Nvidia Stock Forecast: Bullish Outlook for Nvidia in 2020

This Nvidia stock forecast article was written by Chloe Peng, Analyst at I Know First. Master of Science of Finance candidate at Brandeis University.

This Nvidia stock forecast article was written by Chloe Peng, Analyst at I Know First. Master of Science of Finance candidate at Brandeis University.

Nvidia Stock Forecast Summary:

- Nvidia generates 178.61% return on its stocks in 1 year from Sep.10th, 2016 – Sep.10th, 2017

- The industry is facing both challenges and opportunities under current situation, as e-sport events are cancelled but stay-at-home advice also caused increase in video gaming time. The overall influence is still unclear.

- As the leader in its sector, Nvidia maintains its share in GPU market, as well as expands to new markets, for example systems for autonomous vehicles to seek for growth.

- I hold a 1-year bullish Nvidia stock forecast despite the current disruptions to the business due to the coronavirus pandemic.

Company Overview

Nvidia, (NVDA, NASDAQ), is a company focusing on GPU designs for the gaming and professional markets, as well as system on chip units for the mobile computing and automotive markets. It invented the GPU in 1990 and redefined computing and reshaped the market.

However, the company never feels satisfied in its current leadership in existing markets. In recent years, Nvidia is leveraging GPUs in PC gaming, crypto mining, machine learning and artificial intelligence and is diversifying into new markets for example autonomous driving and 5G, seeking for new growth opportunities.

In this report, I will show you the reasons why Nvidia almost doubled its stock value from 2016-2017 and generate an estimation of how the company will perform in 2020.

Major Businesses

Nvidia has two reportable segments: GPU and Tegra Processor, which aim at different market and support different works. The graphs below indicate the details of the two products and its revenue decrease for the year ended Jan, 2020.

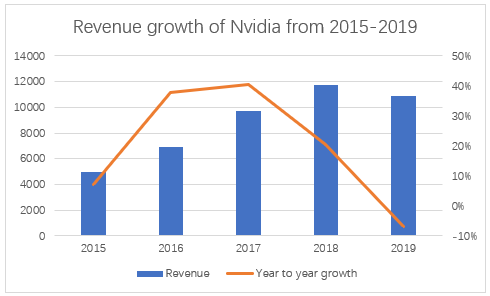

Nvidia’s revenue is highly sensitive to industry trends and have grown significantly in previous years and will probably stay at 2018 level in 2020

2016 and 2017 were epic years for Nvidia. The company launched its next-generation GPU architecture Volta and Tesla V100 Tensor Core, which was an evolutional data center GPU to support AI developments and was widely used by major cloud service providers and internet companies, for example, Facebook, Google, IBM, Alibaba and Amazon.

Moreover, in 2017, Nvidia entered the game console market. Its Tegra processors powered the Nintendo Switch, which turned out to be a huge success.

Despite rising competition from AMD, market trends (crypto and e-sports) and technology developments (AI and rendering) boosted Nvidia’s earning to a new level. The market growth along with the launch of Nvidia’s market-changing products drove its revenue to grow around 40% each year in the 2 years.

Esports and Nintendo Switch’s popularity kept driving Nvidia’s revenue in 2018. And the cryptocurrency trend was a more powerful driver for its sales, when many people switched to mining Ethereum. As a result, the huge need for GPUs increased all GPU players’ revenue in 2018.

Then, revenue for 2019 was down 7% from a year earlier. The cryptocurrency bubble broke in 2019 and the need for GPU fell back accordingly. The US-China trade war also introduced great uncertainty to Nvidia’s business. The company is subject to risks and uncertainties associated with international operations all the time. Revenue from sales outside of US accounted for 92% for year 2020 and 87% for 2019 and 2018. And Revenue from China, including Hongkong, was 25% of total revenue then. Thus, the 2019 trade war hurt Nvidia significantly.

Since the start of 2020, people have seen significant disruptions due to the spread of Covid-19. Apple has to close most retail stores and many tech companies observed production delays due to the shutdown of factories all over the world. Nvidia is no exception. For the fiscal year ended 2021, the company has reduced its revenue outlook for the first quarter by $100 million to 3 billion to account for the coronavirus impact. The total impact on the company is still unclear.

The recent acquisition of Mellanox indicates that Nvidia is gearing onto the cloud computing market, which is expected to grow annually at 18%. And I estimate that the revenue for year 2020 will be around $12 billion, which means the revenue will rise back to 2018 level.

Financial Ratio Analysis

Generally speaking, the company is under a very good financial situation with abundant cash to serve its future projects. It generates good profit and cash from its operations and doesn’t need much debt finance to support its business.

Profitability ratios

Nvidia’s gross profit margin has been growing these years and becomes the industry leader in terms of profit margins. Although not selling as many GPUs as its competitor AMD, Nvidia generates more profit due to the higher margins.

Positive earning strength

The upward curvature of the plotted points in the graph on the right indicates that while NVIDIA Corp.’s earnings have risen from $5.37 to an estimated $5.61 over the past 5 quarters, they have shown acceleration in quarterly growth rates when adjusted for the volatility of earnings. This indicates an improvement in future earnings growth may occur.

Leverage ratios

I would say the interest cover shows that Nvidia doesn’t have any problem in paying interests and is in a very good cash situation. And it’s been reducing debt during the recent years, since it has abundant cash, it would be a good way to reduce financing cost by repaying debt.

Liquidity ratios

Still, Nvidia is always more than able to repay near-term obligations and is in a very good financial situation.

Valuation

Multiple valuation

I choose the following comparable companies: Advanced Micro Devices Inc. (AMD), Intel and Texas instrument because of similar businesses. I assigned equal weights on the three prices derived from Market/book value, EV/Revenue and P/E and multiply the multiple by the estimated year 2020 revenue. The average of three share prices is $193. However, I found it more reasonable to compare Nvidia to AMD only, because they are direct competitors in almost all markets and have similar business models. If we only consider AMD’s ratios, the Nvidia’s share price would be $329.5.

Discounted cash flow model

Under the extreme uncertainties caused by the coronavirus spread, it would be more difficult to result in a fair share price using this model because it would be more difficult to make reasonable assumptions. However, based on my analysis of the market and the company, the fair price of Nvidia is around $308.13, which is higher than the current market price. The stock is currently undervalued due to many reasons, which further justify my bullish Nvidia stock forecast.

Conclusion

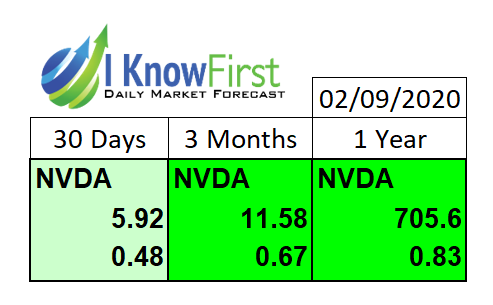

The multiple valuation suggests that it’s reasonable to hold the stock while DCF model shows it would be fair to buy the stocks. As investors, we need to bear in mind that, the stock is getting close to its fair price in the long term. As the leader in many rising markets, Nvidia’s future seems promising. Base on my analysis, I suggest investors to BUY the stock. My view is supported by AI-driven stock forecast generated by I Know First predictive algorithm indicating strong bullish signal up to the value of 838.62 and predictability of 0.81 on 1 year horizon.

Past Success with Nvidia Stock Forecast

I Know First has been bullish on the NVDA stock forecast in past predictions. The I Know First algorithm issued a bullish outlook on February 10, 2020. The algorithm successfully forecasted the movement of NVDA’s stocks and rose by 24.21% after three months. See the chart below.

Here at I Know First, our AI-based stock algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing stock market forecast, as well as a gold predictions, currency forecast, and, in particular, Apple stock forecast. Today, we are producing daily forecasts for over 10,500 assets. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast