Micron Stock Forecast: Why Micron Is Still A Worthy Investment

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- With stronger factory production available, average selling prices of DRAM and NAND flash is down this year.

- On the other hand, the increasing default RAM and flash storage of new smartphones and computers is still a strong tailwind for Micron.

- More RAM and flash storage are needed because smartphones now can play PC-level video games. Smartphones are now also decent HD video camcorders.

- The higher margins possible on 8GB/12GB RAM modules helps offset the lower spot prices of RAM.

- Micron is an industry leader in DRAM and NAND storage products. Sadly, it is still being undervalued compared to its semiconductor industry peers.

Bargain hunters should love it that I am reiterating Micron (MU) as a buy. This bullish sentiment is in spite of the declining average spot prices of DRAM (Dynamic Random Access Memory) and NAND flash or MLC (Multi-level cell) products. My fearless forecast is that smartphone and PC manufacturers will keep on adding more RAM and flash storage to their next generation phones and computers.

Micron is the third-largest supplier of mobile DRAM with 17.5% market share. It stands to benefit from manufacturers pre-installing increasingly larger amount of mobile DRAM on their latest smartphones/tablet and computers.

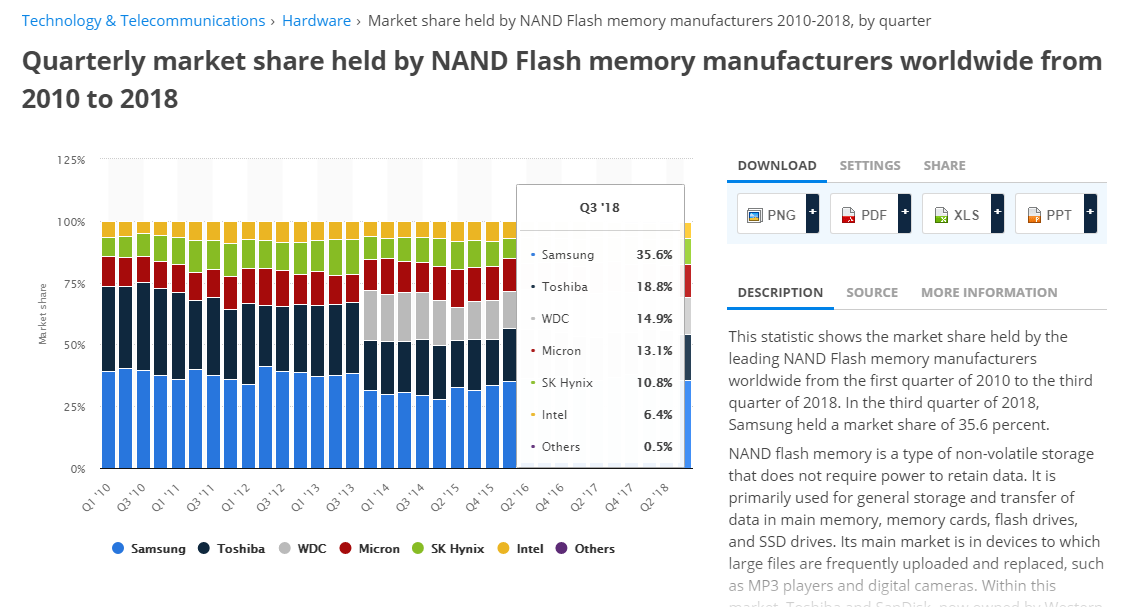

(Source: Statista)

Micron is the no.4 global supplier of NAND flash storage memory used in mobile devices, laptops, flash drives, SSDs, and micro-SD cards. Xiaomi’s upcoming affordable flagship Android phone, the Mi 9, will reportedly come with models installed with 12GB of RAM and 128GB flash storage.

(Source: Statista)

Micron has a long-term tailwind from Xiaomi’s daring move to build and sell smartphones with 12GB RAM and 128GB flash storage. Other leading Chinese smartphone vendors like Huawei, Oppo, Vivo, and OnePlus, will quickly release their own equalizers to the Xiaomi Mi 9. Consequently, Micron and other mobile DRAM manufacturers will see increased demand for their 6GB, 8GB, and 12GB mobile DRAM products.

Low-ball pricing specialists Huawei and Oppo are the ones I expect to quickly release 12GB RAM-equipped smartphones this year. Huawei intends to become no.1 in smartphones this year. It is currently no.3 behind Samsung (SSNLF) and Apple (AAPL). Selling sub-$500 flagship Android phones with 12GB of RAM and 64GB/128GB flash storage can help Huawei beat Samsung this year.

Huawei is a long-term partner of Micron on flash storage. I hope it is also a partner in mobile DRAM.

Xiaomi also hopes that selling smartphones with more RAM and storage can help it move to the no.3 ranking. Huawei and Xiaomi are the two firms with the best year-over-year growth in annual smartphone shipments last year.

Why More RAM And Flash Storage Are Needed By Next-Generation Products

A bigger amount of RAM and storage are two important features when it comes to selling smartphones and laptops. Last year, there were dozens of Android phones with 6 to 8GB of LPDRAM (Low- Power Dynamic Random Access RAM). This year, I expect hundreds of smartphones made by Huawei, Oppo, Samsung, Xiaomi, Vivo, OnePlus, and other white-box Chinese manufacturers will have 6GB/8GB/12GB RAM.

The amount of RAM is very important when it comes to video games. Video game levels/maps is loaded into RAM and it stores the needed variables and content. The rise of PC-level games like Fortnite and PUBG Mobile on Android/iOS devices means phones needed more than 4GB of RAM to host 99 other players in online real-time shooting games.

It is pointless for smartphones to have the latest CPU/GPUs if they do not have enough Random Access Memory (RAM) to load 99 other players on their Fortnite and PUBG Mobile gaming sessions. This is why the best Android gaming phones (like Asus ROG Phone and Razer Phone 2) have 8GB of LPDRAM.

The large file install sizes of latest mobile games also call for larger storage on phones/tablets. Based on my experience, PUBG Mobile initial installation consumed 1.9 GB on my Oppo F1S Android phone. It has grown larger to more than 2.5GB due to updates and new maps.

The other reason why more RAM is needed is because even sub-$350 phones of today are now capable of 1080p video recording. A lag-free & flicker-free full HD video recording needs a lot of RAM to compress the video being recorded. On-device video editing apps are now also available on Android/iOS devices. Unfortunately, having only 4GB of RAM will make video editing on phones very tedious.

Further, a 5-minute full HD (1080p) video recording consumes as much 3.6GB. This is why phone-based bloggers use handsets with at least 64GB default flash storage. Most vloggers I know also use Android phones because those have microSD slots for more video/photo storage.

The other reason I see why more RAM is need in smartphones is the adoption of Artificial Intelligence and Augmented Reality/Virtual Reality capabilities. On-device processing of AI functions on smartphones will demand greater RAM and flash storage.

Conclusion

I hope I was able to convince you why you should go long on MU. Micron’s global leadership (in mobile DRAM and NAND flash storage) gives it a long-term tailwind from smartphones needing increasingly larger amount of RAM and flash storage. Most modern desktop and laptops of today also comes with default 8GB DRAM load-outs. Gaming PCs and workstations comes with 32GB or 64GB DRAM. We know that Micron is also No.3 in PC and server DRAM global sales.

If you are not yet convinced, MU’s excellent long-term investment quality is also due to its unfair undervaluation. Compared to its peers in the semiconductor industry, MU has much lower EV/EBITDA, P/E, and P/B valuation ratios.

(Source: Seeking Alpha)

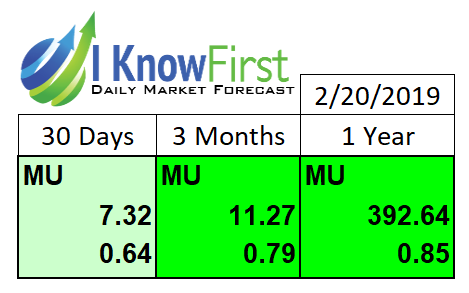

Micron’s stock also touts a very strong buy signal from the 12-month algorithmic market trend forecast of I Know First. MU’s score of 392.64 makes it well above the score of 100 (bullish threshold level). More importantly, I Know First has a predictability score of 0.85 for MU. It means I Know First’s AI stock picking algorithm has an excellent history of accurately predicting previous 12-month trend movements of Micron’s stock.

How to interpret this diagram.

Past I Know First Success with Micron Stock Forecast

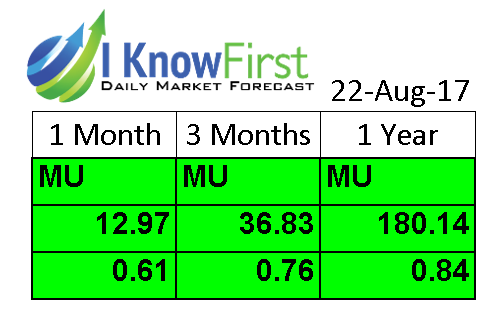

I Know First has been bullish on Micron stock forecast in the past. On August 22, 2017 the I Know First algorithm issued a bullish 1 year Micron stock forecast with a signal of 180.14 and a predictability of 0.84, the algorithm successfully forecasted the movement of the MU share. After a year, MU shares rose by 69.96% in line with the I Know First algorithm’s forecast. See chart below:

This bullish forecast for MU was sent to I Know First subscribers on August 22, 2017.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.