned an average return of 61.17%. That is nearly four times higher than what the S&P 500 index returned for the same time period.

In the one-month forecast, the algorithm was able to correctly predict nine out of ten long position stock movements. The top three returns of the forecast came from KIRK, OSTK, and TUP, yielding 131.09%, 94.85%, and 93.48%, respectively. If an options trader would have constructed a portfolio with all of the predicted assets on July 12, 2020 and sold their position on August 13, 2020, they would have earned an average return of 47.99%. That is eight times higher than what the S&P 500 index returned for the same time period.

To be fully convinced of the reliability of the forecast, we must look also at short-term time horizons and short positions. In the three-day forecast, the algorithm was able to correctly predict seven out of ten short position stock movements. The top three predicted losses came from TRVN, MARA, and HMHC, losing -24.88%, -20.53%, and -10.67%, respectively. If an options trader would have constructed a short portfolio with all of the predicted assets on August 19, 2020 and covered their position on August 22, 2020, they would have earned an average return of 7.77%. That is 35 times higher than what the S&P 500 index returned for the same time period.

Given these analyses, it can be seen that the algorithm is consistent in not only its forecast accuracy but in its returns. Our algorithm models and predicts asset price movements for both long and short positions during both long-term and short-term time frames. Since 2011, we have provided daily predictions for over 10,500 assets, now providing a new Implied Volatility package for our options trading community. Whether it be forex, crypto currency, commodities, or stocks and stock-based securities, our forecasts are used by institutional clients as well as private investors and traders to identify the top asset price movements in the market. Don’t wait any longer and join the family to exercise trades faster than all the other market players!

To subscribe today, click here.

Please note – for trading decisions use the most recent forecast.