NVIDIA Stock Prediction: Is NVDA in a League of its Own?

The article was written by Vladimir Zaslavsky, a Financial Analyst at I Know First.

The article was written by Vladimir Zaslavsky, a Financial Analyst at I Know First.

NVIDIA Corporation (NVDA) Stock Forecast for 2018

“Good, bad or indifferent, if you are not investing in new technology, you are going to be left behind.” ~ Philip Green

Summary

- NVDA strongly positioned for 2018

- NVDA growth driven by Crypto currency, Artificial Intelligence and Gaming Growth

- I Know First Forecast for NVDA

Nvidia Corporation operates as a visual computing company worldwide. It operates in two segments, GPU and Tegra Processor. The GPU segment offers processors, which include GeForce for PC gaming; GeForce NOW for cloud-based game-streaming service; Quadro for design professionals working in computer-aided design, video editing, special effects, and other creative applications; Tesla for deep learning, accelerated computing, and general purpose computing; and GRID for cloud-based visual computing users. The Tegra Processor segment provides processors that integrate a computer onto a single chip under the Tegra brand name; DRIVE automotive computers, which offer self-driving capabilities; and tablet and portable devices for mobile gaming and TV streaming under the SHIELD name. The company’s products are used in gaming, professional visualisation, datacenter, and automotive markets. It sells its products primarily to original equipment manufacturers, original device manufacturers, system builders, motherboard manufacturers, add-in board manufacturers, and retailers/distributors. NVIDIA Corporation was founded in 1993 and is headquartered in Santa Clara, California.

Widely known for its video-gaming chips, Nvidia (NASDAQ: NVDA), has pioneered the art and science of visual computing. Nvidia offers specialised platforms for gaming, automotive, datacenter and professional visualisation markets. Its products, coupled with its services and software facilitate amazing experiences in virtual reality, artificial intelligence and autonomous cars.

Nvidia has delivered impressive results for shareholders with over 80% returns compared to AMD (AMD) and Intel (INTC). The successful year ended with a final selloff across the equity market that erased a portion of the recent gains. AMD lost its previous gains and ended the year down 20% while Intel logged a mere 20% gain at the end. Nvidia’s robust performance is predominately attributed to the company’s phenomenal results in back-to-back quarters. Investor confidence in Nvidia’s stock sustainability has been boosted as many realise that the company is significantly more complex than GPUs.

Market Positioning

Historically, semiconductor stocks have proved to be particularly vulnerable during market downturns, following cyclical demand and pricing patterns. Despite the recent market crash, Nvidia has once again illustrated that investors can rely on the company’s growth trends. Nvidia is insulated from the risk due to its growth trends including gaming, artificial intelligence and autonomous vehicles.

The semiconductor company has recently reported EPS of $1.78 and revenue of $2.91 billion – exceeding analyst predictions of $1.17 EPS and $2.69 billion of revenue. Indeed, this is a pattern that NVDA shareholders have become accustomed to – given it is the 10th consecutive “beat and raise” quarter, demonstrating the strong, persistent tailwind behind the company. Furthermore, Nvidia have announced very strong guidance for 2018.

The crypto currency market has skyrocketed from a market cap under $16 billion at the beginning of 2017 to $813 billion in the first week of 2018. To create the crypto currencies, a computer is required to solve complex mathematical problems. Ultimately, the difficulty has rapidly escalated and “miners” are running high spec computers to generate the coins. Some of the most common chips used by miners are made by Nvidia.

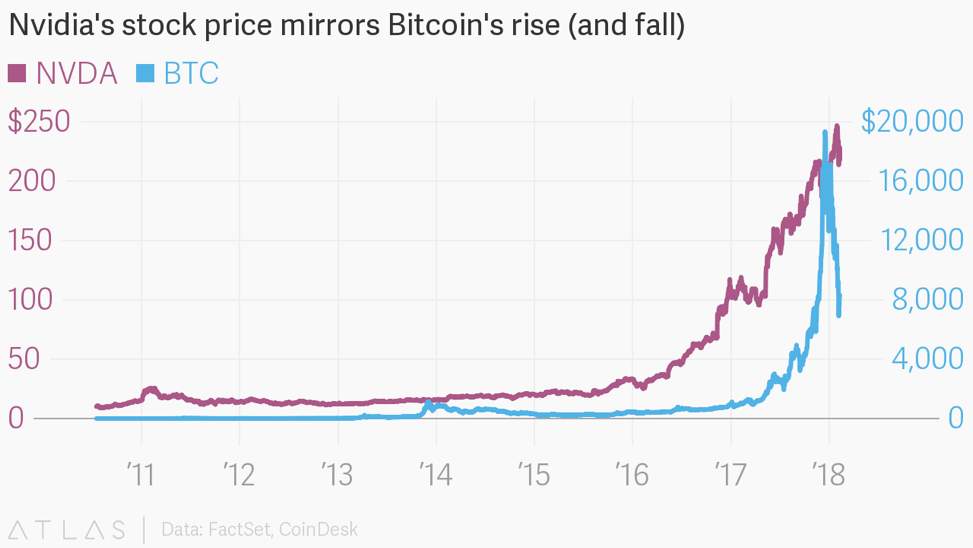

Whilst Nvidia downplayed the direct impact of the sales of mining on its quarterly revenue, it is very likely that a significant portion of the crypto currency related revenue is hidden within Nvidia’s revenue accounting for gaming-chips sales. Indeed, Nvidia’s stock price mirrors Bitcoin’s rise (and fall).

Artificial Intelligence

Nvidia has a valuable artificial intelligence platform that’s finding application in a growing range of different industries. Nvidia’s database has demonstrated steady growth. It is expected to continue along this path as AI applications increase. Analogous to crypto currency mining, institutions and independent AI researches may be purchasing graphic cards for gaming, and using them to run AI algorithms.

Nevertheless, artificial intelligence chips are large part of Nvidia’s business. Nvidia announced $2.9 billion in total revenue in its Q24 2018, with $9.71 billion in revenue over the entire year. The company reported $606 million of that revenue from hardware sold for use in data centers, indicating that just over 20% of Nvidia’s revenue now comes from AI-optimized data center hardware. Revenue for the datacenter is up 21% from the past quarter and 105% from the previous year. Management noted that the Datacenter outperformance was driven by V100 GPUs, new DGX systems, and design wins in HPC.

Nvidia’s overall performance is likely to benefit from its growing strength in the artificial intelligence (AI) space. Nvidia is also a leading player in providing AI applications to autonomous driving vehicles, outpacing other competitors including intel and AMD, in terms of growth.

Notably, during CES 2018, NVIDIA revealed that it is working alongside 320 companies, including Baidu BIDU, Uber and Volkswagen, to develop self-driving technology.

Nvidia has additionally announced its partnership with Continental to enable worldwide production of self driving cars. “The vehicle of the future will be a sensing, planning and acting computer on wheels,” Continental CEO Elmar Degenhart said in a statement. “The complexity of autonomous driving requires nothing less than the full computational horsepower of an AI supercomputer. Together with NVIDIA, we will deliver the complete AI self-driving solution from the cloud to the car.”

Furthermore, Nvidia, alongside GE subsidiary Baker Hughes are attempting to bring the application of AI to the oil and gas industry. This will cover everything from locating new oil sources, bringing it up to the surface, refining it for use and delivering to the customer.

Baker Hughes is working with Nvidia on making this happen using its range of AI-enabling GPU tech, including both its Nvidia DGX-1 supercomputers, which are large, data center powerhouses, to its DGX Stations for desktop supercomputer capabilities, and even the Nvidia Jetson AI, its platform for computing at the edge, which enables deep learning processing locally, rather than routing it through the cloud.

Gaming

Graphics processing units (GPUs) for gaming account for the majority of Nvidia’s revenue, generating $1.74 billion in the past quarter. This reflects a 11% increase from the previous quarter and 29% increase year-on-year. The growth in gaming was driven by largely by strong demand across Pascal GPUs. The growing popularity of gaming and e-sports have propelled the sales of gaming GPUs. Indeed, it is likely that this will remain the case as PwC projects that gaming will grow by 5% annually, generating $90.1 billion in revenue by 2020. Even if the crypto currency market crashes, and demand for gaming GPU’s used for mining drastically falls, Nvidia’s core business will remain intact.

Analyst Coverage

A number of analysts, polled by Nasdaq, shared their views on NVDA’s current momentum. Of 25 analysts surveyed, (including Wells Fargo, Deutsche Bank Securities and Morgan Stanley) 10 advise “Strong Buy,” 3 advise “Buy” whilst 10 advise investors to “Hold” and 2 recommend a “Sell” position. A strong buy recommendation indicates that the shares are currently perceived as undervalued.

Summary

Ultimately, Nvidia is pursuing various high growth markets allowing it to sustain its upward momentum. Despite having gained approximately 800% over the past two years, I believe there is plenty of room to run higher considering its market positioning and growth prospects.

I Know First Algorithmic Bullish Forecast for NVDA

I Know First currently maintains a bullish stance on NVDA with signal strength 479.24 and predictability 0.63 for the 1-year forecast.

Past I Know First Success with NVDA

Past I Know First Success with NVDA

I Know First has predicted NVDA’s stock movements correctly in the past. This article was bullish on NVDA in November 2016, and NVDA is up 56% since then.

I Know First Algorithm Heat-map Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm, allowing the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.