MRVL Stock Forecast: Marvell Technology Group Makes Moves Towards New Markets

This article was written by Julia Masch, a Financial Analyst at I Know First.

“The next wave of semiconductor growth will be fueled by advancements in the data economy. Applications such as AI, 5G, Cloud, automotive, and edge computing all require engineering solutions that combine high bandwidth, very low power consumption, and leadership in complex system on a chip solutions.”

– Matt Murphy, Marvell’s President and Chief Executive Officer

MRVL Stock Forecast

Highlights

- Marvell’s Core Business

- Closing Cavium Acquisition

- Current I Know First Bullish Forecast For MRVL

Marvell’s Core Business

Marvell Technology Group Ltd. (NASDAQ: MRVL) is a leader in semiconductor solutions as well as a supplier and host of storage controllers and components that are utilized in solid-state drives (SSD). As more companies utilize AI and the big data necessary to apply it usefully, data storage has become more and more important. Demand has been surging for data services in the past and will continue to do so. Additionally, Marvell has potential in the market for SSD controllers. Moreover, Marvell is already one of the leading providers of the chips used in hard disk drives (HDD). Over half of Marvell’s revenue comes from data storage and supplying storage controllers for SSDs and HDDs. As the current data boom continues, these revenues will only increase.

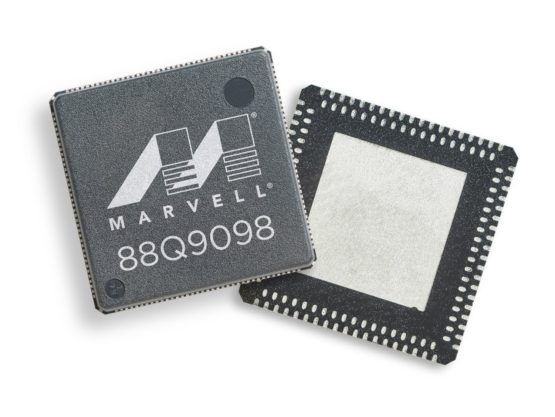

Marvell has also been innovating and in early June announced 2 new products: the 88Q9098 chip and Express® (NVMe™) solid-state drive (SSD). Marvell’s newest chip can be used to connect vehicles and features 2×2 plus 2×2 concurrent dual Wi-Fi®, dual-mode Bluetooth® 5/Bluetooth Low Energy and 802.11p, making it the industry’s first chip of its kind. What is unique about the chip is that it integrates two WiFi 2×2 subsystems into a singular chip which will provide greater power. The chip will provide many features such as vehicle to vehicle communication, multimedia streaming, hotspot functionality, and can also be applied across infotainment and telematics. According to Counterpoint Research, approximately 125 million cars featuring connectivity will be sold in the next 5 years and the market for connected cars will grow annually at a pace of 5%. Marvell’s connectivity segment shot up 19% YoY to 15% of total revenue in the last quarter and this portion will only continue to grow.

Marvel’s 88Q9098 chip (Source: Yahoo Finance)

Additionally, on June 5, Marvell announced its newest SSD controller family, the Express NVMe™ which can be used in high performance PC clients and edge computing SSDs. This new chip will help to expand the use of NVMe SSDs by bringing high performance and reliability to various applications. The controller features 3×4 PCIe® SSD controllers as well as 4-channel 88SS1084 and 8-channel 88SS1100, which allow it to run at 3.6GB/s of bandwidth and up to 700,000 input output per second (IOPS). Moreover, by using both 4-channel and 8-channel components, Marvell is using a common architecture that developers can utilize and build for many uses. Additionally, the controller implements both 96-layer triple level-cell (TLC) and quad level-cell (QLC) NAND architectures. The NVMe market is expected to grow over 25% over the next 5 years and this new chip will increase Marvell’s profitability in this segment.

Marvell Closes Cavium Acquisition

In early July, Marvell completed its acquisition of Cavium, one of its rivals, for over $6 billion after announcing its intentions this past November. The acquisition will be extremely beneficial for Marvell in the long run as the combination of the two competitors will allow them to create a better product portfolio as well as the ability to break into the Intel-dominated server microprocessor market. The buy-out will add increased server and storage connectivity and build on the company’s assets in DCI solutions, networking, connectivity, and more. The deal will boost MRVL’s top and bottom line and has the potential to to increase Marvell’s potential market by $8 billion to $16 billion. By combining Marvell and Cavium, the companies will no longer have to compete against each other and can work together to increase their competitive edge. However, it will take time to incorporate Cavium’s products into revenue streams. Marvell is expected to announce the progress of this in its Q2 2019 earning report.

Following the announcement of the completion of the acquisition, Marvell also announced it would be gaining 3 new board members from Cavium. Syed Ali, Brad Buss, and Dr. Edward Frank will all be joining Marvell’s Board of Directors which will allow the newly joint entity to utilize Cavium’s solutions as best as possible. Syed Ali was a co-founder of Cavium and has served as President, CEO, and Chairman of the Board of Directors since then. Buss and Frank were both directors and also served on Cavium’s Board of Directors.

Marvell Stock Analysis

Over the past year, MRVL has gained 32.42%. However, the stock has made minimal gains of 1.64% since the calendar year began.

A technical analysis of MRVL does not show strong results. Over the past 6 months, the stock price, 50 day simple moving average (purple), and 200 day simple moving average (blue) have begun to converge. The year started with the 50 day SMA much greater than the 200 day SMA. While this does not have significant implications yet, if the 200 day SMA surpasses the 50 day SMA and the stock price, it will indicate a bearish momentum for Marvell. Yet, it is still possible for the stock price to surge and the 50 day SMA to rise again. Therefore, a technical analysis is relatively inconclusive for Marvell.

(Source: Yahoo Finance)

That being said, there is still good value to MRVL. Currently, the stock’s forward price-earnings ratio is 14.20 in comparison to the industry average which is near 25. This is also far below the company’s 5 year average price-earnings ratio which is greater than 30 and shows large potential for the future of the company.

Current I Know First Bullish Forecast

The I Know First machine learning algorithm currently has a bullish forecast for MRVL. However, the signals for the 1 month and 3 month time horizons are not very strong. On the other hand, the 1 year time period prediction is extremely bullish with a signal over 100 and predictability signal of .7. This shows that MRVL is a good investment for the long term.

How to read the I Know First Forecast and Heatmap

Conclusion

Marvell has a bright future ahead of it. Its new products and acquisition with Cavium will allow it to increase its revenue and expand into expanding markets. However, making major headway into these markets will take time, so Marvell is a better long term buy. Moreover, the current I Know First forecast supports this with an extremely strong bullish outlook for the 1 year time horizon.

Past I Know First Success With MRVL

On November 20, 2017, the I Know First self-learning algorithm showed a bullish outlook on MRVL over a 7 day period with a signal of 34.43 and predictability of .32 as part of the dividends package. In accordance with this prediction, MRVL increased by 17.30% over this time period, highlighting the I Know First algorithm’s success with predicting Marvell’s Stock in the past.

Current I Know First subscribers received this bullish MRVL forecast on November 20, 2017.

Please note-for trading decisions use the most recent forecast.