MVIS Stock Forecast: Compelling LiDAR Technology Pushes Target Price Around $32

This MVIS stock forecast article was written by Nicole Shammay – Analyst at I Know First.

This MVIS stock forecast article was written by Nicole Shammay – Analyst at I Know First.

Summary:

- MicroVision pivoted with next-gen LiDAR products after disappointed investors with Q1 reports

- Major revelations encourage bullish signals for a worthy buy-and-hold

- MicroVision merits a one-year target price of $32 for the coming year

Overview

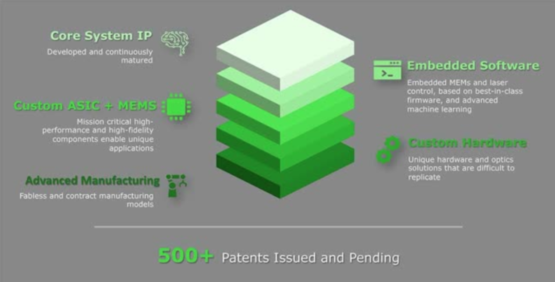

MicroVision, Inc. (NASDAQ: MVIS) is an American-born company that creates and utilizes laser scanning technology for a variety of automotive functions. Its cutting-edge mechanics enable projections, 3D sensing, and image capturing. It is the creator of PicoP, a small engine designed for mobile applications to enhance image quality and ensure focus and power consumption. Perhaps its most popular delivery is its MEMS-based Consumer 3D LiDAR which employs AI-planted hardware to provide users with indoor home automation, augmenting reality, navigation, and more.

Internal Factors Lead To a Decline

On April 29, MicroVision released their Q1 earnings, which deeply feared investors as their sales were down 67% year over year. With revenue down $500,000, and an increase in the net loss by $1.3 million($0.04 per share) – from $4.9 million to $6.2 million. An article by Investor Place contends that the disastrous reports were due to how the company tried to establish itself. Rather than a seller of intellectual property, MicroVision tried to position itself as the sole provider of LiDAR, which consequently led to the downfall in Q1. However, MicroVision’s strength proves significantly in its balance sheet as multiple share sales enabled more than $75 million in cash and investments.

LiDAR Market to Aid Growth

Globe Newswire reported a shocking projection in February, which pinpointed the global LiDAR market size to reach $6.71 billion by 2026. They believe that the projection is driven by increasing investments in newer products with self-driving technology. Though we are unable to precisely know what part MicroVision will take in advancing the LiDAR technology, it is safe to assume it will be a large one given the teasers MicroVision’s CEO, Sumit Sharma, shared on their most recent mission statement. He revealed that “We expect MicroVision’s long-range LiDAR sensor will have two versions in the future … A future generation sensor would be a more advanced version … [and could] include our proprietary software that would provide features needed for a stand-alone sensor used for active safety applications.”

These revelations keep current MVIS stockholders interested and entice new ones. And, even if this news doesn’t make current stockholders believe in the company, they should be reminded of how well MicroVision has actually done despite all of the disarrays. For starters, in May 2020, the MVIS stock was priced at less than $1 per share. Then, in February 2021, it rose to $25 and declined a bit before striving back up again in March. April experienced a cutback to $14, but early June brought us back up to approximately $20. Yahoo Finance released a growth estimate of 10% over the next five years, encouraging strong development in the coming years.

Source: Stock Scores

Teaser About Upcoming LiDAR Product Boosts its Advance

The CEO’s speech also headways various possibilities for new features this year. Investor palace named 5 to be Active Emergency Braking, Active Emergency Steering, Pedestrian Active Emergency Braking, Active Lane Keep, along with higher-level ADAS programs that will run on MVIS computing software. MicroVision’s current patents (approximately 450 according to Seeking Alpha) and models combined with their newer objections will serve many emerging markets, widening their value and enforcing the production of millions of units this year. Not only has MicroVision patented smart glasses and object detection for homes, but they have successfully propelled themselves into other dominant industries such as cars, proving their utility. An article published by Seeking Alpha even mentioned, “LiDAR systems will certainly become mandatory for (still) human-controlled cars to avoid collisions. MicroVision LDIAR could become as revolutionary and successful as airbags.” Regardless of if the products are not fully on the market yet, investors can see their progress with reports and understand the value of what is to come. So, buying now and holding will serve well this year as their ideas will become realities.

MicroVision’s potential and possible profits of the future drives its company value. In other words, their technology is so crucial in today’s time that the market will shut out companies without it, or those with it can eliminate competition. Also, technology is changing so quickly and MicroVision is keeping up with it. In a year’s time, MicroVision’s approaches will be a necessity.

Its current share price is not indicative of all of the product lines and potential profits from ideas and products made in the near future, especially given all of their licenses.

Conclusion

MVIS has made highly promising remarks from both the CEO’s speech, as well as their involvement in the promising acceleration of technology. They are taking on ideas of the future and providing results which leverage high growth potential in the future. With an 10% annual growth estimate over the next 5 years, and accounting for all of technological advances MicroVision will be making in the coming year, I recommend the stock as a buy-and-hold at a price of $27 with potential of growth to $32.

Finally, my bullish prediction for MicroVision is incredibly supported by I Know First’s algorithmic forecast. With a very high and impressive one-year trend signal for 1304.65, it represents a strong trigger for action as well as a sure positive increase in stock price. And, the high signal is strongly supported by a high probability rating which represents our securing confidence.

Past I Know First Success with MVIS Stock Forecast

On February 18, 2021, I Know First predicted the MVIS stock as part of the Aggressive Stocks Forecast Package because we noticed an upward trend of the stock price. The AI MVIS Stock Forecast predicted a very strong signal of 2530.79 on February 18, 2021 and has since been successful. The MVIS stock forecast was also successful on a one-month horizon resulting in a positive 9.37% gain since the forecast date.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.