NFLX Stock Forecast: A Good Buy In The Long Run

This NFLX stock forecast was written by Jessica Kremer – Analyst at I Know First.

This NFLX stock forecast was written by Jessica Kremer – Analyst at I Know First.

Summary

- Netflix has invested millions into their technology and development costs, allowing them to create original content and a better customer viewing experience.

- The company grew by 10.1 million subscribers in this quarter, even beating out top estimates, and fueling my buy verdict for this NFLX stock forecast

- Netflix holds strong financials and with the dramatic increases in revenue and operating income this quarter, I am confident the company will only continue to grow.

Netflix has done remarkably well since the beginnings of the pandemic. The stock is up about 75% from its coronavirus low in mid-March, with investors bullish for further gains. Currently, the stock is trading around $490, and I am setting my NFLX stock forecast price target to $497.25.

How Netflix Stands Out From Competitors

Netflix has been increasing their technology and development costs. This demonstrates success in past technology developments, and implies confidence for future ventures. In 2018, after the emergence of more streaming competitors, Netflix began to increase their development costs. This was in hopes of bettering their software to provide their viewers with the better recommendations and an overall better viewing experience. In Q2 2020, their technology and development cost was at $435 million, up from $383 million in Q2 2019. Cash flow from investing activities has also increased to $142 million, accounting for an increase of more than 280% since Q2 2019. This growth demonstrates the success of their previous investments, as well as promotes confidence in their ability to innovate further in the future.

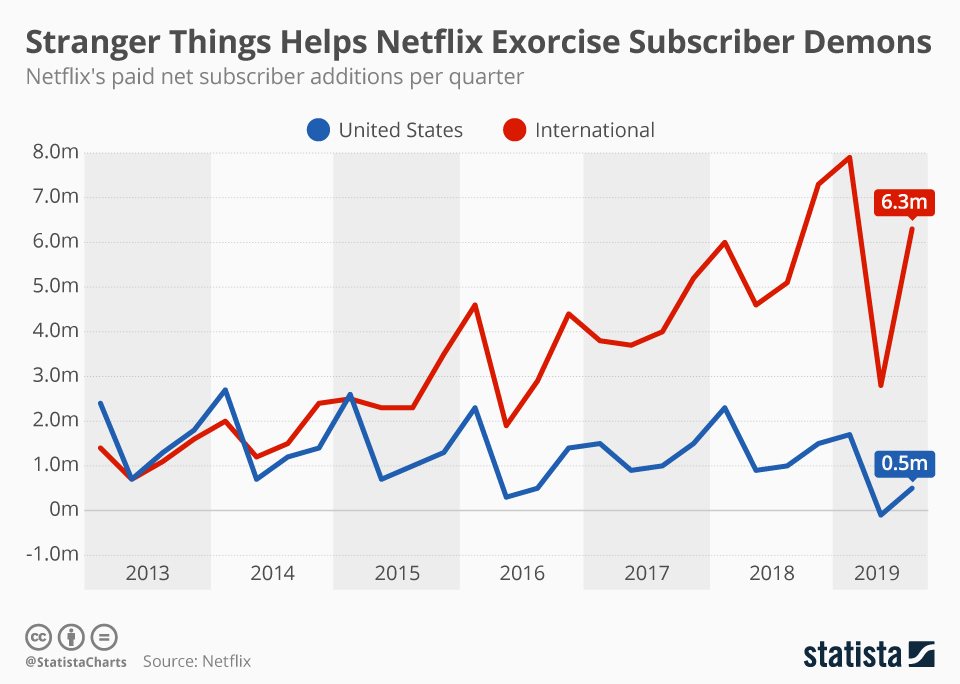

One of Netflix’s most distinguishing features is their menu of original content. The company has produced and owns countless movies, as well as original television shows. In Q2, of the 20 most watched T.V. shows in the U.S., eleven were on Netflix, of which eight were Netflix originals. These successful shows, as can be seen above with Stranger Things, have contributed to growth for the company and to the creation of a dedicated fan base. Additionally, of the 20 most watched movies in Q2, seven were on Netflix, according to data from Reelgood.

Despite this, the pandemic has affected their original content pipeline. In an interview with MarketWatch, CEO Ted Sarandos addressed this concern, stating that this extra time is being spent on scripts and pre-production tasks. He stated that Netflix does have current projects in their pipeline, with several projects resuming production and others already being far along in the process. However, this should result in more original content in 2021 instead of 2020, providing good incentive for long term investors.

Continuous Growth Leads to Bullish Predictions

Gains made by the streaming service have investors hesitant to buy the stock now, with some claiming that someone is not already signed up for Netflix, they probably will stay that way. However, due to the future uncertainty around the coronavirus, this is not necessarily a given. Instead during the second half of March, Netflix experienced large subscriber growth, accounting to 15.8 million new subscribers. This growth, fueled largely by stay at home orders, is expected to have continued into Q2.

During their Q1 results, management estimated 7.5 million new accounts for Q2, but this number has proven conservative. In their Q2 earnings call, the company reported 10.1 million new accounts. Although this increase from the estimate may be a result of many states halting re-openings, it promotes confidence in the company and its ability to continue to grow. However, the company has estimated a 2.5 million subscriber increase in Q3, nearly half of Wall Street’s original estimate. This low number is a result of the surplus of growth in the current quarter, and still leaves me optimistic for Netflix stock.

Netflix’s Healthy Financials

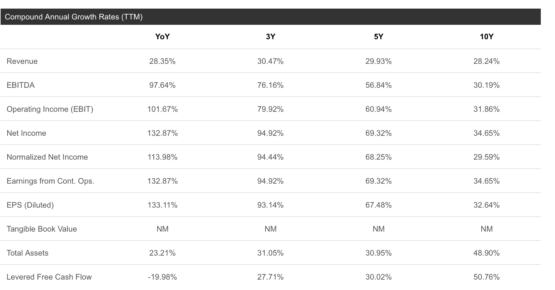

One of the leading indicators of a company’s success is their revenue intake. Netflix has been steadily increasing their revenue, as can be seen by the chart below. In Q2 of 2020, revenue was up to $6.148 billion from $4.923 billion in June of 2020. This increase in revenue was most likely a result of subscriber growth, as well as a 28% cut to marketing and less costs on original content. Netflix will most likely continue it’s revenue growth, leading me to my buy verdict.

Netflix also earned an A rating from Seeking Alpha for its forward revenue growth. As can be seen below, investors are confident in the future growth of the company.

As of Q1 of 2020, Netflix had 6,447,781 thousand in current assets, with current liabilities at $7.854 billion. Since then, current assets are up to $8.564 billion, with liabilities down to $7.626 billion. Not only would Netflix be able to cover their current liabilities, but their total assets could also easily cover their total liabilities.

Additionally, the company’s operating cash flow has increased substantially to $1,041,076 thousand from $260 million in the previous quarter. This, in conjunction with its increase in revenue, exhibits a strong financial position for the company. This much cash from operating activities also demonstrates the ability for Netflix to continue to grow. Regarding the free cash flow forecast below, my price target for Netflix is $497.25. I believe that the previous success of the company, along with the future potential growth, justify this target.

Conclusion

Netflix is an extremely successful streaming platform that will only continue to grow during this pandemic. With their dedicated and growing subscriber base, in addition to healthy financials, Netflix makes a great buy. The company also holds enough assets and free cash flow to cover their liabilities. Despite a recent downturn in Netflix stock due to Q3 subscriber growth estimates, the company performed better than expected in Q2, leading to my bullish forecast and price target of $497.25.

I Know First’s Past Success with NFLX Stock Forecast

I Know First has been bullish on NFLX stock forecast in the past. On April 2, 2020, the I Know First algorithm predicted a bullish forecast for Netflix stock price. The 3-months forecast provided investors with returns of 30.98%. See chart below.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.