NFLX Stock Forecast: Netflix Is Keeping Up Through Content Creation

NFLX Stock Forecast: How Netflix Is Keeping Up Through Content Creation

This article was written by Julia Masch, a Financial Analyst at I Know First.

Netflix “”has created a commanding lead in internet TV domestically and is in the process of creating a similar position internationally,”

-Loop Capital Analyst Anthony Chukumba

(Source: Wikimedia Commons)

Highlights

- A Phenomenal Recovery In The Third Quarter

- Content Creation To Combat A Saturated Streaming Landscape

- Current I Know First Bullish Forecast For NFLX

Netflix (NASDAQ: NFLX) has been a volatile stock as it has repeatedly reinvented itself from a DVD-by-mail service, to online streaming source, to creator of original content. Having surpassed the $100 mark in late 2016, NFLX is now trading at nearly $300. Despite a phenomenal last quarter, the streaming giant is trading well below its 52 week high of $423.21. So why is Netflix stock slumping and is there room for more growth as more companies entering the streaming subscriber competition?

A Phenomenal Recovery In The Third Quarter

Netflix had a subpar Q2 2018, which stymied stock growth earlier in the year. However, Q3 2018 rekindled investor confidence in the company as it blew past many analyst expectations. In the second quarter when Netflix did not meet new member expectations , many became wary that Netflix could continue gaining customers in the extremely saturated online streaming market as more competitors pop up while old competitors ramp up new productions. However, in the third quarter, Netflix crushed analysts and even its own, expectations of 5 million new subscribers. Instead, the streaming giant garnered a whopping 7 million new subscribers, a new Q3 record. This 31% gain in membership also resulted in streaming revenue growth of 36% YoY.

Source: Motley Fool

Netflix also has a positive outlook for the final quarter of the fiscal year. The company is expected to report EPS of $0.24 for a total of $4.2 billion revenue for the quarter, a 41.46% decrease from the last quarter and 27.97% increase YoY respectively. Additionally, Netflix forecasts outstanding membership[ gains for the second consecutive quarters with expectations of new member growth of 9.4 million, with 7.4 million of these new memberships being lucrative paid accounts, thus resulting in YoY increases of 15% and 13% respectively.

The Streaming Landscape

Since Netflix transitioned from a mail-DVD service, streaming has become one of the most popular ways to consume content as more consumers have received access to personal screens as laptops and touch-screen phones have become popular. Not only have new companies dedicated to steaming such as Netflix and Hulu emerged, but as consumer trends have shifted and less choose to pay for expensive cable plans, traditional networks such as HBO and STARZ have also created streaming platforms. These aforementioned companies in addition to Youtube are the top streaming apps. In combination, these apps garnered over $750 million in revenue (just on smartphone apps!). Netflix led the charge in revenue and tied for greatest YoY revenue with Hulu. Netflix was the highest earning app in Apple’s app store and Google Play that is not a game.

While these companies have been leading the streaming scene so far, more and more companies are entering the already saturated market. In a letter to shareholders, Netflix informed investors that it is anticipating increase competition from Disney/Fox and WarnerMedia as they begin prepping new streaming systems. This poses a new problem for Netflix: these comings will stream their own content and are less likely to license their shows and movies to Netflix. At the end of this year, Disney movies will no longer be available in NFLX. This can potentially impact Netflix’s subscriber base as some may move to Disney’s new streaming service is they have brand loyalty to the content juggernaut.

Outside of the United States, Netflix faces competition from Alibaba’s digital media and entertainment business. Youku, Alibaba’s streaming service similar to Youtube, grew nearly 25% YoY and is the Chinese company’s second biggest revenue source. As more competitors also emerge in China and Asia, Alibaba has been focusing on ramping up production of original content, which Netflix has responded to in the same manner.

How Netflix Is Keeping Up With The Competition

Only 5 years ago, Netflix had not released a single original production. In comparison, in 2018 alone, Netflix is at 700 original TV series episodes and 80 movies. In comparison, Disney, Warner Brothers, 21st Century Fox, Universal, Sony, and Paramount will released a combined 106 movies in 2018. These productions have been extremely successful; in 2018, Netflix led Emmy nominations with 112 spanning 40 originals, shows, documentaries, and specials. Moreover, NFLX also tied for greatest number of Emmy wins with HBO, a massive accomplishment in just 5 years. Additionally, in order to garner more critical acclaim, for the first time Netflix will release originals in theaters so that they can be considered for Oscars, thus generating more hype for Netflix’s unique content.

In order to differentiate itself from the competition and retain subscribers in a market approaching saturation, Netflix is depending on its original content to incite subscriber loyalty. As Netflix does not release viewership numbers for its original shows, the metric often used to measure success of Netflix originals is change in number of subscribers for the quarter.

Netflix large increase in subscribers in Q3 2018 can partially be attributed to the success o its Summer Of Love, which focused on many romantic films following the success of rom-coms Set It Up and The Kissing Booth. One of these films, To All The Boys I’ve Loved Before, was one of Netflix’s most viewed originals and shot Noah Centineo into stardom.

Source: Netflix

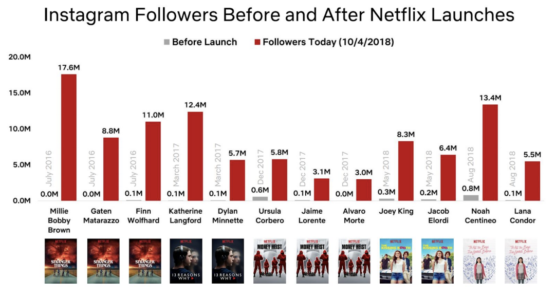

Globally, more than 80 million accounts watched one of the Summer Of Love movies and the popularity of this can be seen by the quantity of Instagram followers the main stars of Netflix originals had before and after launches. This strategy of gaining popularity for its stars has proved successful and generates buzz about the original and urges more people to subscribe to Netflix so they can follow the hottest stars and movies. Netflix’s wide array of original programming has led to global membership surpassing 137 million with 130 million of these revenue generating.

However, while these originals are helping the company grow, they do come at a steep cost. Since NFLX began producing original content, it has had negative cash flow.

Next year, Netflix is expected to spend 7 or 8 billion dollars on original content production. In comparison, Amazon, who is following a similar strategy, is only planning to spend $4.5 billion. However, Netflix only expects to hold its negative cash flows until 2019, therefore after next year they plan to move back towards positive cash generation.

While creating original content is expensive, it reduces reliance on outside studios and producers, strengthens the brand, nd has potentially lower costs. Netflix has 100s of employees in physical production and is going to open a new production hub in New Mexico which will create over 1,000 jobs and bring in $1 billion over the next 10 years. Using its own studios not only gives Netflix more control over the content, but also decreases the markup 3rd part studios charge. Moreover, Netflix does not have to pay to stream its own content as it owns the rights, unlike the shows and movies it licenses from other companies.

Netflix hopes providing consumers with buzz-worthy and relevant content will allow it to stay ahead of the competition and maintain its high growth.

Netflix Valuation

Netflix has a Forward Price/Earning ratio of 102.77 as of November 15, 2018 in comparison to the industry’s average Forward P/E which is ~15. However, it is important to consider that Netflix has consistently met and, in the last two quarters, surpassed earnings expectations.

Source: Yahoo Finance

Additionally, Netflix plans to reduce its spending in the next year, thus increasing revenues and earnings. Moreover, due to recent price drops as a result of a struggling tech sector and its prior earnings reports, Netflix Price to Sales Ratio is 8.65, down from a high of 12.67 in June. This indicates that it may be a good time to buy into Netflix.

Source: MacroTrends

Analyst Expectations

Netflix has recently experienced many upgrades from analysts. Most recently, Buckingham Research double upgraded NFLX increasing its price target from $349 to $406. This is similar to the average analyst price target of $399.78, over $100 greater than current stock price. Moreover, the majority of analysts have bullish prospects for Netflix with an average rating of 2.1, or Buy.

Source: Yahoo Finance

Current I Know First Bullish Prediction For NFLX

Currently, the I Know First algorithm has a positive outlook for Netflix over the next month, 3 months, and year long time horizons.

The strongest forecast is extremely optimistic with a signal of 927.96 and a predictability indicator of .68 over the one year period.

How to interpret this diagram

Conclusion

While the streaming market is growing as more consumers consume content and more competition is entering the space, Netflix will maintain its grasp on subscribers through its continued focus on original content. While this is leading to negative cash flow, the company believes that this is how it can best retain subscribers while still drawing new members in a very saturated market. Netflix is in the process of building an immensely powerful content library. The success of originals such as Stranger Things and the Summer Of Love as well as other award-winning content increases buzz and urges people to watch the unique content. Moreover, analysts have an average price target well above NFLX current value and the I Know First self-learning algorithm reaffirms this bullish outlook. The future looks bright for Netflix.

Past I Know First Success With Netflix

On July 21, 2017, the I Know First self learning algorithm produced a bullish forecast for Netflix as part of a premium article on How Strong International Subscriber Growth Is Driving Netflix. The signal was strong in the short and long time horizons with the strongest over the 1 year period at 386.07. This extremely high signal also had a correspondingly high predictability indicator. The bullish forecast came to fruition and NFLX gained 91.50% in the one year time horizon since this positive prediction.

Source: Yahoo Finance

Current I Know First subscribers received this bullish NFLX forecast on July 21, 2017.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.