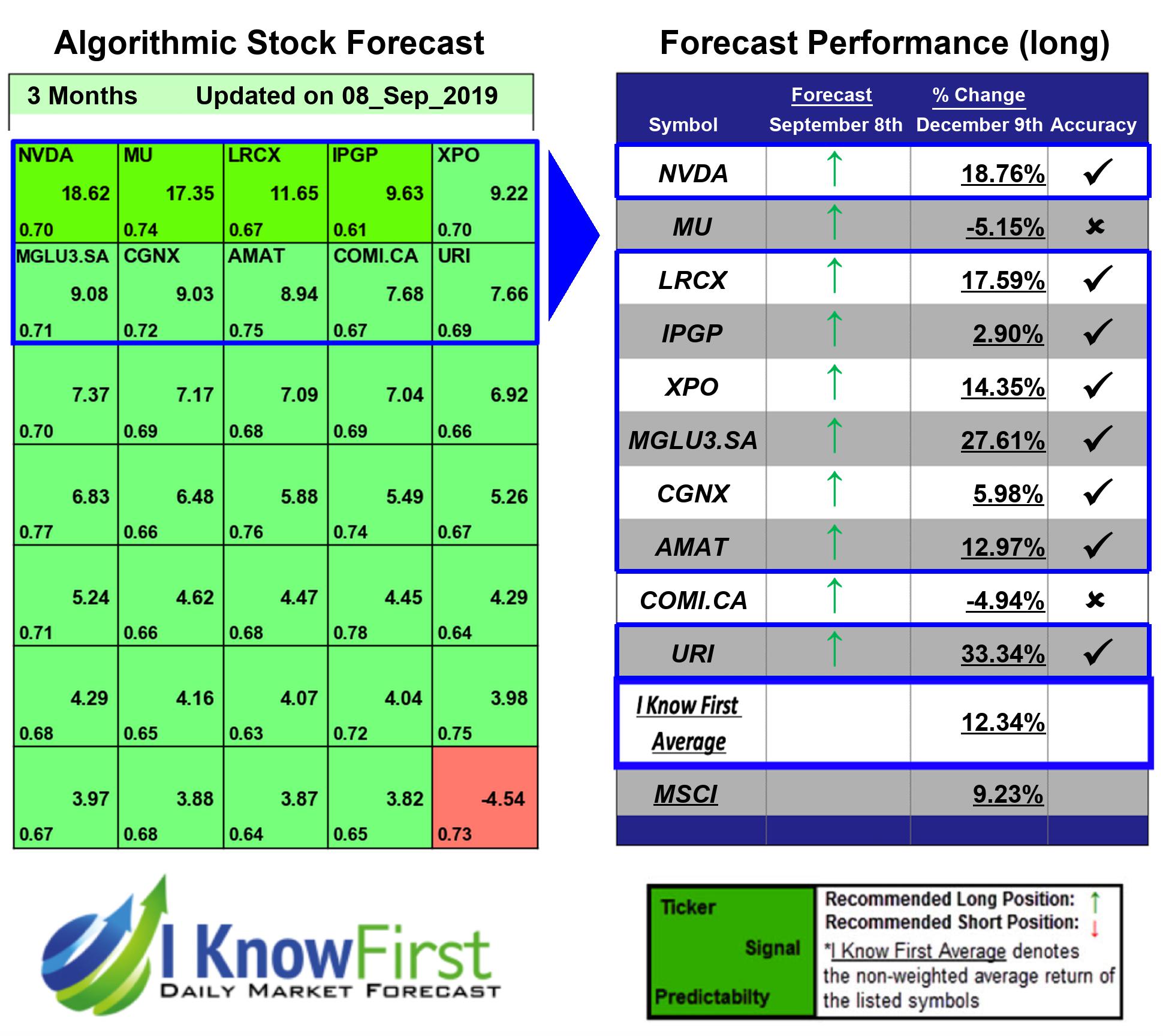

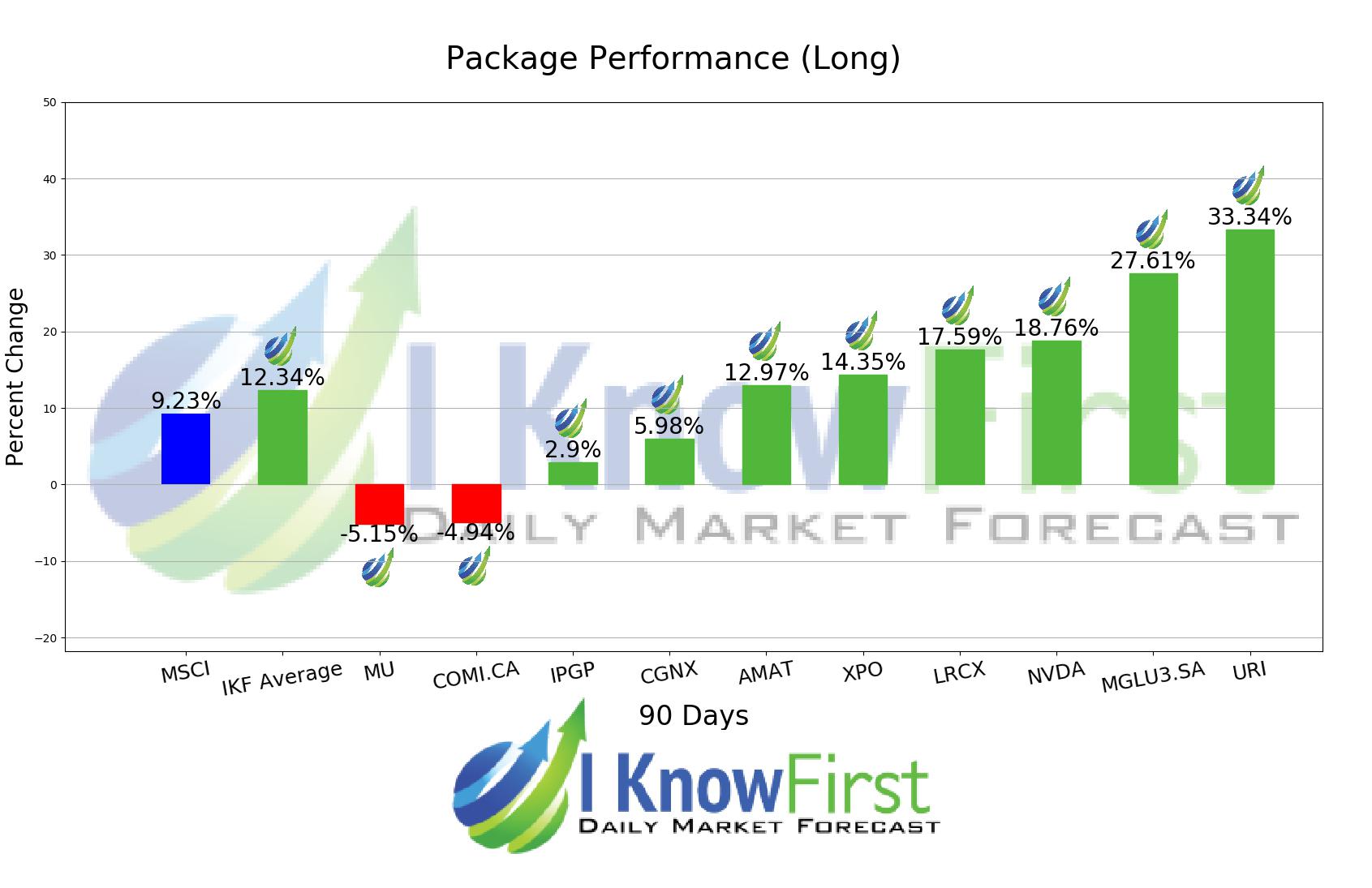

MSCI Indexes Predictions Based on a Self-learning Algorithm: Returns up to 33.34% in 3 Months

MSCI Indexes Predictions

This forecast is part of MSCI Stocks Universe Package and it is designed for investors and analysts who need predictions for MSCI ACWI Indexes stocks currently trading on Western stock markets, such as Germany, France and the USA. This forecast is part of the MSCI Western Stocks Subpackage, one of I Know First’s algorithmic trading tools. The MSCI Stocks Universe is based on MSCI ACWI Index (part of the Modern Index Strategy) and captures all sources of equity returns in 23 developed and 24 emerging markets.

- Top 10 MSCI Western stocks for the long position

- Top 10 MSCI Western stocks for the short position

Package Name: MSCI Stocks Universe – Western Markets

Recommended Positions: Long

Forecast Length: 3 Months (9/8/2019 – 12/9/2019)

I Know First Average: 12.34%

In this 3 Months forecast for the MSCI Stocks Universe – Western Markets Package, there were many high performing trades and the algorithm correctly predicted 8 out 10 trades. The top-performing prediction in this forecast was URI, which registered a return of 33.34%. MGLU3.SA and NVDA saw outstanding returns of 27.61% and 18.76%. The package had an overall average return of 12.34%, providing investors with a 3.11% premium over the MSCI return of 9.23% during the period.

United Rentals, Inc. (URI), through its subsidiaries, operates as an equipment rental company. It operates in two segments, General Rentals; and Trench, Power, and Pump. The General Rentals segment engages in the rental of general construction and industrial equipment, such as backhoes, skid-steer loaders, forklifts, earthmoving equipment, and material handling equipment; aerial work platforms, such as boom lifts and scissor lifts; and general tools and light equipment comprising pressure washers, water pumps, and power tools. This segment serves construction and industrial companies, manufacturers, utilities, municipalities, and homeowners. The Trench, Power, and Pump segment is involved in the rental of specialty construction products, including trench safety equipment, such as trench shields, aluminum hydraulic shoring systems, slide rails, crossing plates, construction lasers, and line testing equipment for underground work; power and HVAC equipment, which consists of portable diesel generators, electrical distribution equipment, and temperature control equipment; and pumps primarily used by energy and petrochemical customers. It serves construction companies involved in infrastructure projects, municipalities, and industrial companies. The company also sells new equipment, such as aerial lifts, reach forklifts, telehandlers, compressors, and generators; contractor supplies, including construction consumables, tools, small equipment, and safety supplies; and parts for equipment that are owned by the company’s customers, as well as provides repair and maintenance services. It sells its used equipment through its sales force, brokers, and Website, as well as at auctions and directly to manufacturers. As of February 18, 2016, the company operated 897 rental locations in the United States and Canada. United Rentals, Inc. (URI) was founded in 1997 and is headquartered in Stamford, Connecticut.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.