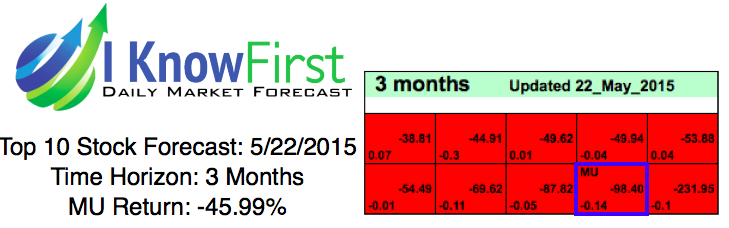

MU Stock Forecast: 45.99% Return In 3 Months

MU Stock Forecast

MU had a very strong signal of -98.40 and a predictability of 0.14. In accordance with the algorithm, the company reported short-term capital losses of -45.99%.

MU was part of the stock forecast that is found in the “Best Tech Stocks” Package.

The full Top 10 Tech Stocks forecast includes a daily prediction for a total of 20 stocks with bullish and bearish signals:

- Top ten stocks picks to long

- Top ten stocks picks to short

Micron Technology, Inc. (MU) is an American multinational corporation based in Boise, Idaho which produces many forms of semiconductor devices, including dynamic random-access memory, flash memory, and solid-state drives.

About two months ago news broke out that China’s ambitious microchip maker Tsinghua Unigroup was mulling a bid for leading US memory chip leader Micron. But because of a lack of interest from Micron and US political opposition against it, the deal appears to be near death. US Senator Charles Schumer voiced his concerns in a letter to US Treasury Secretary Jack Lew, saying he was particularly concerned about a Chinese company controlling a US-based counterpart that sold components for use in defense products. In this same letter, Schumer also said the US should block such a deal until US tech firms get better access to the China market. That referred to the recent new restrictions on many US tech firms selling into China following Beijing’s passage of a new national security law. In late July investors were still hoping that Unigroup would make a bid at $21 per share, but since then Micron’s share price has been steadily moving downwards to its current level of $14.53.

Before making any trading decisions, consult the latest forecast as the algorithm constantly updates predictions daily. While the algorithm can be used for intra-day trading the predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.

Missed the latest trend? Looking for the next best market opportunity? Find out today’s stock forecast based on our advanced self-learning algorithm