Netflix SWOT Analysis: What Is There To Come In 2016?

![]() Ever Haggiag is a Financial Analyst Intern at I Know First.

Ever Haggiag is a Financial Analyst Intern at I Know First.

Netflix SWOT Analysis

Netflix expands to South Africa, as well as other countries soon

Netflix expands to South Africa, as well as other countries soon- SWOT Analysis

- I Know First forecast a strong bullish signal over the next year

Netflix recently announced its launch in South Africa starting next month according to local news reports. The latter had hinted its potential debut in the African continent almost a year ago, and it seems like the moment has come. It must be known that Netflix will be facing brutal competition in this market and becoming the leader won’t be an easy task, nevertheless Netflix tags along original content, in the form of a recent movie release and various T.V series such as House of Cards and Narcos.

Their first movie released, “Beast of no Nation” is considered a success after receiving a 91% rating on Rotten Tomatoes (a movie rating site for professional movie critics) as well as 7.9/10 rating on IMDB. Netflix has been planning expansion for some time now, finally having sorted a feasible plan, they plan to launch their services in nearly 200 countries worldwide by this time next year. To this day, the latter boasts 70 Million active subscribers worldwide. Netflix plans to invest at least an additional $5 Billion in new original content.

SWOT Analysis

Strengths:

- International rollout is on track with launches in Spain, Italy, & Portugal through the end of the year, and Korea, HK, Taiwan, & Singapore in early 2016, along with ROW skimming. NFLX continues to expect contribution losses will peak in 2016 with material global profits starting in 2017.

- We believe the company has a strong track record of prudently investing in successful original content, high-value licensed content, and marketing. We note that assuming no impact to churn, the recent $1 increase should give NFLX an additional $200-$300M in domestic streaming revenue next year, and $600M+ in 2017

- Originals continue to perform with strong slate ahead, including the company’s first original feature film, Beasts of No Nation, which earned $90M at the box office on a mere $6M budget. Marvel’s Jessica Jones was also a hit, the first of four films from Adam Sandler, and The Ridiculous Six, which just came out. NFLX also reiterated on the call that it has been positively surprised by the global strength of Narcos, with much of the language in Spanish.

Weaknesses:

- Netflix’s International Business is not yet profitable. Although thanks to their international expansion they have seen increased revenues, internationally they operate at a loss, in 2013 alone they lost $274M internationally. In the first 3 quarters of 2015, they a recorded a contribution loss of $81M added to an expect loss of $95M at the end of Q4. The company’s recent expansions added various expenses to the business, including a new value-added tax that will begin in January 2016 under European law. We believe internationally Netflix will keep on losing money for some time. Their strategy seems to be prioritizing long-term performance over short-term profits, which in our opinion is the way to go.

- Although Netflix has started creating original content, we believe another weakness is their dependency on striking deals with content owners. They need to do so in order to constantly upgrade their streaming catalog.

Opportunities:

- We believe the main opportunity here for Netflix is to expand. Netflix first internationally rolled out to Canada in September 2010, eventually launching in many European countries and South American countries. Now they are present in about 50 countries, and as mentioned above, they plan on expanding to at least 200 countries by this time next year.

- Netflix has started to produce Movies as well recently, we believe that if they were to continue expanding on the Original Content business they could very well become a full-on entertainment company producing their own movies and T.V shows. This combined with the fact of showing it online to their growing existing customer base could make a killing.

Threats:

- The main threat Netflix faces is competition. The online market for streaming service is constantly subject to change and technological updates. We believe that in such a market, subject to constant changes, with low barriers to entry the possibility of increasing competition is high. As of now Netflix has 2 main competitors in the form of Amazon Prime, a yearly subscription service which on top of providing the user with free shipping all year long, allows them to access its instant streaming platform that boasts a lot of content. Secondly, HBO recently released HBOGO, another online movie subscription service to which customers can sign up, without necessarily needing an existing, or new membership with HBO cable T.V. CBS also recently announced the possible introduction of a new online streaming service.

- We believe the black market around the world in the form of downloading is also a potential threat for Netflix. Increasingly high numbers of young people between the ages of 20 and 30 download content for free. These customers don’t need a subscription service at all, and most content is available to them for free.

Forecast:

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database and utilizes it to predict the flow of money across 2000 markets. The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

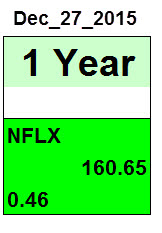

I Know First released a bullish forecast on Netflix. The one-year forecast for Netflix is shown below. We notice that on the 1 Year period, Netflix has a signal of 160.65 and high predictability of 0.46.

On the 21st of November 2014, I Know First released the following forecast (shown below). The latter released a bullish signal for Netflix on a 1-Year time horizon. In the 1-Year time frame given by I Know First Netflix appreciated by 135.48%. Our predictive algorithm has released a similar forecast for this year (shown above).

I Know First wrote a Seeking Alpha Article which argued that the investors had concerns at the time about the international expansion and content costs and how this eventually has impacted Netflix Inc. future in regards of new and exciting content as well as the international expansion. Since this algorithmic forecast article Netflix, the stock price has risen by 145%. In the hitmap below you can see the signals provided on January 7th, 2015 and we can see that the algorithm correctly predicted the behavior of the stock price in the 3 months and 1 year periods.

Conclusion:

We believe Netflix is on track toward significantly disrupting the linear TV market through strong subscriber growth, content differentiation, and a better consumer proposition. We think the company is benefiting from key secular trends, including the proliferation of Internet-connected devices and increasing consumer preference for on-demand video consumption over the Internet rather than linear TV. Higher subscribers have a disproportionately larger impact on profitability as relatively fixed content costs account for the majority of Netflix’s costs. As mentioned earlier in the SWOT analysis Netflix is prioritizing long-term performance over short-term gains, this reinforces our fundamental, and algorithmic view that Netflix is a long-term buy.

Netflix expands to South Africa, as well as other countries soon

Netflix expands to South Africa, as well as other countries soon