MS Stock Forecast: Large Financial Institution Under Market Variations

This MS Stock Forecast article was written by He Xu – Financial Analyst at I Know First

Summary

- Morgan Stanley’s current consensus Q1 2022 EPS of $33.1 is fair while it reports earnings of $40.35 on April 14, 2022.

- Morgan Stanley made a record in M&A in 2021, contributing to the revenue growth of the Institutional Securities segment.

- Morgan Stanley’s forecast of the next quarter’s earnings will not be at a high level.

- Based on the estimated price target, Morgan Stanley’s stock value per share is from $94 to $113 for the next 12 months.

Overview

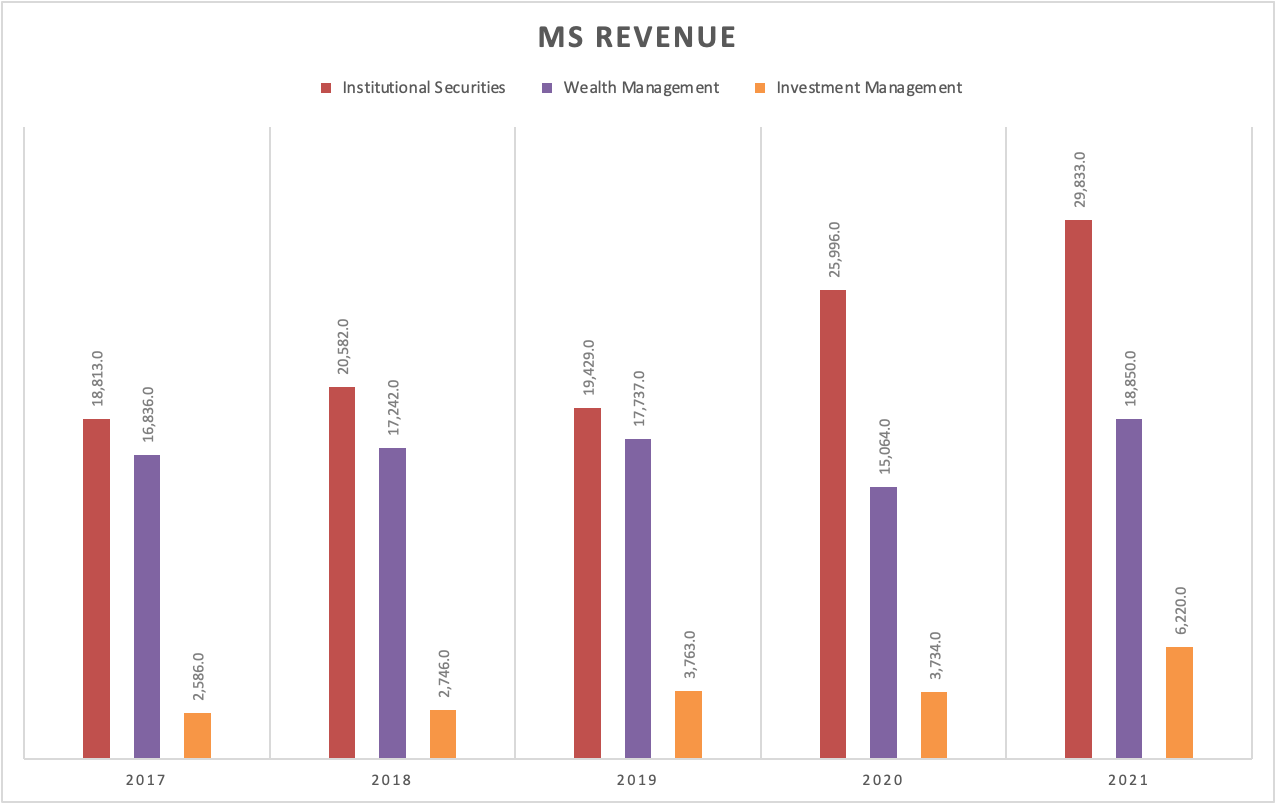

Morgan Stanley, a financial holding company, was founded in 1924 and is headquartered in New York. It provides various financial products and services to corporations, governments, financial institutions, and individuals in the Americas, Europe, the Middle East, Africa, and Asia. The institutional securities segment (54.3% in 2021) accounts for approximately 50% of the company’s net revenue, with the remainder coming from wealth (34.3% in 2021) and investment management (11.3% in 2021). The company derives about 30% of its total revenue outside the Americas. Morgan Stanley last announced its earnings data on April 14th, 2022, which reported $40.35 earnings per share (EPS) for the quarter, beating the consensus estimate of $33.1 by $7.25.

MS Stock Forecast: Revenue and Earnings

Q1 2022 results affirm Morgan Stanley’s business model is well-functioned for sustainable growth over a long period. I researched the reasons for revenue growth in 2021 and see whether this growth would continue in 2022. In the revenue structure of Morgan Stanley, the Institutional Securities segment increased by 14.67% by the end of FY 2021, lower than the growth rate of 33.8% in FY 2020. However, Investment banking and Advisory fee under this segment gained growth rates of 42.59% and 73.66% respectively. The reason for the rapid growth is that 2021 marked a record year for M&A with more than $5 trillion in global volume. The Wealth Management segment increased by 25.13% by the end of FY 2021. Wealth Management grew client assets by nearly $1 trillion to $4.9 trillion this year, with $438 billion in net new assets. The Investment Management segment increased by 66.58% driven by strong fee-based asset management revenues on a record AUM of $1.6 trillion. In the future, I expect that the valuation growth would be sustained if the bank expands its client asset base and continues to increase revenue from the wealth and investment management segment.

Morgan Stanley’s earnings have been steady rather than volatile as predicted. However, the forecast for quarter 2 still shows a relatively low level. To research its profitability, I analyzed its financial ratios compared with the industry. Net Margin of 26.26%, ROE of 13.42%, and 3-year revenue growth rate of 12.7% are better than over 60% of companies in the Investment Banking and Brokerage industry. Overall, Morgan Stanley’s ability of profitability is good.

Why is Morgan Stanley Stock Forecast of EPS for Q2 2022 still relatively low?

High leverage means higher risk. Morgan Stanley’s loans increased by 4% to $209 billion from Q4 2021 to Q1 2022. Based on the cash-to-debt ratio of 0.36%, Morgan Stanley couldn’t pay off its debt using the cash in hand for the quarter that ended in Dec. 2021. Equity-to-asset of 0.09% and asset-to-equity of 2.31% are worse than over 90% of companies in the same industry, therefore MS has relatively high leverage, which generally means that a company has been aggressive in financing its growth with debt. This can result in volatile earnings as a result of the additional interest expense.

It seems that the pandemic has triggered the short recession – high inflation and a shortage of labor force. 2022 may be a critical year to adjust this imbalance caused by the pandemic. Results of the adjustment might be higher-than-expected growth and inflation, greater capital spending, and improving productivity. As businesses are forced to transform to digital services during the pandemic and the US labor market transform, these could further strengthen these results. According to Seeking Alpha, MS’s P/E ratio is smaller than the main players in the same industry, such as SCHW, BLK, and IBKR, which means that MS is possibly undervalued. Therefore, there is a lot of uncertainty about the forecast of future earnings, and I endorse the prediction for Q2 2022.

(Figure 4: MS and its competitors’ P/E ratios for the past 12 months)

From a long-term perspective, Tipranks makes a moderate buy recommendation over the next year. As Tipranks estimates, MS’s stock price will be between $94 and $113 with an average of $104.4, which shows an upward sloping.

The Yahoo Finance coverage also made a moderate buy solution for the company, performed by 27 analysts, and 8 of them take a hold position while 3 and 14 analysts take Strong Buy and Buy positions on the stock respectively, while 1 of them take a sell position.

Conclusion

Morgan Stanley is a buy stock with good profitability. The company has formed a good revenue base and good EPS performance. Compared with its competitors, MS is probably overvalued now. In addition, under the uncertainty of high inflation, shortage of labor force, and other market variations, I do have a moderate buy for its next-quarter performance just like analysts of Yahoo Finance and Tipranks.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the Morgan Stanley stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.