Micron Stock Forecast: Windows 11 And Chia Crypto Miners Are Tailwinds For Micron

The Micron stock forecast was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

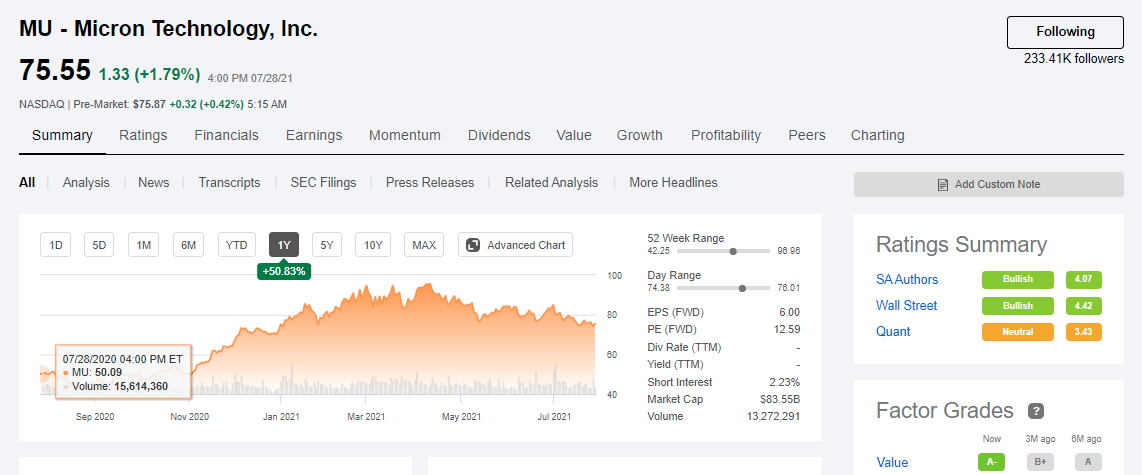

- In spite of the 3-month price slide of -12.18%, Micron’s stock is still +46.7% since my July 28, 2020 buy recommendation.

- Work-from-home and learn-from-home are still the new normal. More infectious variants of COVID-19 renew the pandemic tailwind for Micron.

- Nascent Chia cryptocurrency mining is a very promising tailwind for Micron.

- Windows 11 is a solid tailwind for the server and PC DRAM industry.

- The low-margin-on-hardware smartphone success of Xiaomi and BBK Electronics is also beneficial to mobile DRAM vendors like Micron.

Congratulations to those who acted on my July 28, 2020 buy recommendation for Micron (MU). The stock is +46.7 since that article. MU’s 1-year price performance is +50.83% but I’m still endorsing it as a buy. The strict TPM 2.0 hardware requirement of Windows 11 is an upcoming tailwind for Micron’s DRAM and solid-state drive storage products. Microsoft (MSFT) also requires TPM 2.0 for the next version of Windows server. The TPM 2.0 mandate of Microsoft will ultimately compel people to buy new computers and servers.

Thanks to the TPM 2.0 push of Microsoft, Micron could achieve quarterly revenue greater than $8 billion. Windows 11 could help Micron deliver FQ1 2022 EPS higher than $2.63.

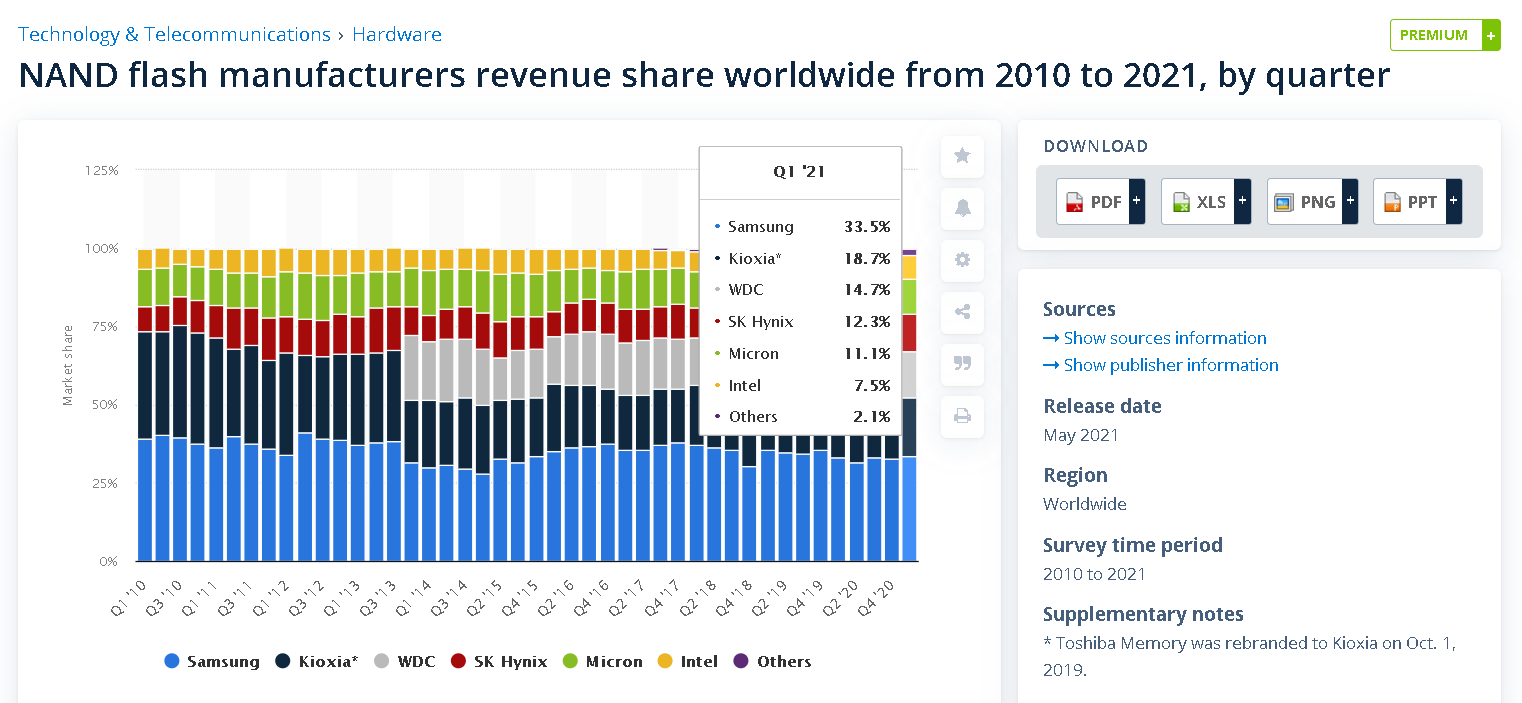

Windows 11 is an upcoming tailwind for the $65.215 billion DRAM industry and $55.155 billion NAND flash business. Global DRAM sales is the biggest revenue generator of the semiconductor industry. Please study the chart below and you will appreciate why Windows 11 convinced me MU deserves a Bullish recommendation. Windows 11 will likely help global DRAM revenue to reach $68 billion.

Some of those new Windows 11 computers that will be sold in the next quarters of 2021 to 2023 will come with Micron-branded DRAM and NAND flash SSD storage. Better go long now on MU while the big majority is still pessimistic. Micron is still the world’s no. 3 DRAM manufacturer, behind no. 1 Samsung (SSNLF) and no. 2 SK Hynix (HSXKL). The quarterly global sales of DRAM is still $17.65 billion. This is in spite of ex-President Trump’s banning U.S. hardware/software technologies to Huawei. Huawei used to be the world’s no. 1 smartphone vendor and used to be Micron’s top customer.

Going forward, future sales of TPM 2.0-compliant Windows 11 desktop computers and laptops can boost Micron’s DRAM market share to above 25%. There’s a very limited list of Windows 11-ready laptops in the market today. It’s given that Micron’s future quarterly revenue will get a boost from Windows 11 computer sales. Windows 11 can help Micron achieve $8.5 billion in sales during this 2021 holiday shopping quarter.

Micron’s stock has been on a downward trend since April. Its 3-month price performance is -12.18%. This continuing pessimism over MU is in spite of the excellent FQ3 2021 EPS and revenue numbers. Most investors apparently are skeptical of management’s FQ4 revenue guidance of $8.0 to $8.4 billion. Wall Street consensus is $7.89 billion. Let us ignore this ongoing negativity. It’s better to just take advantage of MU’s beaten-down valuation.

Huawei’s international expansion is hampered but Micron’s DRAM business is still strong because other Chinese firms like Xiaomi (XIACF) and Lenovo (LNVGY) are still heavy buyers of PC DRAM and mobile DRAM. The world’s no. 2 smartphone vendor, Xiaomi is the first phone company to use Micron’s LPPDR5 RAM in its Mi 10 flagship phone last year. The continuing anti-Huawei emotion of U.S. politicians was never a headwind for Micron. Other Chinese hardware vendors are becoming Micron customers. Micron’s early leadership in DDR5 RAM modules is a long-term tailwind.

Micron Stock Forecast: Micron Has An Emerging Tailwind From Chia Crypto Miners

My fearless forecast is that Micron’s stock can shoot up higher in September after it Q4 ER. Management only needs to announce $8 billion or higher in Q4 revenue. This is feasible. Micron is a leading player in the global NAND flash solid-state drive or SSD products. Chia cryptocurrency mining uses storage drives like Micron’s pricey NVMe SSD products. The early-bird principle means Chia crypto coin miners/plotters are buying all the datacenter-grade SSD drives they can get. Ordinary consumer SSDs cannot survive for more than a few days under the heavy plotting workload of Chia.

Even without Huawei as its top customer, Micron is still the no. 5 NAND flash manufacturer. Counterpoint Research said Q1 2021’s global NAND flash was $15.3 billion.

MU is a buy because Chia crypto miners are spending big since March on enterprise-grade SSDs like Micro’s $2,153 9300 Pro U.2 NVme product. There is now a growing, highly-infectious frenzy over Chia. Chia is not electricity-hungry like the GPU/CPU-mining of Ethereum and bitcoin.

Micron is cheaply valued at $75.55, but Chia (or XCH) crypto price is still over $200. Chia is still in its infancy. There are only 865,641 XCH. Crypto miners who are no longer making a decent profit on Ethereum and Bitcoin are now obviously shifting to XCH because there are still few Chia miners out there. The blockchain Chia network was created by legendary programmer Bram Cohen. Cohen is the coder who made BitTorrent – the world’s first and still the best peer-to-peer file-sharing protocol. Cohen apparently dislikes the electricity-gobbling mining requirement of Bitcoin and Ethereum. The Bitcoin network’s annual electricity consumption is 110 Terawatt Hours. Cohen, therefore, created the Chia Network as a green, environmental-friendly XCH cryptocurrency platform.

Bram Cohen’s environment-first approach to cryptocurrency mining can help Micron achieve $1.9 billion/quarter in revenue. Chiacrypto mining is going to boost all the leaders in NAND flash products.

Conclusion

MU is relatively undervalued when compared to its semiconductor industry peers. Western Digital (WDC) has no DRAM business and yet its forward P/E is 38x. It is an injustice that Micron’s forward P/E is only 15x. This erroneous undervaluation of MU will eventually get corrected. Better go long on MU now while it trades below $80. My fearless forecast is that MU will again breach $90 before 2021 is over.

The lower valuation ratios of Micron is a stock market aberration that is head for a correction soon. Micron is more profitable than Western Digital. Please study the chart below. Micron has far higher gross and net income margins than Western Digital. We should invest more in companies that tout better profitability.

The other factor behind my optimism on Micron is its very bullish 1-year trend score of 240.33%. The stock prediction AI algorithm of I Know First is extremely confident that MU has a lot of upside potential. Windows 11 and Chia crypto miners will likely inspire investors to push MU above $85 again soon.

Past Success With Micron Stock Forecast

I Know First has been bullish on Micron’s shares in past forecasts. On our July 28, 2020 premium article, the I Know First algorithm issued a bullish Micron stock forecast. The algorithm successfully forecasted the movement of Micron’s shares on the 1 year time horizons. MU’s shares rose by 52.54% in line with the I Know First algorithm’s forecast.

Here at I Know First, our AI-based stock forecast algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. The database used is 100% historical data free from human-derived assumptions and is constantly evolving with newly added data and adapting to changing market situations. Today, we are producing daily forecasts for over 10,500 assets such as S&P 500 forecast, as well as gold predictions and forex forecast. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note – for trading decisions use the most recent forecast.