Oil Prices Forecast: Oil Prices Are Rising And AI Can Help You Profit

This article about oil prices forecast was written by Gabriel Plat, a Financial Analyst at I Know First.

This article about oil prices forecast was written by Gabriel Plat, a Financial Analyst at I Know First.

Summary

- After a 2020 melt, oil prices overcame the pandemic fear and reached their highest prices since 2008;

- The war in Ukraine is pushing the oil prices up and a change of tendency might depend on when the conflict ends;

- Analyzing the scenarios over the war may lead to good investment opportunities;

- I Know First AI-powered algorithm can mitigate your risks investing in this area.

How Prices Reached The Current Level?

The year is 2020. The month is April. Back then, the COVID-19 pandemic indicated that would last (much more) longer than expected. The impact on the economy as a whole was significant, plunging stock markets all around the world. Oil prices followed the trend and reached rock bottom.

From the moment that the pandemic forced people to stay at home and restricted travel, the oil industry suffered a strong demand shock. In April, Brent crude oil price fell to $9.12 while contract futures prices for WTI tumbled to -$37 per barrel. Since then, oil prices started to rise and never look back.

Even though Delta and Omicron variants showed up, the world started to recover from the pandemic. As life started to return to normal, the demand for the oil industry started to increase. As you can see above, both Brent and WTI not only returned to the price they reached by January 2020 but also surpassed them by the end of 2021.

Fast forward to March 2022 and we are facing a Brent price of almost $130 per barrel. For a few minutes, both Brent and WTI peaked at their highest price since 2008, respectively $139.13 and $130.50. But for how long this positive tendency will remain?

For How Long Can We Expect The Prices Increase?

It is no accident that oil prices are almost reaching an all-time high. The war in Ukraine brought several sanctions to Russia, the third-largest producer of crude oil in the world. For a matter of comparison, Russia alone accounts for over 12% of all global crude oil production, behind only Saudi Arabia (12.5%) and the United States (18.6%).

With the U.S. sanctions over Russia’s oil export, the positive trend would not be reversed in the short term. According to analysts at Bank of America, restricting Russia’s oil export may lead to a 5 million barrel shortfall. Without Russia, the global oil supply may disrupt, which leads to the price we are facing right now.

From the moment the price is being defined by decisions regarding the war in Ukraine, the current trend might as well depend on how long it will last.

In an optimistic scenario where the war does not stand for too long, the sanctions would not be lifted quickly. In other words, it would take some time before the situation comes back to normal, lingering the oil price situation. But in a scenario where the Ukraine invasion persists, the sanctions might in fact hit Russia’s oil export. If that is the case, we are talking about the 5 million barrel deficit scenario we just mentioned.

Iran, owner of the world’s fourth-largest oil reserves, can be a key piece to this issue. There are talks about a new nuclear deal with the country, which will lift sanctions on the country’s oil production. This will not impact the short term, still, but the expectation of an increase in the crude oil supply can calm down investors.

Is There A Way To Invest Amid Everything?

We can not talk about investments without discussing uncertainty and risks. Is part of the nature of an investment. So which type of risks we are facing in these scenarios? Is there a way to profit from it?

If we are really facing a scenario where the war will extend for an undefined amount of time, oil prices will continue to rise in the short term. In 2008, the falling demand only affected oil prices when it reached about $140. Adjusting for inflation, this price would be equivalent to around $200 today. In other words, this can be an opportunity to profit.

But in the opposite scenario, where the war will end just soon and sanctions will lift up immediately, the absence of risk may impact negatively at oil prices. The options market for assets linked to the oil industry might as well be the opportunity here.

And if you are looking for a way to mitigate risks when trading, know that artificial intelligence can help you.

Believe It, You Can Mitigate Risks Investing In It

It does not matter if you are investing in options, the oil industry, or any other asset. The I Know First predictive algorithm can help you optimize your investments. By using decades of stock market data around the world, the algorithm can understand market trends and generate predictions of stock movements.

From the beginning of the year, the ETFs forecast was already showing high signals to the oil ETFs. From the ETFs with the strongest signals since the beginning of the year, half of the picks were from the energy sector. More than that, the S&P 500 stock picks, a package that screens all sectors, also identified the energy sector as the leading one. In this forecast from January, we can observe strong signals coming from energy stocks. 40% of the picks are oil-related stocks.

More than that, our algorithm was already high signaling the energy sector last year! As you can see below, oil and energy-related ETFs topped the package as predicted by our AI-powered algorithm.

The options forecast also followed the trend. In this forecast, we can see stock picks such as CDEV, SLB, DVN, CVE, MRO, and MPC, all of them from the energy sector. And we are talking about January!

Also, I Know First uses algorithmic outputs from the Energy package to provide an investment strategy for institutional investors.

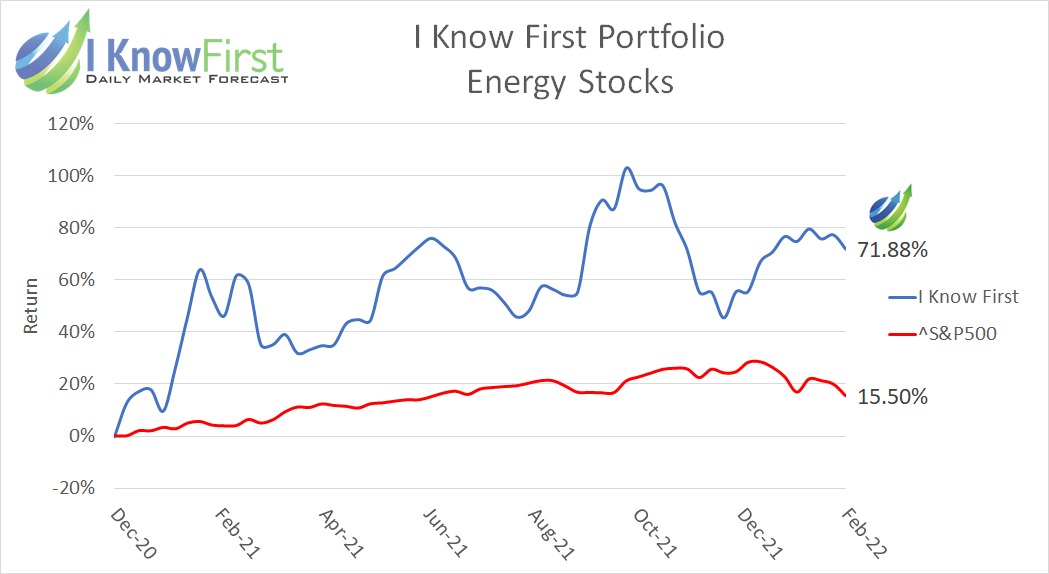

The investment strategy that was recommended to institutional investors by I Know First accumulated a return of 71.88% that exceeded the S&P 500 return by 56.38%.

If you are interested in any of these packages mentioned above, you can have access to it here.

Conclusion

Oil prices are sky-rocketing during the course of 2022. After plummeting in 2020, both Brent crude and WHI resurged and are now facing their highest prices since 2008. Right now, the price fluctuation is highly dependent on Russia’s invasion of Ukraine. If we can think about scenarios in the future, we must analyze how long the war will continue.

The extent of the war will determine the oil prices, as well as the sanctions imposed on Russia. Of course, there is always an opportunity to invest and profit.

Investing right now may seem risky, but there is a way to mitigate it. By using the AI stock market predictions of the I Know First algorithm, it is possible to invest safely and enjoy the best market opportunities at the same time.

As we are still dealing with a period with high volatility, investing can be challenging and risky. By using the AI stock market predictions of the I Know First algorithm, it is possible to mitigate risks and enjoy the best market opportunities at the same time.

To subscribe today, click here.