Nokia Stock Forecast: Buy Nokia Before The Rebound (NOK)

Nokia Stock Forecast

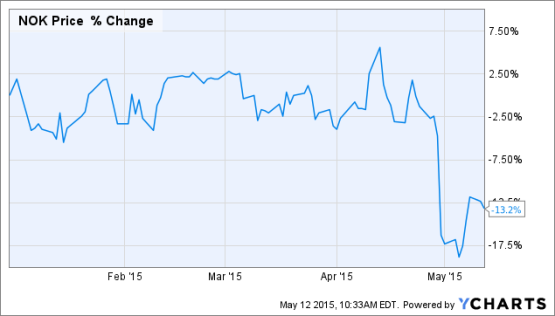

At this point in time, Nokia Corporation (NOK) is a company worth considering opening a position in. The stock price has fallen 8.5% since its earnings report, and is down 12.7% year-to-date. The decreased stock price is a result of a decline in operating profit in the Networks core division, which fell 61% from a year earlier, and concerns about the company’s proposed acquisition of Alcatel-Lucent (ALU). However, the Networks division will turn around during the rest of the year and the company’s planned sale of HERE, its mapping unit, will help the company’s performance and make the stock bullish in the long-term.

Figure 1. Source: YCharts. Year-To-Date Performance Of Nokia.

Networks Business Profitability

As I mentioned, profitability fell precipitously in the first quarter for the core Networks business. This division provides mobile infrastructure across much of the world, and brands itself as the world’s specialist in mobile broadband. Profits fell from $238 million in the first quarter of 2014 to $94 million in the first quarter of this year for this segment, while operating margins fell from 9.3% to 3.2%, as well.

This performance is clearly disappointing, but the resulting sell-off of the stock has been overdone. There were many culprits according to CEO Rajeev Suri during the company’s earnings call, but two really stand out as to why the Nokia Networks will rebound. The first main factor was lower core networking revenue from China and North America, which he does not believe will be a structural change in the company and should correct itself in the future.

The other key culprit was strategic entry deals in China. The short-term effects of these deals were greater in the first quarter than what the Nokia originally believed they would be. However, the long-term profitability of these deals are good, meaning that the profitability will more than balance itself going forward.

In fact, Suri claimed that operating margin in this core business would be in the middle of its guidance of 8% to 11%, so roughly around 9.5%. Considering it was just 3.2% during the first quarter, the front-loaded contracts will most likely have great margins during the rest of the year, and operating margin from this business segment will improve by almost 10% for the remaining three quarters of the year.

HERE Mapping Sale

The poor performance of the Networks business caused the good performance of the HERE mapping division to go unnoticed. This business segment had increased sales of 25% compared to the same quarter a year earlier, and gross margins increased to 7.3%. The HERE business is not a core part of Nokia’s core business model, however, as it focuses on driving growth from the previously mentioned Networks business as well as its IP business.

Nokia is exploring the possibility of selling HERE, possibly in full or in part, keeping some ownership of the mapping service. The New York Times reported that Uber, the taxi service that allows consumers to order transportation through their smart phones, was interested in the service. In the report, it was stated that Uber was willing to pay as much as $3 billion dollars for HERE, which would be a good return of value for Nokia.

Figure 2. Source: Microsoft.com. HERE Maps Screenshots.

A deal is expected to be closed by the end of the month, and should have a positive effect on the stock price. Besides the fact that Nokia would be getting good value for the business allowing it to shore up its balance sheet, it will also allow the company to focus more on improving its Networks business and the upcoming acquisition of Alcatel-Lucent.

This deal will require lots of work to merge the two companies’ cores, since Nokia is Finnish and Alcatel-Lucent is French. The French government will want assurances that it will not lose jobs as a result of the merger. By not having to spend time on the mapping service, Nokia can focus more on its core business as it moves forward with its acquisition, improving the company’s performance during the rest of the year and sending the stock price higher.

Algorithmic Analysis

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The algorithm has more data to forecast within the long term and, naturally, outputs a more accurate predication in that time frame. Having said that, intraday traders, along with short-term players, will also benefit by taking the algorithmic perspective into consideration.

The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

I Know First was correctly able to predict the rise of Nokia’s stock price in the past. An article written on September 3rd, 2013 had a bullish three-month forecast for the company, indicating that the stock price was undervalued and would increase during that time. As one of the top suggested stock picks by the algorithm, the company had a signal strength of as much as 194.01 on August 20th, 2013. In the three months after that article was published with that forecast, the stock price increased an astonishing 95.57%.

Having explained how I Know First’s algorithm works and demonstrated its success in predicting the stock’s behavior in the past, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company.

Figure 3. Long-Term Algorithmic Forecast For Nokia.

The above forecast is for the long-term time horizons of three months and one year. These forecasts are bullish, especially the one-year forecast with a strong signal strength of 48.84 and predictability of 0.35. The stock price is likely to start rising during the upcoming quarter as the company sells the HERE mapping service. After that, the stock price should continue increasing as the poor Networks business profitability will turn around. With the stock price falling so much since the beginning of the year, now is a great time to buy this stock.