MU Stock Predictions: Accelerating AI Drives Demand for Flash Memory

MU Stock Predictions

This article was written by Graham Ellinson, a Financial Analyst at I Know First.

This article was written by Graham Ellinson, a Financial Analyst at I Know First.

Summary

- Micron has taken a hit in recent months following ruling blocking sales in China

- As the U.S. – China trade war continues Micron could be considered one of the victims

- Remain patient with Micron as NAND flash storage is set for an upward shift as AI is accelerating

- Prices set to remain stable with DRAM products owing to small number of competitors

When talking about semiconductor stock Micron Technology Inc. (NASDAQ: MU) is one to watch in recent months. Although MU stock has performed poorly in recent months dropping by -19.09% in the past three months, it is important to note that the semiconductor industry is cyclical in nature and the PHLX Semiconductor ETF is also down 4% over the past three months. While this indicates that perhaps MU is taking a larger hit than its competitors it is critical to recognise that this is not in tandem with its true performance. The three-year EBITDA growth rate for the tech giant has been around 49.6% compared with the industry median of 8.4%. Moreover, the three-year revenue growth rate has been around 21.3% for Micron compared with the industry median of 3.7%.

The impact the US – China trade war has had on Micron

As the U.S. – China trade war continues Micron could be considered one of the victims, owing to a recent Chinese court ruling, in July, blocking the U.S. company’s sales of 26 DRAM and NAND flash chip products. This continued trade war strikes fear into investors leading the short term to remain at a hold. Consequently, MU stock is being undersold owing to the short-term market value of Micron plummeting owing to the ongoing trade war.

Interestingly, Micron seem to be performing strongly “In the last quarter, we set revenue records across all our major markets, from automotive and industrial to mobile and cloud data centers,” says CEO Sanjay Mehrotra. It would therefore be wise to have a little more patience with MU stock. Currently 70% of its sales come from its DRAM sector, a relatively inelastic market while demand for NAND products regularly shifts in typical semiconductor cyclical style

AI is Accelerating is Creating a Need for Improved Memory Solutions

From 2017 smartphones have been built with an integrated AI that performs a host of different tasks taking in information from its sensors. One such task is 3D facial mapping that many smartphones have introduced. As each generation of smartphones is released the features that an AI is expected to perform increase and users expect the speed, security and accuracy of existing features to have dramatically improved. Consequently, this means that they become more complex and require an increasing data demand which must be stored and processed on the device itself.

NAND flash memory is arranged in series it remains one of the cheapest methods of manufacturing as opposed to NOR flash where they are arranged in parallel. Data stored on the flash drive is secured even without a power source when data is saved it is sending energised electrons/data to a floating gate. As its name implies, it floats above the “p-type silicon substrate.” The floating gate is isolated from the substrate by a thin oxide layer of about 10nm thick. This isolation is needed to enable the floating gate layer to store charges (data). Microns latest 3D NAND is becoming the go-to storage solution for mobile devices that require high density and high capacity in a small footprint. The latest 64-layer versions of 3D NAND stack layers of data storage cells vertically to create storage devices with up to six times higher capacity than legacy 2D planar NAND technologies.

Source: Cyferz via wikimedia

Can Micron and Other Big Players Succeed in Putting a Hard Floor On Prices

There are two markets to consider when discussing memory, DRAM and NAND. Although NAND is the smaller of the two a big chunk of Microns revenue still comes from NAND. For the NAND the competition is stiff and Micron will always find it difficult to escape from the cyclical nature of this market. Currently, NAND prices are dropping rapidly and with reports in early 2018 that the likes of Samsung and Micron are slowing production seems to have had little effect on the NAND price, as NAND prices fall 10% this past quarter. The relatively cheap nature of manufacturing NAND flash means there are a lot more players in the game and the optimal profit in these scenarios is normally achieved in volume.

With DRAM (dynamic random-access memory) however, things are a little different the more complex nature where it requires frequent system refreshing a more complicated circuitry and timing requirements are installed. It is with DRAM where consumers will turn to a more premium product especially given that they are still cheaper than other flash storage options. This means there is greater stability in DRAM prices and there are fewer competitors in the market.

Quarterly share of the global dynamic random-access memory (DRAM) market held by the leading manufacturers, from 2010 to 2018. Source: statista.com

In the third quarter of 2013 Micron acquired Japanese chip vendor Elpida Memory Inc. doubling its market share. Currently, there are only three big producers in the DRAM market: Samsung, SK Hynix and Micron. This provides Micron with an added level of reassurance that their mainline product will not be threatened in the near future. The notion that a hard floor can exist in the semiconductor market is perhaps a little to fanciful however the big 3 in the DRAM sector are currently in the best position to prevent prices from dropping too far below a comfortable profitability level.

Current I Know First Forecast for MU

The I Know First Algorithm forecast dated on October 9th 2018, gave positive signals for all three time frames. Signals for one month, 3 months and a year are 3.58, 5.34 and 160.90. The predictabilities also give strong confidence in the forecast, as suggested by the correlation between historical predictions and actual movements. The signal for I Know First’s one-year forecast is the strongest at 160.90. The strong signal indicates that the prospect for Micron’s long-term movement is indeed very robust.

Go here to read how to interpret this diagram

Past I Know First Forecast Success with MU

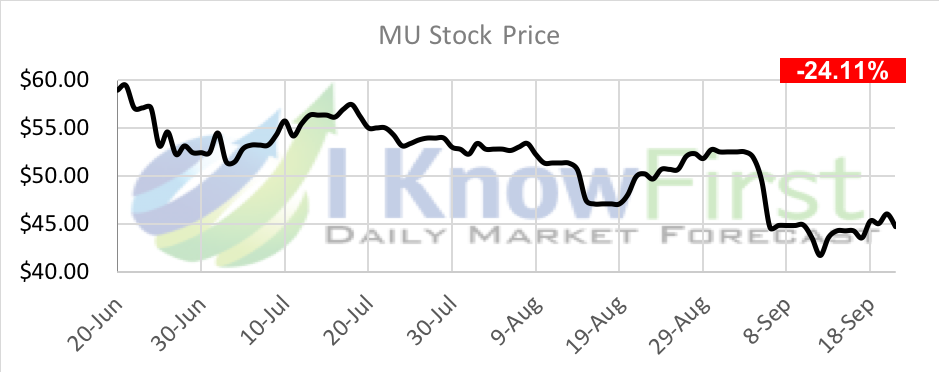

On June 21st the I Know First Algorithm provided a bearish forecast. The signal for 1 month was -11.59, and predictability was 0.61. During the one month forecast the stock dropped from $58.95 to $44.74 by -24.11%. This bearish movement was perfectly caught by I Know First.

Stock price movement since I Know First past forecast

Stock price movement since I Know First past forecast

Current I Know First subscribers received this MU forecast on June 21st, 2018 To subscribe today, click here

Conclusion

Micron is suffering in the short term from a volatile NAND market and the ongoing U.S. – China trade war. However, 70% of its revenue still comes from the relatively stable DRAM sector and the ever increasing memory demands from new AI enables smartphones indicate the NAND sector will only grow. The long term prospects for Micron remain positive in line with its record levels of revenue. This analysis is supported by I Know First Algorithm bullish ling term forecast for MU.