NXPI Stock Forecast: NXP Semiconductors Is Misunderstood And Undervalued

![]() Naman Shukla is an Analyst at I Know First. He writes and invests in the stock market. Ranked in the top 8 percentile in TipRanks.com. Featured on SeekingAlpha.com, GuruFocus.com, Valuewalk.com among others.

Naman Shukla is an Analyst at I Know First. He writes and invests in the stock market. Ranked in the top 8 percentile in TipRanks.com. Featured on SeekingAlpha.com, GuruFocus.com, Valuewalk.com among others.

NXPI Stock Forecast

Summary

- Weak performance by Apple has hurt NXP Semiconductors.

- Connected cars market can presents a huge opportunity for NXP Semiconductors.

- NXP Semiconductors is also gaining traction in the autonomous car segment.

- Although there are risks of increasing competition, NXP Semiconductors should deliver in the long-term.

- I Know First Algorithm is currently bullish on the NXPI stock movement

Apple suppliers have been under selling pressure ever since the Cupertino giant released weak earnings. Tepid iPhone sales along with lowered guidance has not only had an impact on Apple’s stock, but has also put downward pressure on Apple suppliers like NXP Semiconductors (NXPI).

While a pullback in NXP Semiconductors is understandable, I think the market is undermining the company’s efforts to diversify its revenue stream. NXP Semiconductors has consistently been working on reducing its dependence on Apple and the stock should surge higher once Mr. Market realizes its true future potential.

Strong quarterly growth

NXP Semiconductors not only deals in the PC or smartphone market, as the company is still subject to the varying conditions of the semiconductor market as a whole. In the most recent quarter, the company reported earnings per share of 86 cents, beating the consensus estimate of 83 cents. The company’s revenue came in at $2.22 billion, $.01 billion higher than the analysts’ estimate of $2.21 billion.

NXP Semiconductors’ top-line surged 52 percent y-o-y and a surge of 39 percent compared to prior quarter. Moving forward towards HPMS segment, the company’s revenue came in at $1.9 billion, a surge of 73 percent y-o-y and an escalation of 46 percent equated to previous quarter. Moreover, NXP Semiconductors’ automotive revenue was $805 million, approximately $5 million higher than the midpoint of guidance.

This strong growth was mainly driven by robust demand for Auto MCU products and the company’s advanced automotive analog products which comprise its in-vehicle networking as well as safe car access products. The company also expects that worldwide auto unit production will lean towards 3 percent this year, and will act as a significant growth driver for the company. As you can see from the image below, the connected cars segment is estimated to grow at a rapid pace, and NXP Semiconductors should make the most of this opportunity by moving into the space first.

(Source: BusinessInsider.com)

BlueBox Platform

Earlier this month, NXP Semiconductors launched its new Autonomous Driving Platform named BlueBox. It accounts for a platform that delivers the mandatory performance, automotive reliability, and functional safety for engineers to design and test self-driving cars. Moreover, this platform offers the performance required to analyze driving environments, assess risk factors and finally directs the car’s behavior with the help of several kinds of sensors.

The company claims that four major auto manufacturers are already using this system, and will most likely launch their autonomous vehicles for the mass market by 2020. However, graphics cards giant NVIDIA has formerly launched its automotive platform titled Drive PX, therefore it clearly means that NXP Semiconductors will face a tough competition from NVIDIA.

However, given the potential size on the market, both NXP Semiconductors and NVIDIA can easily coexist in the market.

A growth opportunity

Although NXP’s alliance with Freescale added substantial revenue, the company’s Non-GAAP EPS declined 15.6 percent year over year mainly due to increase in the amount of outstanding shares as an outcome of the Freescale merger.

In spite of the short-term problems facing NXP Semiconductors, the company is well positioned to take advantage from the mounting demand of semiconductor products by the automakers for their automobile. In the prior quarter, automotive revenue accounted for 36 percent of the company’s overall revenue, a surge of 15 percent compared to year ago period. Moreover, NXP’s impending sale of its standard products business could take that figure even further.

The automotive segment has been mounting at a rapid rate throughout the past few years with the transformation of vehicles, escalated fuel efficiency, and more aggressive sales. While these figures will probably not keep up with the agitated speed they have been on, but they do seem to be continuing strong.

Intensifying competition

It is clear to stockholders that NXP Semiconductors is not the only supplier of semiconductors in the automotive industry. Throughout the last few years, NVIDIA has been putting huge efforts to grasp a leading position in the automotive industry, but it looks like NVIDIA is aggressively focusing on autonomous semiconductors and infotainment systems leaving a lot of growth room for NXP Semiconductors.

Therefore, the company is pursuing the future ability to warn drivers of approaching obstacles, traffic and more. These types of things are making the company to be a part of the smart cities movement during its early stages.

However, If NXP Semiconductors fails to meet automakers expectation and introduce new technologies and products keeping in mind the varying market conditions and demands, the company might get kicked out of the race. Apart from that, it is also possible that competition can eat the company’s lunch.

The only way for the company to survive in this market is by leading the market with new insights and innovative ideas, and that only comes from a vigorous investment in R&D sector. As of now, NXP Semiconductors seems to be doing quite well and investors looking to benefit from the boom of the connected cars and autonomous cars market should consider buying NXP Semiconductors.

Conclusion

NXP Semiconductors has effectively diversified itself from Apple. Going forward, its dependence on Apple will keep on reducing, which is why I think it is unfair to tie its success to iPhone sales. As mentioned above, the company is gaining traction in two rapidly growing markets and once investors realize its true potential, shares will surge higher. Thus, I think investors should take advantage of the recent pullback to buy NXP Semiconductors.

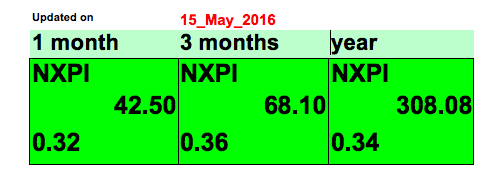

My bullish stance on NXPI is echoed by I Know First’s algorithmic forecasts. I Know First uses an advanced state of the art algorithm based on artificial intelligence and machine learning to foresee market performance for more than 3,000 markets including stock forecasts, world indices, commodities, interest rates, ETFs, and currencies. The algorithm generates a forecast with a signal and a predictability indicator. The signal is the number at the center of the box. The predictability is the figure at the bottom of the box. At the top, a particular asset is identified. This format is standardized across all forecasts. The middle number indicates strength and direction, not a price target or percentage gain/loss. The bottom figure, the predictability, signifies a confidence level

As you can see from the above image, the green 68.10 and 308.08 shows that I Know First’s bullish signal for NXP Semiconductor is strong in the short term and very strong in the long-term, which resonates with my outlook as well.

In addition, I Know First Algorithm predicted in the past the stock movement of NXPI in this forecast from the 9th of February to 16th of February 2016. With a signal of 1.85 and predictability of 0.18 bringing returns of 8.31% in just 7 days.